In a recent comprehensive review of Vietnam’s reform efforts, VinaCapital’s Head of Macroeconomic Analysis and Market Research, Michael Kokalari, highlighted how announcements made in late 2024 are now being materialized with new policies being implemented.

Specifically, the National Assembly has passed significantly more laws compared to the 2021-2023 period, covering a wide range of sectors such as power, personal data, rights of dual citizens, and land reform.

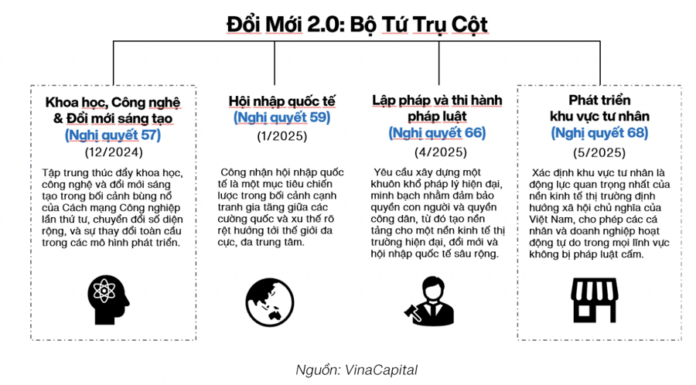

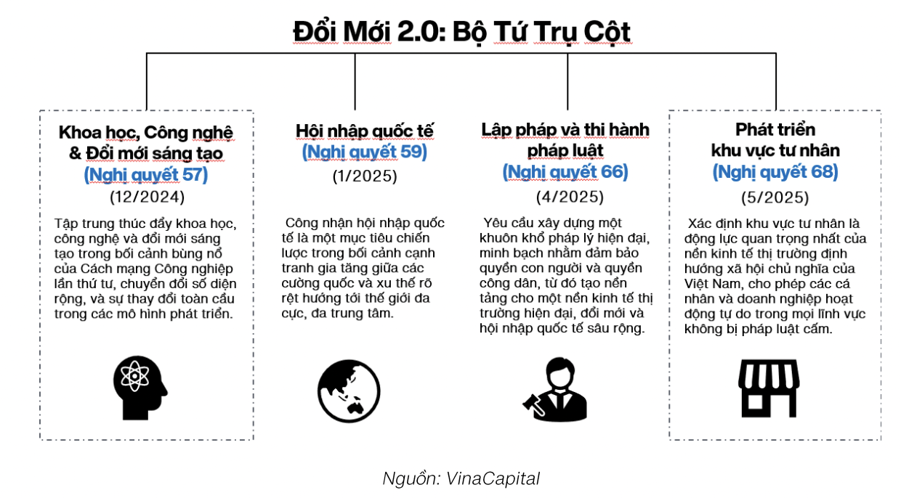

Most of the policy reforms center around four main pillars: Resolution 57 emphasizes technological progress, especially in priority sectors. The government aims to increase spending on research and development (R&D), attract international experts, boost Vietnam’s technology exports, and establish five internationally competitive tech firms by 2030.

Resolution 59 aims to deepen the integration of Vietnamese businesses into global supply chains while attracting more capital into the domestic market from international financial institutions and experts.

Resolution 66 calls for a comprehensive overhaul of the legal system, eliminating overlapping, contradictory, and inconsistent regulations to enhance efficiency for both the public and private sectors.

Resolution 68 elevates entrepreneurship as a pillar of national identity, portraying entrepreneurs as “warriors on the economic front.”

According to VinaCapital’s analyst, these “warriors” are tasked with fostering private sector growth at a pivotal moment in Vietnam’s history.

Among the resolutions, Resolution 68 notably elevates the private sector from a “component” to the “most important driving force of the economy.”

This resolution has also garnered significant attention, partly due to the rise in stock prices of companies perceived to benefit from government policies. Other potential beneficiaries include domestic contractors and construction material manufacturers, who are experiencing increased orders due to accelerated public investment disbursement.

The market anticipates the emergence of more winners as the government implements its strategy to boost private sector growth through the realization of Resolution 68.

The private sector development strategy has a two-pronged approach: developing 20 “national leading enterprises” and vigorously promoting the growth of small and medium-sized enterprises. The government aims to double the number of small and medium-sized enterprises in Vietnam from 1 million to 2 million by 2030 by supporting the development of this sector and transitioning informal individual business households into formally registered enterprises, participating in the tax system, and adopting electronic invoicing.

The strategy to develop 20 large enterprises modeled after the chaebol system, with deep integration into global supply chains, bears resemblance to South Korea’s 1970s economic promotion policies, notably the Heavy and Chemical Industry Promotion Program.

In South Korea, companies in priority sectors benefited from various advantages such as preferential credit from state-owned banks, tax exemptions, market protection from foreign competitors, and support in accessing international strategic partners.

In Vietnam, the government is also gradually providing support to selected enterprises to boost economic growth and develop national infrastructure, albeit using more indirect mechanisms compared to South Korea’s approach in the 1970s.

“Vietnam is entering a phase of Doi Moi 2.0, a rapid evolution from policy statements to tangible outcomes, as evidenced by the 34 laws passed in June 2025, along with far-reaching administrative reforms,” said Michael Kokalari.

“In the coming months, VinaCapital expects faster disbursement of infrastructure investment, particularly in transportation and energy, due to new mechanisms that shorten approval times and minimize capital delays. Similarly, the real estate sector is also expected to continue benefiting from recent policies that unblock stalled projects.”

A New Major Shareholder for Nam Long as Keppel Land Exits

Keppel Land’s exit paved the way for a new major shareholder in Nam Long – the UK-based investment fund, Fiera Capital (UK) Limited.

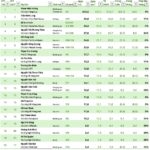

The Wealth of Vietnam’s Top 20 Stock Market Billionaires: Vietjet Chair Adds Another $29 Million, VPBank Chair’s Family Sees Largest Increase

As of Wednesday, August 6, 2025, Mr. Pham Nhat Vuong, Chairman of Vingroup, remains the wealthiest individual on the Vietnamese stock market. With a staggering net worth of 233,500 billion VND, Mr. Vuong’s wealth continues to be a testament to his success and influence in the country’s economy.

Proposed Title: A Luxury Proposition: The Vietnamese High-Roller’s Monthly Indulgence

The Ministry of Finance has proposed a unique proposition for Vietnamese citizens wishing to try their luck at local casinos. Under this proposal, locals will be required to purchase an entry ticket priced at 2.5 million VND, granting them access for a continuous 24-hour period. Alternatively, for frequent visitors, a monthly pass is offered at a cost of 50 million VND per person. This innovative approach aims to regulate and monetize the country’s casino industry while offering an exciting and exclusive experience to enthusiasts.