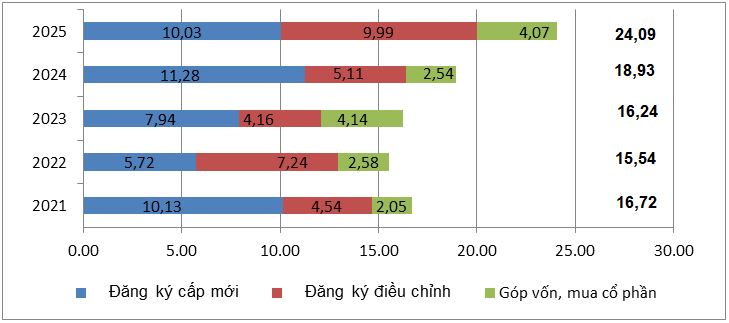

Foreign Investment Registered in Vietnam from January to July 2021-2025 (Billion USD)

|

Specifically, the registered capital for new projects included 2,254 newly licensed projects with a registered capital of 10.03 billion USD, a 15.2% increase in the number of projects compared to the same period last year, but an 11.1% decrease in registered capital. The manufacturing industry attracted the largest foreign investment with a registered capital of 5.61 billion USD, accounting for 55.9% of the total newly registered capital. Real estate business activities reached 2.36 billion USD, or 23.5%, while other industries attained 2.06 billion USD, making up 20.6%.

Among the 74 countries and territories with newly licensed projects in Vietnam during the first seven months of 2025, Singapore was the leading investor with 2.84 billion USD, accounting for 28.3% of the total newly registered capital. This was followed by China with 2.27 billion USD (22.6%), Sweden with 1.0 billion USD (10.0%), Japan with 865.8 million USD (8.6%), Taiwan with 735.0 million USD (7.3%), Hong Kong SAR (China) with 721.2 million USD (7.2%), and the British Virgin Islands with 317.1 million USD (3.2%).

The registered adjusted capital involved 920 projects that were previously licensed from previous years, with an additional investment of 9.99 billion USD, marking a 95.3% increase compared to the same period last year.

Considering both the newly registered capital and the registered adjusted capital of previously licensed projects, the foreign direct investment into the manufacturing industry reached 12.12 billion USD, accounting for 60.6% of the total newly registered capital and showing an increase. Real estate business activities attracted 4.95 billion USD, or 24.7%, while other industries attained 2.94 billion USD, making up 14.7%.

There were 1,982 transactions of capital contribution and share purchases by foreign investors, with a total value of 4.07 billion USD, a 61.0% increase compared to the same period last year. Among these, 836 transactions involved capital contributions and share purchases that increased the charter capital of enterprises, with a value of 1.52 billion USD. Meanwhile, 1,146 transactions involved foreign investors buying shares from domestic investors without increasing the charter capital, valued at 2.55 billion USD. Regarding the form of capital contribution and share purchases by foreign investors, the manufacturing industry attracted an investment of 1.6 billion USD, accounting for 39.3% of the value of capital contributions. Professional, scientific, and technological activities reached 827.2 million USD, or 20.3%, while other industries attained 1.65 billion USD, making up 40.4%.

The realized foreign direct investment in Vietnam for the first seven months of 2025 was estimated at 13.6 billion USD, an increase of 8.4% over the same period last year. This was the highest foreign direct investment realization for the first seven months in the past five years. The manufacturing industry accounted for 81.6% of the total foreign direct investment realization, reaching 11.1 billion USD. Real estate business activities attained 1.09 billion USD, or 8.0%, while electricity production and distribution, gas, hot water, steam, and air conditioning achieved 505.2 million USD, or 3.7%.

Regarding Vietnam’s outbound investment during the first seven months of 2025, 105 new projects were granted investment registration certificates, with a total capital of 398.9 million USD from the Vietnamese side, 3.2 times higher than in the same period last year. There were also 20 capital adjustment transactions, with an adjusted capital increase of 129.6 million USD, 4.5 times higher.

In total, for the first seven months of 2025, Vietnam’s outbound investment (including new and adjusted capital) reached 528.5 million USD, 3.5 times higher than in the same period last year. Electricity production and distribution accounted for 21.0% of the total investment, reaching 111.2 million USD. Warehousing and support activities for transportation achieved 109.1 million USD, or 20.6%, while wholesale and retail trade, automobile and motorcycle repair, and other vehicle maintenance reached 78.1 million USD, or 14.8%.

During the first seven months of 2025, Vietnamese investment was present in 33 countries and territories. Laos was the leading destination with 150.3 million USD, accounting for 28.4% of the total investment. The Philippines attracted 61.8 million USD (11.7%), Indonesia 60.5 million USD (11.4%), Germany 50.6 million USD (9.6%), and the United States 31.2 million USD (5.9%).

– 09:20 06/08/2025

The Shortest Route Connecting Phan Thiet and Da Lat: Construction Update

The renovation and upgrade project of National Highway 28B, connecting Phan Thiet and Da Lat in Lam Dong Province, commenced in April 2024. However, as of now, there are still 6.3 kilometers of land awaiting handover, and over 23 hectares of land are yet to be approved for clearance. According to the plan, the project was slated for completion in the first quarter of 2026, but it currently remains in a state of disarray.

The Reason for the Delay in the Ho Chi Minh Road Project in An Giang – Ca Mau

The Ho Chi Minh Road project, spanning An Giang to Ca Mau, has faced some setbacks since its commencement in March 2024. As of now, only 42% of the construction has been completed, primarily due to shortages in filling materials and delays in land clearance. With these challenges, the project is at risk of falling behind schedule, making it unlikely to meet its target completion date this year.

“A Flourishing Business Landscape: Vietnam Witnesses 107,700 New Enterprises in the First Seven Months of 2025”

According to the latest statistics from the General Statistics Office of Vietnam, in the first seven months of 2025, the country witnessed the establishment of 107.7 thousand new enterprises with a total registered capital of 928.4 trillion dong and 670 thousand registered employees. This signifies a notable 10.6% increase in the number of businesses compared to the same period last year.

“Phát Đạt Repositions Its Investment Portfolio, Focusing on the Southern Market to Embrace the New Growth Cycle.”

As the real estate market enters a more selective and substantive recovery phase, businesses must reshape their strategies to adapt. Phat Dat Real Estate Development Corporation (HOSE: PDR) is demonstrating a clear and aggressive shift to capture the significant movements in planning, policies, capital flows, and consumer trends.