HDBank, one of Vietnam’s leading banks, concluded the second quarter of 2025 with impressive financial results, becoming the ninth bank in the country to surpass the 10,000 billion VND profit milestone.

This remarkable achievement can be attributed to the bank’s ability to optimize its net interest margin (NIM), coupled with a significant breakthrough in fee income and proactive risk management strategies.

Recognizing the bank’s exceptional financial performance, Emerging & Frontier Capital (EFC), a renowned independent research organization, selected HDBank for a detailed valuation update.

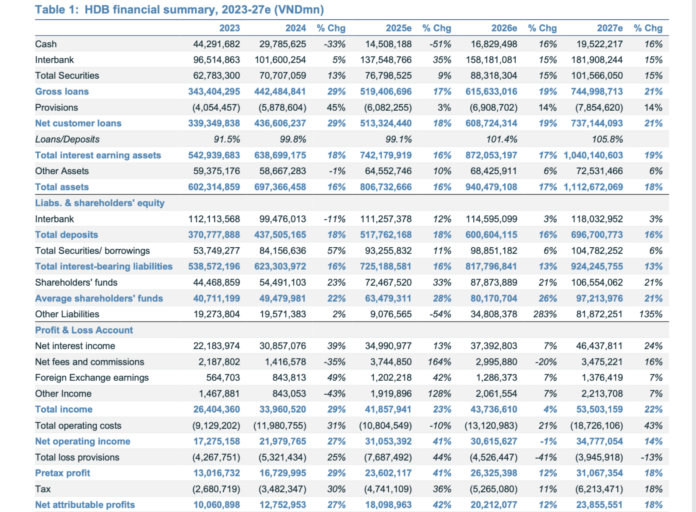

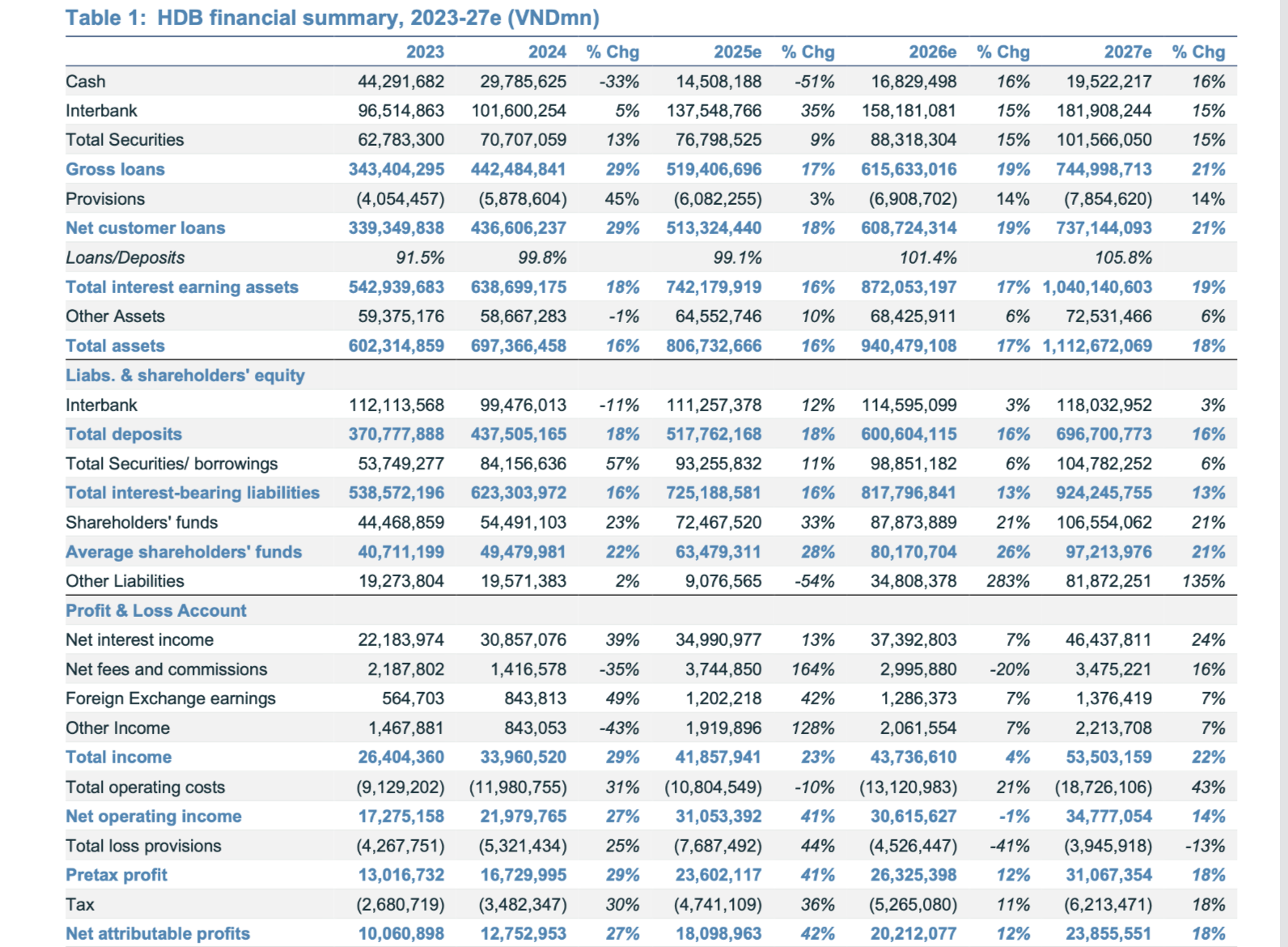

In their recently published analysis report, EFC provided a positive outlook on HDBank’s second-quarter results and forecasted a full-year profit of over 23,600 billion VND for 2025.

According to EFC, HDBank’s pre-tax profit for the second quarter of 2025 reached 8,781 billion VND, reflecting a remarkable 67% increase year-over-year and a 32% surge compared to the first quarter of 2025. This impressive growth is attributed to a substantial surge in non-interest income (up 204% YoY) and effective cost management (down 8% YoY).

HDBank’s parent bank maintained its strong credit growth trajectory, with a 33% increase compared to the same period in 2024. For 14 consecutive quarters, the parent bank has consistently achieved over 20% year-over-year credit growth. HD Saison, a subsidiary of HDBank, has also demonstrated solid performance, with an average credit growth of 11% over the past six quarters. In the second quarter of 2025, HD Saison’s credit growth reached 10% year-over-year.

During the second quarter of 2025, HDBank’s lending rate stood at 4.5%, as lending yields decreased by 2.55 percentage points over the past three quarters while deposit costs rose by 0.57 percentage points during the same period.

Despite the decline in customer lending rates, HDBank’s NIM for the second quarter of 2025 witnessed a significant improvement, increasing by 1.16 percentage points to reach 6.13%. This expansion can be primarily attributed to a rise in asset yields (+1.17 percentage points) to 11.2% and well-controlled funding costs, which only saw a slight increase (+0.16 percentage points) to 5.35%.

EFC acknowledged HDBank’s strategic utilization of its position as a net lender in the interbank market. The bank has effectively increased its interbank deposits from 44,811 billion VND in the fourth quarter of 2020 to 132,104 billion VND in the second quarter of 2025, almost tripling in less than five years. Notably, HDBank transitioned from a net borrower (30,507 billion VND) in the fourth quarter of 2020 to a net lender (32,825 billion VND) in the interbank market during the second quarter of 2025.

Additionally, EFC highlighted that HDBank’s customer loan-to-deposit ratio for the second quarter of 2025 stood at 106%, compared to a historical average of 103%, indicating a comfortable liquidity position. Furthermore, the bank’s total loan-to-total funding sources ratio (including interbank, deposits, and wholesale funding) for the same quarter was a conservative 77%.

In terms of non-interest income, HDBank witnessed a remarkable surge of 204% quarter-over-quarter, reaching 1,744 billion VND in the second quarter of 2025. This impressive growth was primarily driven by a significant 493% increase in fee income.

Given the strong pre-provision profit in the second quarter of 2025, supported by robust credit growth, expanded NIM, and surging non-interest income, HDBank proactively increased its loan loss provisions to 3.26% of total loans (up from 1.19% in the first quarter of 2025), effectively managing 5,247 billion VND in non-performing loans.

Based on HDBank’s outstanding performance in the second quarter of 2025, EFC projected that the bank’s total operating income for the full year 2025 could reach 31,053 billion VND, translating to a pre-tax profit of 23,600 billion VND. This forecast represents a remarkable 41% increase compared to the bank’s performance in 2024, surpassing the target set by its shareholders.

Emerging & Frontier Capital (EFC) is an independent equity research organization focusing on emerging and frontier markets. Their key areas of expertise include Sub-Saharan Africa (SSA), the Middle East and North Africa (MENA), Central & Eastern Europe and Central Asia (CEECA), South Asia (SA), and Southeast Asia (SEA).

EFC’s analysts are consistently ranked within the top 25% in leading research polls.

Amid the Supply Chain Remapping Wave, ACB and FDI Enterprises Explore Opportunities in Vietnam

Vietnam is among the first nations to strike a deal with the US on mirror taxes, with expected rates of 20% for exports from Vietnam and 40% for transshipped goods.

Crafting Climate-Resilient Project Criteria

This criterion will contribute to refining policies related to climate change adaptation and public investment. It will aid ministries, sectors, and localities in clearly identifying the relevance of projects to climate change adaptation goals, providing a basis for selecting well-focused project proposals.

“Registered FDI Capital for the First Seven Months Reaches Nearly US$24.1 Billion: Investor Confidence Confirmed”

Vietnam continues to showcase its allure in attracting foreign investment, with registered and disbursed capital in the first seven months of the year surpassing that of the same period last year.