Economic Structure

The structure mentioned here includes several key structures such as the economic sector structure, economic type structure, economic region structure, and some detailed structures, including internal/external factors, labor, investment capital, enterprises, revenue, expenditure, budget, etc.

Economic Sector Structure

Just a few words, “Agriculture is the primary front, and food is the top priority,” contributed to Vietnam’s escape from a severe crisis that loomed from the late 1970s to the early 1990s. This crisis was characterized by low growth, a GDP per capita of $86 in 1988, placing Vietnam among the lowest in the world, hyperinflation, and high unemployment – an economy with significant shortages.

The proportion of the agriculture, forestry, and fisheries group decreased

After basically overcoming the crisis, especially after 20 years, in 2008, Vietnam transitioned to a lower-middle-income country. The country entered the industrialization and modernization era, aiming to become an industrialized country with a modern industry, surpassing the lower-middle-income threshold.

Accordingly, the decrease in the GDP proportion of the agriculture, forestry, and fisheries group is a correct direction in the process of industrialization and modernization and the transition from an agricultural to an industrial country. In 2022, among the countries and territories with comparable data, the proportion of this group in Vietnam’s GDP remained the 4th highest in Southeast Asia, 21st in Asia, and 34th in the world.

This process also contributed to the increase in the proportion of the industry and construction group in GDP. However, this proportion is still low (5th in Southeast Asia, 11th in Asia, and 17th in the world).

For a transitioning country with a high degree of openness, although the proportion of the real economy is larger than that of the service economy, the proportion of Vietnam’s real economy is still low. The proportion of the service economy is increasing and accounts for the most significant proportion among the three industry groups. While this is necessary in the long run, it is still relatively low compared to many countries and territories with comparable data (6th in Southeast Asia, 24th in Asia, and 90th in the world).

Notably, the sectoral shift in some areas needs to be considered: the proportion of services in large cities is still low, while the proportion of industry and construction is high (but the proportion of clean and high-tech industries is not significant); some areas suitable for agriculture, forestry, and fisheries development also prioritize industry…

The GDP structure has shifted due to various factors, including labor and investment shifts…

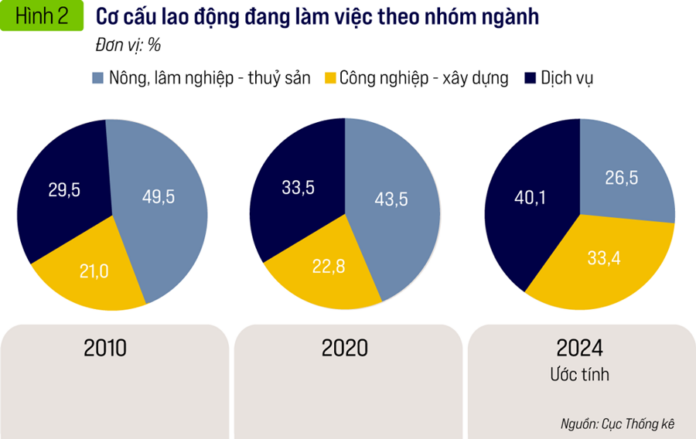

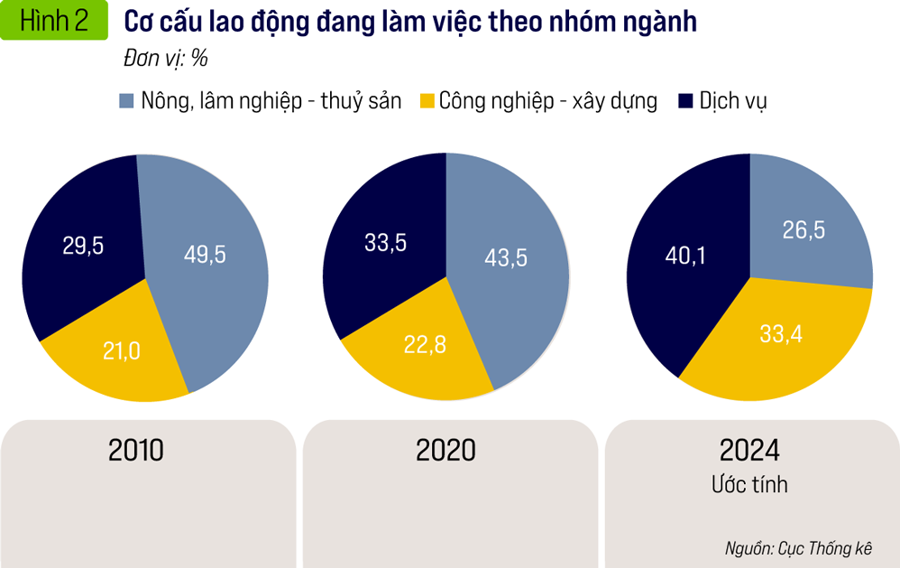

The labor structure by industry group has shifted positively. The proportion of labor in agriculture, forestry, and fisheries decreased to shift to industry, construction, and services to achieve higher labor productivity and income than working in the agriculture, forestry, and fisheries sector.

In the past, labor moving from the agriculture, forestry, and fisheries group to cities for industrial and service jobs was positive, but now there are messy “labor markets.” Currently, many industrial and service enterprises have moved to rural areas, attracting agricultural labor in a “leaving agriculture but not the countryside” manner, which has a dual impact. It not only shifts the labor structure by industry group but also increases the urban population ratio.

Many service activities that were previously attached to agencies and enterprises are now separate, making them more professional and increasing service labor productivity. However, due to the weakness of the auxiliary industry and the large proportion of assembly, income is low and dependent on imports (Figure 3)

The investment in new rural construction has contributed to changing the rural face, especially in village roads. However, the proportion of investment in agriculture, forestry, and fisheries is still far lower than its proportion in GDP and the number of laborers working in this group. This causes agriculture and rural areas to have a slower GDP growth rate and lower indicators (such as the proportion of trained laborers, labor productivity, etc.) while having higher indicators in other areas (such as the poverty rate) compared to urban areas.

The proportion of GDP in agriculture, forestry, and fisheries tends to decrease, which is appropriate and correct after overcoming the “instability without agriculture.” When there is enough agricultural, forestry, and aquatic products for domestic use and export, with a volume ranking high in the world…, we must realize that “without industry, there is no wealth,” and shift to industry to get rich and “without commerce, there is no activity” (in a broader sense, services) to ensure dynamism and flexibility in the market economy…

However, Vietnam started as an agricultural country with climatic and land advantages for agricultural development, while neighboring countries with large populations are rapidly transitioning to industry and services. Vietnam is also predicted to be one of the few countries most affected by climate change and rising sea levels.

The rural population is large, and the country’s population has exceeded 100 million, still increasing by nearly 1 million people annually. The proportion of labor in agriculture, forestry, and fisheries remains high. The proportion of total social investment in agriculture, forestry, and fisheries is decreasing and is still far lower than its proportion in GDP, labor…,

The proportion of high-tech agriculture is low; processing to increase the value of agricultural products is still inadequate. For many trees, animals, and regions, the situation of “making a profit by working hard” persists…, so it is necessary to consider the industrialization and modernization of agriculture, forestry, and fisheries as an important goal.

The proportion of the industry and construction sector is increasing

The proportion of GDP in industry and construction tends to increase, which is appropriate and correct. This result is achieved due to the shift in labor structure, investment, the proportion of trained laborers, export ratio…, in industry and construction. Notably, the proportion of processing and manufacturing industry (the main criterion for an industrialized country) has increased in many indicators, with the proportion in GDP in 2024 surpassing the 24% threshold. The continuous increase in the urban population ratio during this period also contributes to the development of industry, construction, and services.

However, there are three limitations in industry and construction that need to be addressed promptly. Supporting industries have been proposed for a long time but remain weak. The situation of assembly and processing is still significant, even in some sectors of foreign-invested enterprises. This situation significantly affects the income of laborers and enterprises and their dependence on imports…

The foreign-invested sector accounts for a large proportion of industrial production value, affecting not only export market share but also domestic consumption market share. There are many reasons for this situation, including limitations in the spillover between the foreign-invested sector and the domestic sector.

The proportion of the service sector has grown faster

The proportion of GDP in the service sector has grown faster than the real economy (including agriculture, forestry, fisheries, and industry and construction), which is appropriate and correct. This includes the rapid development of transport warehousing, tourism, trade…, related to logistics, the digital economy…, which is necessary. However, the real economy is more resilient than the service economy when there are fluctuations in the world economic, financial, and monetary situation…, While the number of enterprises and people working in the service sector in Vietnam is large, the scale of capital is small and scattered, and international competitiveness is very weak…

Economic Type Structure

The economic type structure has the specificity of a transitioning economy like Vietnam, but it significantly impacts exploiting social resources and the market nature of the economy. The structure and shift of Vietnam’s GDP structure by economic type in the past time are as follows (Figure 4):

The economic type structure is not only about the shift in GDP structure but also about the shift in the number of laborers and investment capital and the shift within the enterprise sector.

The prominent result of the shift in the economic type structure is the decrease in the proportion of the state economic sector, the increase in the proportion of the non-state economic sector, and the increase in the proportion of the foreign-invested sector, leading to an increase in the market nature of the economy…

The state economic sector, although reduced in proportion, still plays an important role in forming key projects for the country, especially in security and defense, infrastructure; investing in regions and fields that other sectors cannot or do not want to invest in, and being a “seed capital” for other sectors to follow…

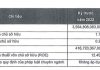

However, many proportions of this sector remain high, and the administrative apparatus is still cumbersome. The market nature of the economy is not deep and broad enough, and the state still holds many direct production and business fields. The fields of law and mechanism are also slow to improve. State-owned enterprise operations are not yet effective, as the proportion of net revenue and total income is lower than the proportion of operating capital, fixed assets, and long-term financial investment. The proportion of total income and pre-tax profit in 2022 decreased compared to 2010…

The non-state economic sector increased in many proportions, contributing to the increase in the overall market nature. However, the proportion of net revenue and total income, especially pre-tax profit, is lower than the proportions of operating capital, fixed assets, and long-term financial investment. The proportion of private economy is small and has hardly increased over the years, while this is the sector that needs attention as the private economy is honored as the growth driver.

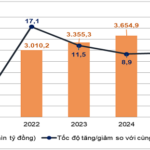

The number of business owners in 2023 decreased compared to 2010 (from 1,687,900 to 669,500). The proportion of total employed labor decreased (from 4.14% to 2.09%). The number of large private enterprises has appeared on the list of USD billionaires or those with assets worth millions of USD, but many enterprises have exited the market (in 2024, 100,098 enterprises temporarily ceased operations, up 12.4%; 78,155 enterprises temporarily ceased operations awaiting dissolution, up 16.3%; 21,608 enterprises completed dissolution procedures, up 20%; a total of 197,861 enterprises, up 11.4%).

The foreign-invested sector accounts for a large proportion of industrial production (about 50%), a very large proportion of exports (about 72%), and an increasing proportion of labor and investment capital. From 2025, these proportions are expected to increase rapidly when a large amount of capital, concentrated in high technology, will be invested in Vietnam to avoid taxes when exporting to the US…

Economic Region Structure

According to data published by the General Statistics Office, among the ten localities with the largest regional gross domestic product (GRDP) in 2023, Ho Chi Minh City ranked first (VND 1,613 thousand billion), followed by Hanoi (VND 1,291 thousand billion), Dong Nai (VND 449 thousand billion), Binh Duong (VND 447.2 thousand billion), Ba Ria – Vung Tau (VND 410.2 thousand billion), Hai Phong (VND 395.5 thousand billion), Quang Ninh (VND 313.7 thousand billion), Thanh Hoa (VND 276.7 thousand billion), Bac Ninh (VND 225 thousand billion), and Hai Duong (VND 187.5 thousand billion).

The ten localities mentioned above had a total GRDP of VND 5,608.8 thousand billion in 2023, accounting for over 54% of the country, much higher than the population ratio of 35.8%, far exceeding the ratio in terms of area, accounting for 42% of FDI registered, 65.5% of exports…, This means that, in addition to favorable locations, infrastructure, and many operating enterprises, there are also positive results in attracting FDI, the number of operating enterprises, export turnover, and a reasonable economic structure…

Regarding GRDP per capita in 2023, among the ten localities with the highest GRDP per capita in the country, Ba Ria – Vung Tau ranked first with VND 345.4 million/person, followed by Quang Ninh with VND 227.1 million/person, Hai Phong with VND 187.9 million/person, Ho Chi Minh City with VND 170.6 million/person, Binh Duong with VND 169 million/person, Hanoi with VND 150.3 million/person, Bac Ninh with VND 148.3 million/person, Dong Nai with VND 135.6 million/person, Vinh Phuc with VND 130 million/person, and Thai Nguyen with VND 115.1 million/person.

Notably, Thai Nguyen province – a province in the Northern Midlands and Mountainous region – is on this list thanks to its large FDI inflows and high export turnover. Two other small provinces, Bac Ninh and Vinh Phuc, are also on the list due to their large FDI inflows, developed industries, and high export turnover.

Ho Chi Minh City and Hanoi have many advantages and strengths in terms of geographical location, infrastructure, and organizational apparatus…, but they only ranked 6th and 7th. The other centrally-run cities, Da Nang and Can Tho, are not among the ten localities with the highest GRDP per capita in the country, ranking only 12th and 16th in the country.

In addition, the ten localities with the lowest GRDP per capita in 2023 are: Ha Giang with the lowest level (VND 35.6 million/person), followed by Cao Bang with VND 41.2 million/person, Dien Bien with VND 43.4 million/person, Yen Bai with VND 50.9 million/person, Son La with VND 51 million/person, Bac Kan with VND 51.7 million/person, Ben Tre with VND 52 million/person, Lai Chau with VND 52.2 million/person, Nam Dinh with VND 52.3 million/person, and Nghe An with VND 56 million/person…

The article was published in the special edition of Economics 2024-2025: Vietnam & World, released in February 2025. Please refer to it here: https://postenp.phaha.vn/tap-chi-kinh-te-viet-nam/detail/1262

A Buzzing July: Trade and Tourism Thrive

The estimated total retail sales of goods and consumer services revenue in July reached VND 576.4 trillion, a 1.1% increase from the previous month and a 9.2% surge compared to the same period last year.

The New 117 Million Ton Resource Trove: A Massive Windfall Awaits if Exports Take Off

The agricultural sector emits nearly 117 million tons of CO2 equivalent. This presents an opportunity to tap into a new resource reservoir by adopting farming practices that reduce emissions. By embracing sustainable methods, not only can we mitigate our environmental footprint, but we can also explore the potential of carbon credit exports, given the high demand for this commodity.