Last month, the Bank for International Settlements (BIS) warned that if stablecoin growth goes unchecked, public trust in currencies could be seriously undermined. Photo: Arnd Wiegmann/Reuters.

|

Central banks worldwide face a difficult choice: embrace stablecoins or develop alternative tech solutions, as the US actively promotes privately issued digital currencies and pushes the sector into the mainstream of finance.

|

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged 1:1 to the US dollar, and are commonly used for trading digital assets. Stablecoin usage has surged in recent years, fueled by expectations of instant value transfer. |

This week in Washington, politicians are pushing for a bill that would prohibit the Federal Reserve from issuing a national digital currency and establish a legal framework for private stablecoins. For the Trump administration, these largely USD-backed assets became a tool to assert the global dominance of the US dollar.

However, the Bank for International Settlements (BIS) warned last month that unchecked stablecoin growth could erode public trust in currencies, threaten monetary sovereignty, and make financial stability risks harder to manage. Policymakers also worry that stablecoins could be exploited as a vehicle for financial crimes.

To counter this trend, some countries are rushing to develop central bank digital currencies (CBDCs) to offer their citizens a safe digital payment option and curb the rising tide of “dollarization.” However, CBDC projects have faced significant challenges and shown limited implementation success so far.

Christian Catalini, founder of the Cryptoeconomics Lab at the Massachusetts Institute of Technology, remarked, “We’re in a strange context where USD-pegged stablecoins hold a dominant position. Without regulation, this could lead to rampant dollarization.”

He further emphasized, “But this isn’t a long-term equilibrium. Other nations realize this and are pondering whether to try to control this trend or harness stablecoins as a catalyst for financial innovation by developing domestic versions.”

Currently, there are approximately $250 billion worth of stablecoins in circulation globally, mostly pegged to the US dollar. Investors often pour capital into these assets to hold funds before trading cryptocurrencies or using them for payments, as transactions take just minutes instead of days with traditional banks, and transaction costs are significantly lower.

Analysts predict that the stablecoin market will continue to experience explosive growth in the coming years. Citi Institute forecasts that global stablecoin supply could reach $1.6 trillion by 2030 and even surge to $3.7 trillion with a more favorable legal framework in the US. However, this rapid growth also poses risks, as countries that fail to keep up may miss out on developing this new industry and lose their voice in shaping global rules.

Recently, the Bank of Korea (BOK) decided to halt its national digital currency project temporarily. Meanwhile, eight major commercial banks in the country have joined forces to develop a won-backed stablecoin, reflecting a clear shift in priorities toward private sector-led digital solutions.

In the UK, the Bank of England (BOE) has also signaled a shift in attitude, relaxing its previously cautious stance toward stablecoin issuers. Varun Paul, a senior director at Fireblocks and former head of fintech at the BOE, attributed this to concerns that the UK could fall behind in the global competition if the US legalizes and promotes stablecoins as a mainstream trend.

Mr. Paul also emphasized that the market has changed dramatically since the BOE’s first consultation on stablecoin regulation in 2023. While the technology was once on the fringes of the financial system, it has now become a booming force. The BOE recognizes that failing to adapt promptly will cause them to lose their initiative in shaping the rules for this new market.

However, the BOE’s governor, Andrew Bailey, recently warned in The Times that stablecoins issued by large banks could pose risks to financial stability. According to Mr. Bailey, a more sensible approach for the UK would be to gradually transition to tokenized bank deposits—digitizing commercial bank deposits to shorten settlement times—rather than rushing to launch a new national digital currency.

In the Eurozone, many policymakers aspire to establish the euro as a new reserve currency to rival the dominance of the US dollar. The European Central Bank (ECB) is a key driver, strongly promoting the issuance of a digital euro. Since 2021, a digital euro project targeting retail customers has been underway, aiming to reduce Europe’s dependence on US tech giants that dominate cross-continental payment infrastructure.

Nevertheless, the global picture for central bank digital currencies (CBDCs) remains lackluster. While there are 69 retail CBDC projects in progress worldwide, only three have been officially launched, and two others have been discontinued, according to the Atlantic Council.

The most significant CBDC failure is Nigeria’s. In 2021, the country confidently launched the e-Naira, but most citizens were indifferent and opted for USD-pegged stablecoins issued by private entities. Consequently, the project was deemed a failure, forcing the Nigerian government to increase control over crypto exchanges, compromising the market’s freedom to develop.

According to Nitin Datta, Chief of UNDCIF (a UN agency for digital assets), one reason for the e-naira’s failure was that it was merely a digitized version of the traditional domestic currency, which lacked public trust. He commented, “Nigeria was a free-market experiment. Whether we like it or not, exchanges and stablecoins will continue to exist; we can’t entirely eliminate market activity.”

While not dismissing stablecoins’ potential, Ruth Wandhofer, Chair of the UK’s Payment Systems Regulator, emphasized that this asset class has yet to demonstrate large-scale applicability. As she exemplified in a recent conference, a global CFO is unlikely to use stablecoins for substantial cross-border transactions due to significant currency conversion costs.

Ms. Wandhofer also pointed out that consumers in many countries lack basic financial knowledge, payment systems are limited, technology infrastructure is inadequate, and transparency is lacking. “Using stablecoins as an intermediary for deposits and withdrawals can sometimes incur higher costs than transferring money via Western Union,” she warned.

Additionally, she noted that as crypto transactions increase, states may experience tax revenue losses due to the difficulty of monitoring cash flow. “Therefore, the UK and Europe will undoubtedly need to develop digitized versions of the pound and the euro in the future,” she concluded.

For these projects, Josh Lipsky, a senior director at the Atlantic Council’s Geoeconomics Center, believes that the birth of the digital euro will be the ultimate test. “If the digital euro succeeds, the Eurozone will demonstrate to the world that the public sector’s digitalization is feasible and worthy of becoming a global paradigm,” he emphasized.

The House Passes Landmark Stablecoin Legislation

“Stablecoins are a unique type of cryptocurrency designed to maintain price stability, typically pegged 1:1 to the US dollar. They are a trusted medium for exchanging digital assets and offer a stable haven in the often volatile world of cryptocurrencies. With their stable value, stablecoins provide a reliable and efficient way to transact, free from the extreme price fluctuations that other cryptocurrencies can experience.”

“Chubb Life Vietnam: Elevating the Customer Experience.”

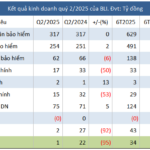

Chubb Life Vietnam has once again been recognized as one of the Top 10 Most Reputable Life Insurance Companies in 2025. This prestigious accolade was awarded by Vietnam Report in collaboration with VietNamNet newspaper, highlighting Chubb Life’s unwavering commitment to excellence in the industry.

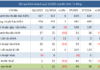

Tokenizing Real-World Assets: Dragon Capital Proposes Pilot with ETFs

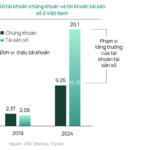

The Vietnamese economy has witnessed remarkable growth over the past few decades, resulting in a significant increase in household wealth and a heightened demand for more diverse investment options. Notably, digital assets have captured the interest of individual investors seeking to diversify their portfolios and embrace higher risk to maximize their wealth.