Nhon Trach 2 Power Company (NT2) is a leading power company in Vietnam with a charter capital of over VND 2,878 billion. The company is the investor, owner, and operator of the Nhon Trach 2 Power Plant, a state-of-the-art combined-cycle gas turbine power plant.

The power plant utilizes advanced F-generation combined-cycle gas turbine technology with a 2-2-1 configuration, comprising two gas turbines, two heat recovery boilers, and one steam turbine, for a total capacity of 750 MW.

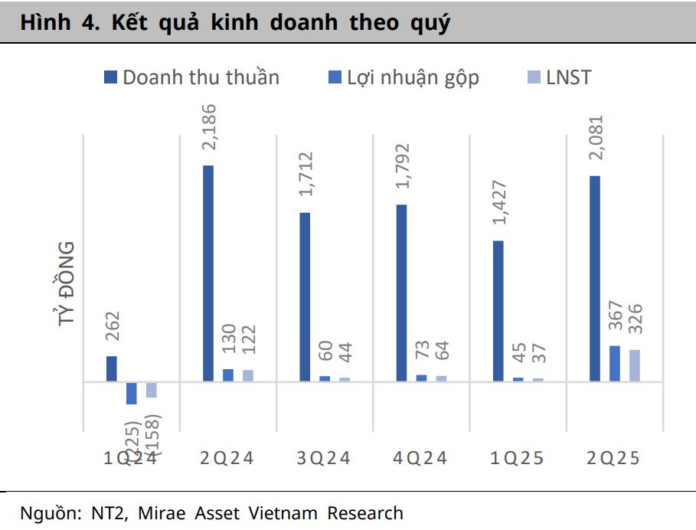

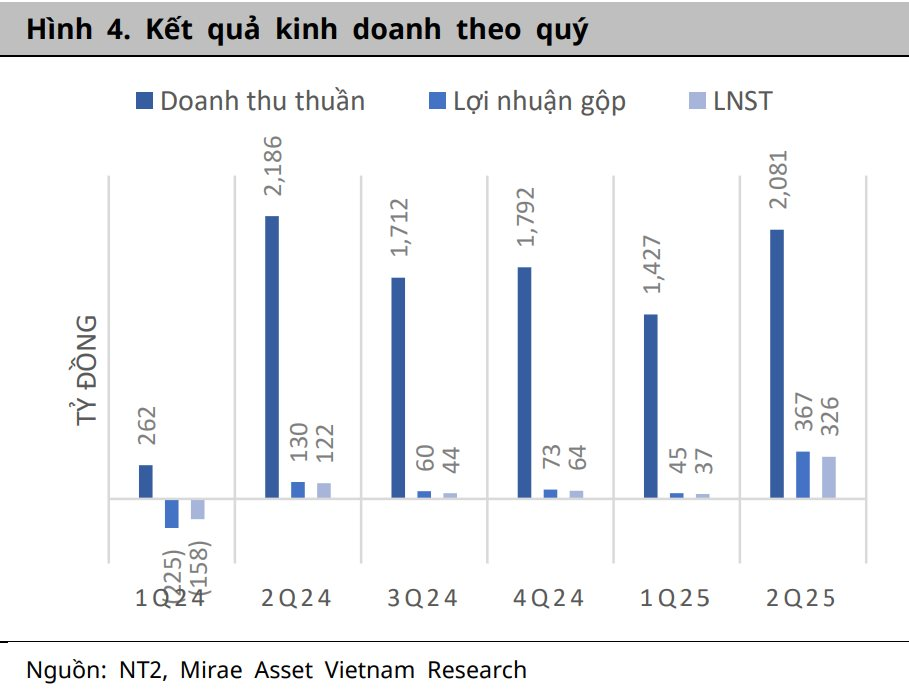

NT2’s business results for the first half of 2025 exceeded expectations, with a 43% year-on-year surge in revenue to VND 3,508 billion. After-tax profit skyrocketed by 910% to VND 363 billion, far surpassing the full-year plan. This exceptional performance is a testament to the company’s efficient contract structure, prudent financial policies, favorable electricity selling prices, and effective cost management.

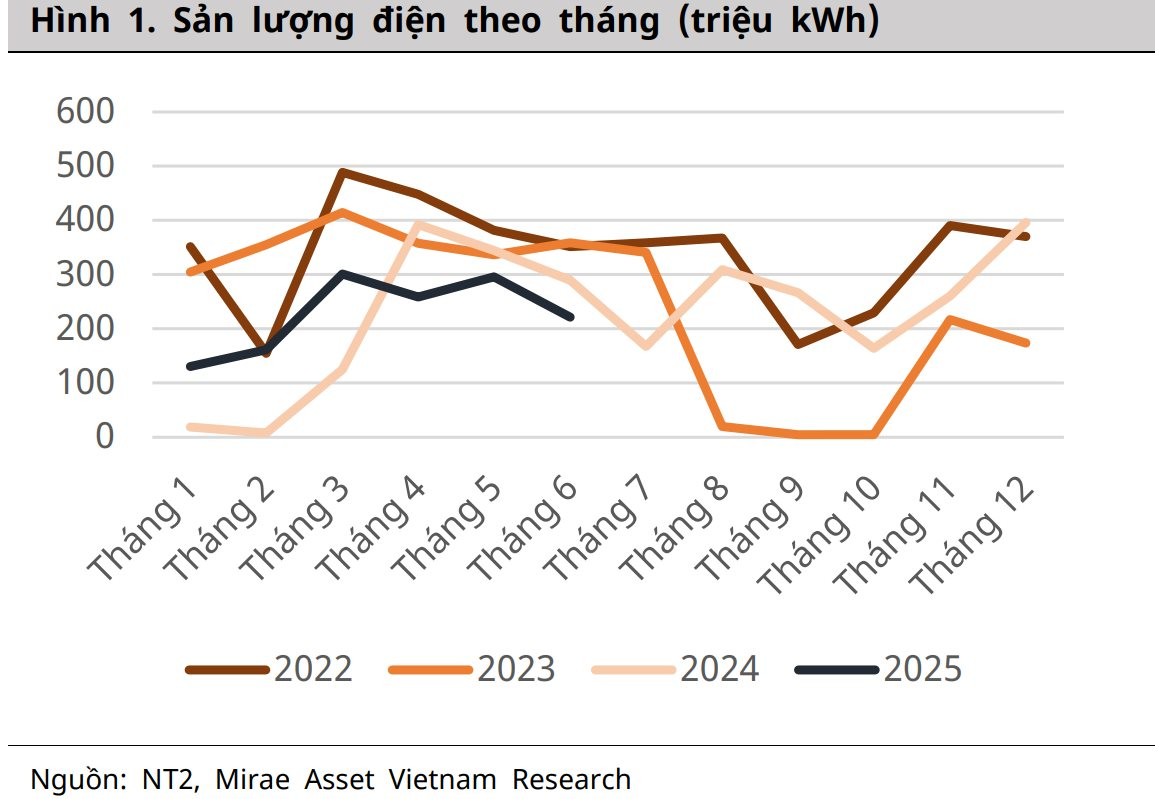

A standout highlight from MAS’s analysis is NT2’s contracted electricity output (Qc) for the first half of 2025, which doubled year-on-year to 1.584 million kWh. Notably, the Qc execution rate for Q2 2025 reached an impressive 123%, indicating NT2’s continued high dispatch in the power market.

While total electricity output decreased by 24% compared to the previous year, the focus on contracted output—which benefits from higher and stable selling prices—has significantly enhanced NT2’s business performance and capitalized on the competitive electricity market.

In terms of financial structure, NT2 maintains a strong liquidity position. The report reveals that short-term financial investments (mainly deposits) amount to VND 3,433 billion, comfortably surpassing short-term borrowings of approximately VND 1,987 billion.

Financial income grew by 80% due to high deposit interest rates, while financial expenses remained manageable. As a result, NT2 recorded a 70% year-on-year increase in financial profit, amounting to VND 37 billion for the period. By Q2 2025, the fuel gas costs prepaid under the gas sales and purchase agreement with PV GAS were fully deducted.

According to MAS’s assessment, NT2 is poised to benefit from the potential transition of Phu My 2.2 and 3 thermal power plants to LNG usage after the expiration of their BOT contracts. Additionally, NT2 has planned for a minor overhaul in July 2025.

“We project NT2’s revenue and after-tax profit to reach VND 7,568 billion and VND 532 billion, respectively, representing increases of 27% and 542%. We also anticipate a dividend payout of VND 1,000 per share (a yield of 5%)”, MAS’s report emphasized.

With impressive business results in the first half of the year, MAS has upgraded its recommendation for NT2 to “Overweight,” setting a target price of VND 23,300 per share, implying a potential upside of 13% from the current market price (around VND 20,600 per share).

Petrolimex Posts Nearly VND 1.3 Thousand Billion Profit in Q2, Highest in 16 Quarters

In Q2 2025, Petrolimex (HOSE: PLX) witnessed a slight growth compared to the same period last year. Nonetheless, this increase was significant enough to mark the highest performance for the oil and gas giant since Q2 2021.

“Ben Thanh TSC Announces 30% Cash Dividend, to be Paid in Two Installments”

Ben Thanh Trading & Services Joint Stock Company (Ben Thanh TSC) has announced a generous cash dividend payout of VND 40.5 billion for the fiscal year 2024, amounting to a 30% dividend ratio. This payout marks the second-highest dividend in the company’s history and is a testament to its strong financial performance and commitment to returning value to shareholders. As the company embarks on a new phase of growth, with plans to reinvest profits into a long-awaited project in the heart of Ho Chi Minh City, this dividend declaration stands as a highlight in the company’s trajectory.

Sacombank Enters the Top 10 Most Reputable Commercial Banks in Vietnam for 2025

Sacombank has been recognized by Vietnam Report and VietNamNet Newspaper as one of the Top 10 most reputable commercial banks in Vietnam for 2025. This prestigious accolade further cements Sacombank’s position as a leading private joint-stock commercial bank in the country. Additionally, Sacombank has also made significant strides, climbing into the Top 5 most reputable private banks and securing a spot in the Top 50 public companies for efficiency and reputation (VIX50).

“Cen Land Reports Significant Growth in Second Quarter After-Tax Profit”

Century Real Estate Joint Stock Company (Cen Land, HOSE: CRE) has unveiled impressive business results for the second quarter and the first half of 2025, showcasing a remarkable surge in post-tax profits.

KienlongBank Announces Q2 2025 Financial Results: Multiple Business Indicators Achieve Over 90% of Targets

KienlongBank (UPCoM: KLB) has announced its Q2 2025 financial results, boasting impressive performance. The bank’s consolidated pre-tax profit reached VND 565 billion, with key business indicators such as total assets, mobilized capital, and credit outstanding achieving over 90% of the year’s set plan.