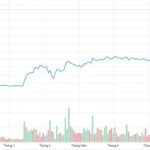

Bitcoin has soared to new heights, surpassing 123,000 USD this week, while other cryptocurrencies such as Ether and Solana have also seen significant gains.

This surge has pushed the total market capitalization of all cryptocurrencies beyond the 4 trillion USD mark on July 18th, according to the price-tracking website CoinGecko.

These developments come as former President Donald Trump signed into law important legislation regarding stablecoins. Mark Palmer, an analyst at The Benchmark Company investment bank, described these bills as “one of the most significant steps” toward mainstream adoption of cryptocurrencies.

“Institutional investors who have long been observing and awaiting this legal clarity will now start allocating capital to the market,” Palmer said.

|

Stablecoins are a type of cryptocurrency designed to maintain a stable value, often pegged 1:1 to the US dollar, and are commonly used for trading between digital assets. The use of stablecoins has skyrocketed in recent years, fueled by expectations of instant fund transfers. |

On July 19th, former President Trump signed into law the Genius Act, which provides regulations for stablecoins.

Separate legislation regarding the structure of the digital assets market and a ban on central bank digital currencies has also been passed by the House but still awaits a Senate vote.

With the market surpassing 4 trillion USD, the industry has made a remarkable recovery since 2022 when its value plummeted to around 800 billion USD following the collapse of the FTX crypto exchange in late 2022. At that time, Bitcoin’s price plunged to roughly 16,000 USD, causing many investors to withdraw from the market, deeming cryptocurrencies too risky.

The industry has greatly benefited from former President Trump’s enthusiastic support. He has also launched or endorsed numerous tokens and appointed crypto-friendly officials in Washington.

Investors predict that the stablecoin legislation will pave the way for Wall Street banks, asset management firms, and other businesses to invest in digital assets or issue their own tokens.

Leaders of major banks, including Bank of America, Citigroup, and JPMorgan Chase, have expressed intentions to create their own stablecoins following the enactment of the Genius Act.

“Big wins for the crypto market in the House,” tweeted David Sacks, who oversaw crypto and AI policy in the Trump administration.

Former President Trump is also preparing to sign an executive order that would open up the US$9 trillion retirement market to cryptocurrencies and other alternative investments.

However, experts warn that closely tying cryptocurrencies to the traditional financial system could pose significant risks in the event of a market crash.

Democratic Senator Elizabeth Warren argues that the Genius Act “lacks basic safeguards necessary to ensure stablecoins don’t endanger the whole financial system.” She also contends that allowing private companies to issue stablecoins risks “concentrating enormous economic power in the hands of a few unregulated companies.”

Former President Trump has received hundreds of millions of dollars in campaign contributions from crypto leaders and has pledged to make the US the “crypto capital of the world.”

The crypto industry, including companies like Coinbase, Binance, and Crypto.com, faced a slew of lawsuits during the Biden administration. In Trump’s second term, all these lawsuits have been dropped.

– 11:40 19/07/2025

The House Passes Landmark Stablecoin Legislation

“Stablecoins are a unique type of cryptocurrency designed to maintain price stability, typically pegged 1:1 to the US dollar. They are a trusted medium for exchanging digital assets and offer a stable haven in the often volatile world of cryptocurrencies. With their stable value, stablecoins provide a reliable and efficient way to transact, free from the extreme price fluctuations that other cryptocurrencies can experience.”

The Digital Asset Exchange is Almost Here.

The early launch of the crypto asset exchange for beta testing is a significant step forward, offering legal trading opportunities for citizens.

The Trump Organization Invests in Bitcoin: $2 Billion in Crypto Purchased

On July 21st, the Trump Media and Technology Group announced it had purchased approximately $2 billion worth of Bitcoin and other cryptocurrencies. This substantial investment in digital assets further bolsters the already vast fortune of former President Donald Trump, highlighting his forward-thinking approach to financial opportunities.