Industrial Real Estate Report: Strong Leasing Performance Despite US Tariff Challenges

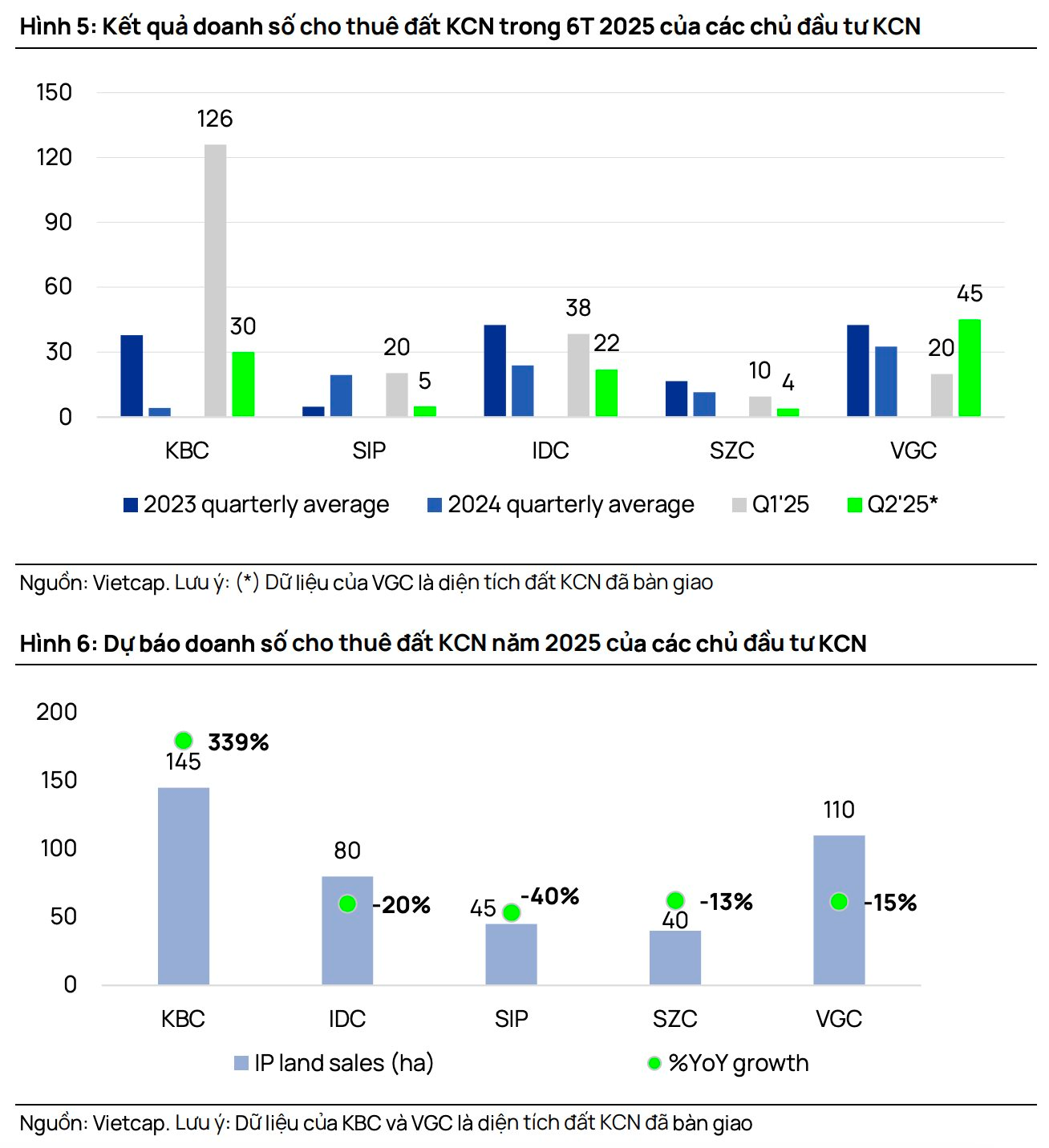

According to the Vietcap Securities’ Industrial Real Estate Report, large listed industrial park investors witnessed stable land leasing sales during the first half of 2025 (6T 2025), despite US tariff challenges.

In this period, the tenants were mostly medium and small-sized enterprises or companies with limited exposure to the US market, as large multinational corporations generally adopted a cautious approach amidst the evolving tariff landscape.

The US announced a 20% tariff on exports from Vietnam to the US and 40% on transshipped goods; the announced tariffs for Vietnam narrowed the gap with regional producing countries and reduced the rate by 26 percentage points compared to the preliminary tariffs published in early April.

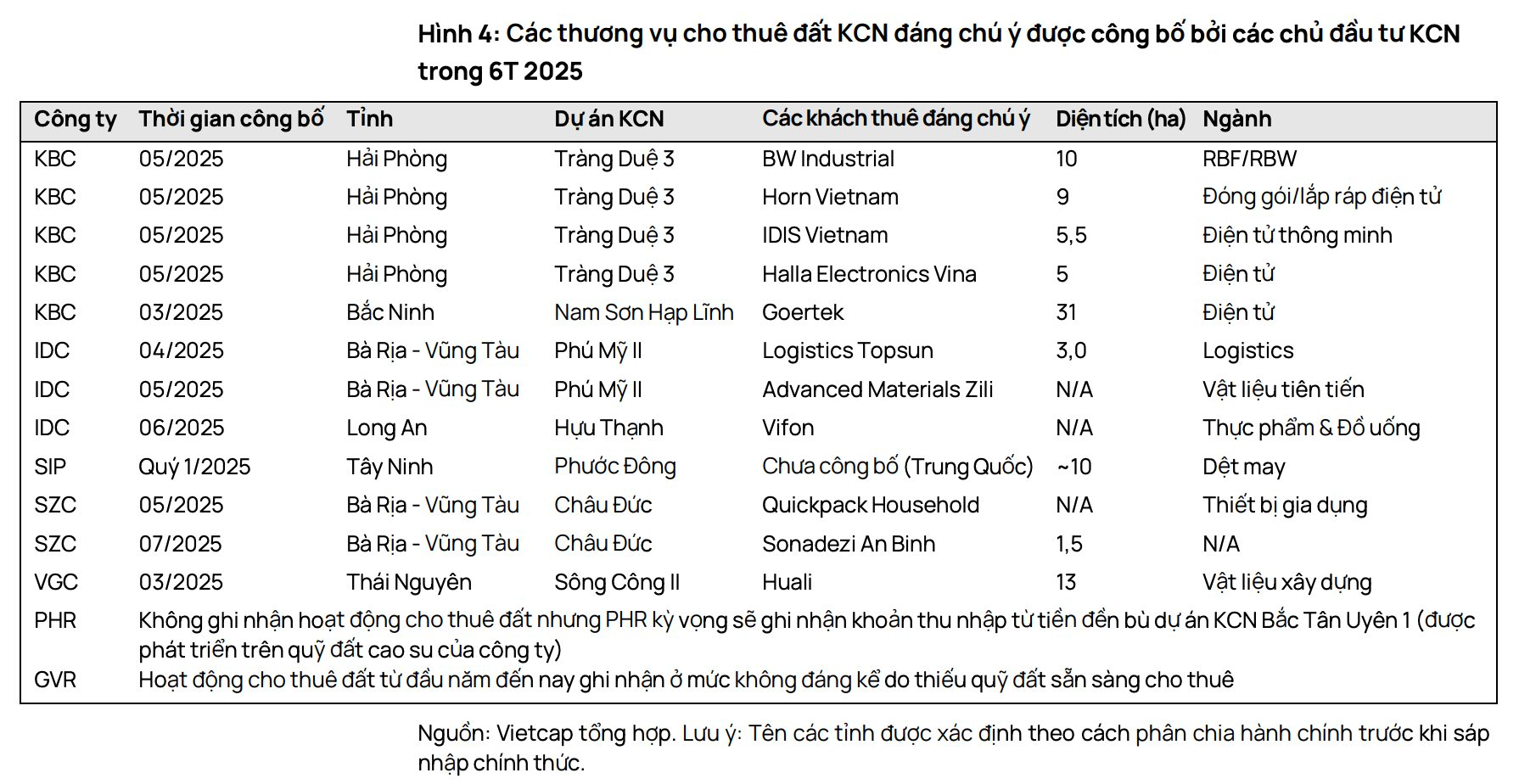

The report also provides an update on the industrial land leasing activities of several companies in the market over the past six months.

Kinh Bac City Development Holding Corporation (KBC)

Kinh Bac City Development Holding Corporation (code: KBC) announced approximately 150 ha of industrial land leasing sales in the first six months of 2025, a significant increase from the 18 ha recorded in 2024.

The main transactions included 83 ha in Hung Yen Industrial Clusters, 36 ha in Nam Son Hap Linh Industrial Park (Bac Ninh), and 30 ha in Trang Due 3 Industrial Park (Hai Phong). Additionally, the company signed a Memorandum of Understanding (MOU) for approximately 50 ha in Que Vo 2 Expanded Industrial Park (Bac Ninh) in July 2025. Notable tenants include Goertek (25 ha) and BW Industrial (10 ha).

IDICO Corporation (IDC)

IDICO Corporation (code: IDC) has not disclosed the progress or results of industrial land leasing sales for Q2/2025. However, based on the equivalent of 50 ha of industrial land leasing sales recorded in the first four months of 2025 and contracts signed in May-June with Topsun Logistics and Vifon, Vietcap estimates that IDC’s industrial land sales in the first half of 2025 will reach no less than 60 ha.

Sai Gon VRG Investment Joint Stock Company (SIP)

Sai Gon VRG Investment Joint Stock Company (code: SIP) is forecasted to have preliminary industrial land leasing sales of 25 ha in 6T 2025 (compared to 74.5 ha recorded in 2024), including a 10 ha contract with a Chinese tenant in the textile industry at Phuoc Dong Industrial Park.

Sonadezi Chau Duc Joint Stock Company (SZC)

Sonadezi Chau Duc Joint Stock Company (code: SZC) has not disclosed total industrial land leasing sales in 6T 2025. However, the company signed an MOU for approximately 9.6 ha in Q1/2025 and recently announced a transaction to lease 1.5 ha of land to Sonadezi An Binh, an affiliated company of Sonadezi Corporation.

Industrial land leasing sales in 6T 2025 were relatively low compared to 2024; in that year, SZC signed contracts with Tripod (18 ha, valued at $250 million) and HPG (6 ha).

Phuoc Hoa Rubber Joint Stock Company (PHR) and Vietnam Rubber Industry Group (GVR)

Both Phuoc Hoa Rubber Joint Stock Company (code: PHR) and Vietnam Rubber Industry Group (code: GVR) recorded low industrial land leasing sales in the first half of 2025, mainly due to the limited amount of land available for leasing by these two companies.

However, the two companies have made progress in legal procedures for converting rubber land to industrial land. PHR may record compensation income from the Bac Tan Uyen 1 Industrial Park project, spanning 786 ha (developed by THADICO Binh Duong on PHR’s rubber land) which was approved in June. Additionally, GVR has received investment approval for approximately 2,100 ha of new industrial land since 2024 and is seeking further approval.

Viglacera Corporation (VGC)

While Viglacera Corporation (code: VGC) did not disclose specific figures for industrial land leasing sales, according to Vietcap, the accumulated sales from the beginning of the year are supported by the opening of leasing in projects such as Thuan Thanh Industrial Park (Bac Ninh, opened for leasing in 2024) and Song Cong II Industrial Park (Thai Nguyen, opened for leasing in Q1/2025).

In terms of land area handed over, VGC recorded approximately 65 ha in the first six months of 2025 — compared to about 130 ha in 2024 — mainly from Thuan Thanh Industrial Park (about 40 ha) and Yen My.

2025 Outlook: Diversified Industries and FDI Attraction in Southern Industrial Parks

Regarding the outlook for 2025, Vietcap stated that not all FDI inflows into Vietnam are directed towards the US market.

Northern industrial parks face higher concentration risks due to their reliance on high-tech electronics exports to the US, while southern industrial parks benefit from a more diverse range of industries and attract more FDI aimed at the domestic market — factors that contribute to mitigating the impact of external shocks.

For 2025, the growth momentum is expected to be driven primarily by a four-fold increase to 145 ha in the area of industrial land handed over by KBC, supported by new industrial land supply available for leasing in Hung Yen and Hai Phong.

In 2026, the growth momentum is anticipated to be propelled by BCM’s new industrial park projects in Binh Duong and Ho Chi Minh City (cay Truong and Bau Bang expanded), along with the expected recovery of industrial land demand across the sector.

Special Economic Zone Phu Binh: KBC Takes Over the Reins of the $500 Million Thai Nguyen Project

The Urban Development and Investment Corporation (UDIC), a leading Vietnamese infrastructure development company, has announced that its proposal for the construction and business infrastructure investment project in Phu Binh Industrial Park has been approved by the People’s Committee of Thai Nguyen province. This decision, made on June 30, 2025, authorizes UDIC, listed on the Ho Chi Minh Stock Exchange as KBC, to proceed with its plans for developing key industrial infrastructure in the region.

Is Industrial Real Estate Rental Price Set to Soar?

Industrial real estate rental rates continue their upward trajectory in 2024, with a projected increase of 6-8% compared to 2023. The average rental rate stands at $132 per square meter in the North and $185 per square meter in the South. Forecasts for 2025 predict a slight increase of 1-2% due to limited supply and robust demand, with the Northern region offering more competitive rental rates.

The Japanese ‘Big Boss’ Partners with Billionaire Pham Nhat Vuong: A Sneak Peek into Their Venture and the Assets Involved

Nomura Real Estate Strengthens Vietnam Footprint with Vinhomes Partnership.

A strategic MOU between Nomura Real Estate and Vinhomes will see the former bolster its investment in Vietnam’s thriving urban landscape. With a focus on sustainable and innovative development, this partnership is set to elevate the country’s real estate sector.