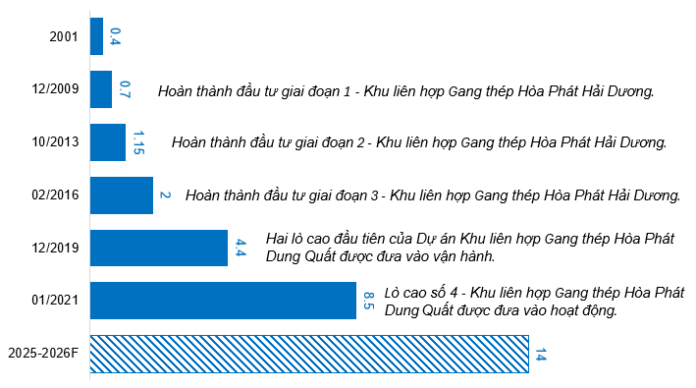

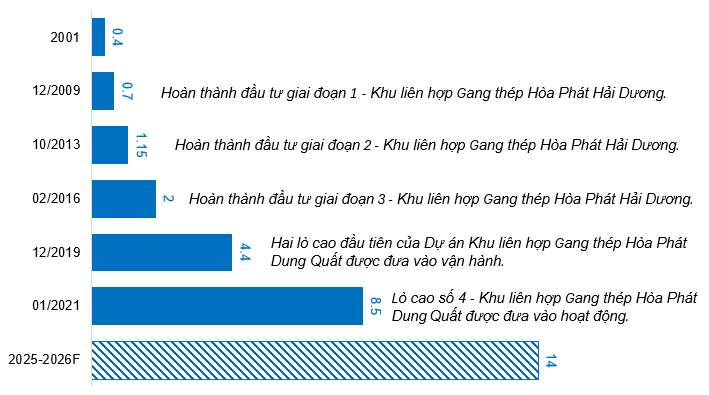

Dung Quat 2 Project on Track for a Breakthrough

The Hoa Phat Dung Quat 2 Integrated Steel Production Complex project is making good progress. Phase 1 completed the installation of the blast furnace and rolling mill by the end of 2024, with trial operations starting from the end of the first quarter of 2025. Phase 2 is also being expedited to bring Blast Furnace No. 6 into operation in September 2025. When the entire project is completed in the 2025-2026 period, Hoa Phat will increase its total crude steel capacity to approximately 16 million tons per year, with hot-rolled coil (HRC) reaching 9 million tons per year – becoming the largest HRC producer in Vietnam.

The Dung Quat 2 Project not only strengthens domestic production capacity but also serves as a strategic springboard for HPG to expand internationally, enhance its influence, and improve long-term profit margins. The period of 2025-2030 is expected to be a new growth cycle for the Group, with HRC playing a central role.

HPG’s Total Steel Production Capacity Over the Years

(Unit: Million tons/year)

Source: HPG

Golden Opportunity with HRC

The anti-dumping tax policy on HRC from China, effective from July 6, 2025, with rates of 23-28%, presents a significant opportunity for HPG in both the domestic and international markets. In the domestic market, reduced competitive pressure from imported steel enables HPG to regain market share and increase sales volume. In Europe, a 0% tax rate for HPG (while competitors face around 12%) enhances the company’s export performance. Combined with plans to increase HRC capacity to 9 million tons and the progress of the Dung Quat 2 Project, HPG is moving closer to a leading position in the industry.

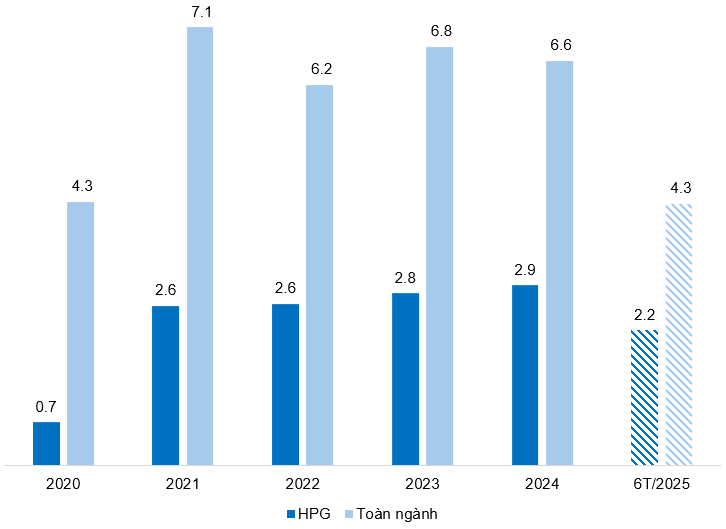

HRC Consumption Volume in the period 2020-6M/2025

(Unit: Million tons)

Source: HPG and Vietnam Steel Association (VSA)

Positive Outlook Due to Stable Production Costs

Currently, the prices of the two main raw materials for steel production, iron ore and coking coal, remain low compared to the 2021 period. Specifically, iron ore prices fluctuate around $99/ton, significantly lower than the 2021 peak, while coking coal prices continue to drop to around $178/ton, the lowest level in almost three years.

Stable input costs enable HPG to effectively control production costs, thereby expanding profit margins and enhancing price competitiveness as domestic construction demand recovers.

Iron Ore Price Fluctuations in the 2021-07/2025 period

(Unit: USD/Ton)

Source: Tradingview

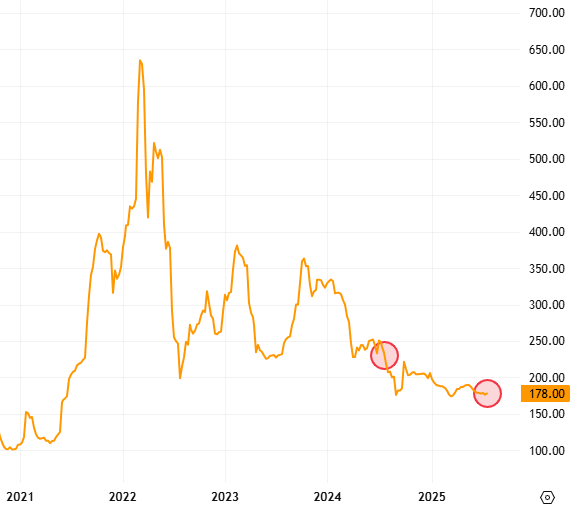

Coking Coal Price Fluctuations in the 2020-07/2025 period

(Unit: USD/Ton)

Source: Tradingview

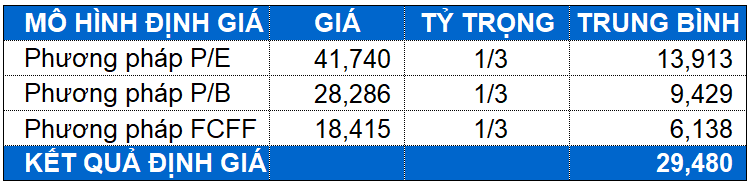

Stock Valuation

With equal weights assigned to the FCFF, P/E, and P/B methods, the results indicate a fair value of VND 29,480. The current price of HPG stock is reasonable for long-term investment purposes.

Enterprise Analysis Department, Vietstock Consulting

– 09:00 08/06/2025

A Strategic Vision for Vietnam’s Urban Future

Amidst Vietnam’s rapid urbanization, the need for smart, green, and sustainable urban planning strategies is not just imperative but presents a unique opportunity for consulting firms to take the lead.