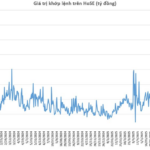

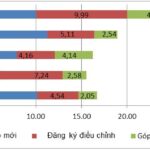

The market witnessed a dramatic volatility spike during this afternoon’s session, taking an unexpected turn. As investors were reveling in VN-Index’s 3.72% surge, a sudden sell-off occurred, sending the index plunging by 0.6%, equivalent to a 4.34% swing in less than 30 minutes. Today’s trading volume on the HoSE soared to a new record of 72,841 billion VND, surpassing the previous peak on July 29th.

Including matched transactions, the total value of the three exchanges reached 82,563 billion VND, another unprecedented high. The market shifted from strong gains to losses, and this liquidity surge reflected a significant sell-off.

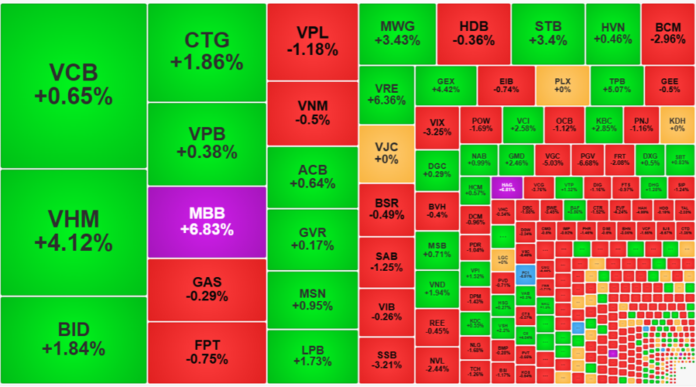

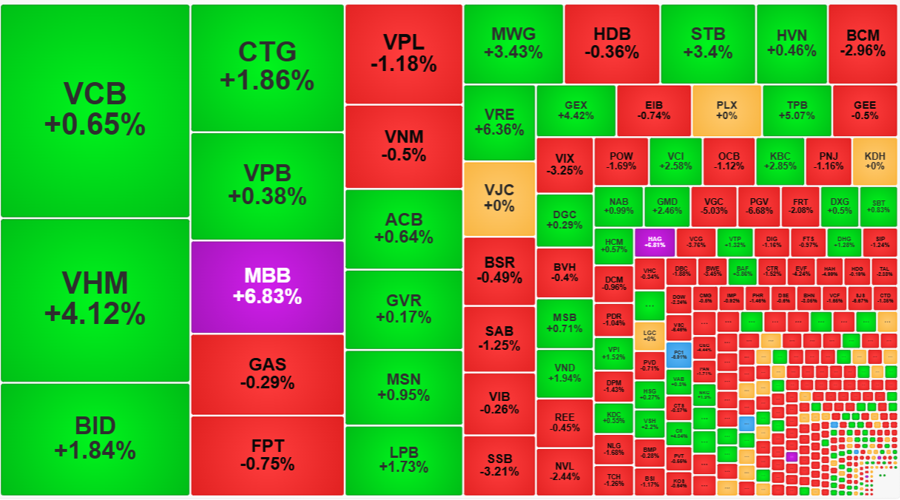

VN-Index closed with a 1.24% gain, equivalent to 18.96 points above the reference level. However, this was merely a numerical boost, as many stocks took a hit. At its peak, VN-Index touched 1584.98 points, a 56.79-point jump, with 229 gainers and 94 losers. At the bottom, it stood at 73 gainers and 264 losers, eventually closing with 118 gainers and 221 losers.

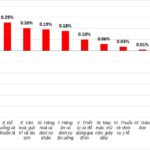

This wide swing indicates two key points. Firstly, the intense selling during the last 30 minutes of continuous matching occurred across a broad spectrum, impacting hundreds of stocks, including large-caps, which experienced unusual pressure. Secondly, while VN-Index’s late-day surge above 1% was influenced by large-caps, most stocks didn’t recover significantly.

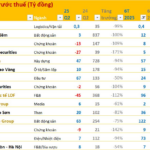

Large-cap stocks demonstrated better resilience, with VN30-Index closing 2.25% higher, featuring 19 gainers and 9 losers. Compared to the morning session, 25 stocks in this basket slipped lower, while only four improved. All 30 stocks in the basket experienced intense pressure from their peak prices, except for MBB, which closed at the ceiling price. Moreover, 16 stocks plunged over 3% from their highs, and another five fell within the 2-3% range. This significant volatility occurred within an incredibly short time frame. Today’s trading volume for the VN30 basket hit a historical high of 39,251 billion VND, surging 162% from the previous day and surpassing the July 29th volume of 30,015 billion VND.

The performance of other stocks wasn’t as robust as the large-caps. Midcap dipped by 0.27%, while Smallcap fell by 1%. However, some stocks still showed resilience, as the HoSE floor saw 60 stocks rise over 1% at the close, including 13 from the VN30 basket. VND climbed 1.94%, GEX surged 4.42%, VCI gained 2.58%, CII rose 4.04%, KBC increased by 2.85%, and HAG soared 6.81%, all with trading volumes exceeding 600 billion VND each. VND, GEX, and VCI even witnessed transactions worth thousands of billions of VND. Nevertheless, compared to the morning session, when 109 stocks rose over 1%, this performance was disappointing, especially considering that 255 stocks had gained over 1% at the market’s peak.

The situation was more dire for declining stocks. While only 35 stocks dropped more than 1% in the morning session, this number climbed to 124 at the close. The four stocks with the highest trading volume in this group were SHB, falling 1.34% with nearly 3,329 billion VND; VIX, dropping 3.25% with 2,120 billion VND; DIG, declining 1.16% with 1,050 billion VND; and VSC, plunging 6.46% with 1,047 billion VND. Some stocks, like PC1 and PET, witnessed double-digit percentage drops to their floor prices.

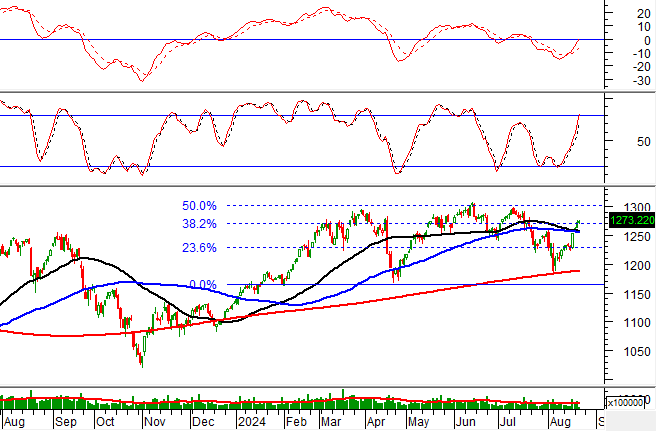

The intense sell-off after VN-Index breached its historical peak reveals a fragile market burdened by a massive stock supply. Bottom-fishing activities around the 1500-point level are evident, but as the market climbs higher, selling pressure intensifies. Today’s events echo those of July 29th, when a sell-off emerged as investor sentiment peaked.

New Record: Nearly VND 70,000 Billion in Matching Orders on HoSE

The VN-Index’s consecutive record-breaking performance has ignited a speculative frenzy, resulting in a vibrant trading landscape unseen in recent times.

The Stock Market Surge: Banking Sector Leads VN-Index to New Heights

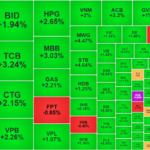

The market slowed down and turned volatile in the afternoon session, but ultimately finished on a positive note. The VN-Index rose 1.72% to 1573.71, closing at a new all-time high. This achievement was largely driven by TCB, VCB, and the banking sector as a whole, which propelled the index beyond its previous peak.

Market Beat: Green Dominance, VN-Index Extends Gains

The trading session concluded with significant gains, as the VN-Index surged by 26.56 points (+1.72%), closing at 1,573.71. Meanwhile, the HNX-Index also witnessed a robust increase of 2.54 points (+0.95%), ending the day at 268.66. The market breadth was strongly positive, with 529 advancing stocks versus 254 declining ones. This bullish sentiment was echoed in the VN30 basket, where 28 stocks climbed while only 2 witnessed losses.