The Federal Reserve (Fed) voted to maintain the US dollar policy rate at a high level (4.5%) during its meeting on July 30, 2025.

Following the meeting, the Fed Chair clarified the decision, stating that the US economy continues to grow steadily (3% in Q2 2025) despite tariff-related headwinds. Unemployment remains low, while inflation slightly exceeds the 2% target. As a result, the Fed believes that the current interest rate path is appropriate and awaits further data in the coming months to inform any decisions regarding rates for the latter part of 2025. The Fed Chair did not provide a definitive forecast for the interest rate trajectory in the September 2025 meeting.

Mr. Dinh Duc Quang – Director of Treasury, UOB Vietnam

|

With this latest development, Mr. Dinh Duc Quang, Director of Treasury at UOB Vietnam, assessed that the US dollar has strengthened significantly against other major currencies, and the USD-Index has returned to 100, the highest level in the past three months. The market also started trading key currency pairs, interest rates, and gold at levels factoring in the possibility of a Fed rate cut in September, now priced at below 50%. Thus, there is a strong likelihood that USD interest rates could remain elevated, averaging above 4% throughout the remaining months of 2025, despite UOB’s view that the Fed will still cut rates by 2-3 times in the final quarters of the year, totaling a reduction of approximately 0.5-0.75%.

In the domestic market, this puts pressure on expectations for VND interest rate cuts to support business production and promote high growth in line with the government’s GDP target of over 8% in 2025. High USD interest rates will also continue to attract USD holdings and USD-denominated assets in the US and worldwide, further challenging the implementation of monetary policies aimed at ensuring USD/VND exchange rate stability and expanding foreign reserve assets for the managing authority.

According to Mr. Quang, the State Bank of Vietnam (SBV) will temporarily refrain from adjusting VND policy rates in the short term. UOB believes that the SBV will continue to monitor domestic macroeconomic developments, USD interest rate trends, and the impacts of the new tariff policies that took effect on August 1 before making decisions regarding VND interest rates.

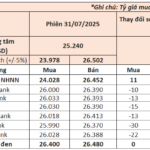

Mr. Quang also leans towards the view that the SBV will promptly reduce VND interest rates by approximately 0.5% if the Fed cuts USD rates in the September meeting and the downward trend in USD rates becomes more apparent in Q4 2025 and Q1 2026. The USD/VND exchange rate is expected to remain high around 26,400/26,500 in Q3 2025 and slightly decrease to around 26,000 by the end of 2025 and early 2026. At the 26,000 level, the VND may depreciate by about 2-3% against the USD in 2025.

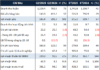

Mr. Quang believes that commercial banks are unlikely to significantly reduce VND deposit and lending rates in the final quarters of the year. VND deposit rates in August 2025 are slightly lower than the same period in 2025, by about 0.2-0.4% depending on the term, and are appropriate in the overall context of the correlation with international USD interest rates and USD/VND exchange rate fluctuations in recent months. At these interest rates, the market also recorded high credit growth of 10% in the first six months, and the credit growth for the entire year of 2025 is expected to reach 18-20%, significantly supporting economic growth.

In the most optimistic scenario, if USD interest rates fall later in the year, tariff impacts remain minimal, and the stock market upgrade attracts strong foreign capital inflows again, we may hope for a more substantial VND interest rate reduction of 0.5-0.75%. This would be a crucial factor in positively impacting the economic growth plan of 8-9% for 2026.

– 13:13 04/08/2025

The Alluring Appeal of Bank Deposits: What’s Keeping Funds from Venturing Out?

Despite the low savings interest rates, banks continue to attract massive cash inflows. This phenomenon can be attributed to a combination of factors, including a cautious mindset, deep-rooted trust in the banking system, and traditional savings habits, which together create a strong pull for idle funds to remain within the confines of these financial institutions.

“Vietnam’s Central Bank Meets With Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself, with a key focus on maintaining stability in deposit interest rates. Institutions are also encouraged to further reduce operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to lower lending rates.