The first half of 2025 saw several positive economic indicators for Vietnam: GDP increased by 7.52%, credit growth reached nearly 10%, supporting a breakthrough in bank profits, rising by about 15% compared to the same period. In line with this positive trend, Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) has recorded synchronized growth in both quantity and quality, with notable progress in the parent bank as well as its ecosystem members such as GPBank, FE CREDIT, and VPBankS…

Confident in completing the full-year plan for 2025

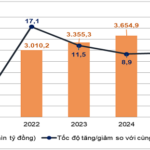

At the Individual Investor Meeting on August 4, 2025, VPBank leaders shared the impressive growth picture of the entire ecosystem, with consolidated profits of over 11,200 billion VND in the first six months, a 30% increase that fulfilled 44% of the full-year plan. The bank’s consolidated credit balance in the first half grew by 18.6%, reaching more than 842,000 billion VND, with positive contributions from both the parent bank and its subsidiaries.

VPBankS made significant progress due to the recovery of the stock market, with margin lending reaching nearly 18,000 billion VND, ranking in the Top 4 for margin lending in the market; its six-month profit growth stood at 80%.

FE CREDIT also witnessed a remarkable improvement, with total disbursed loans increasing by 19% year-on-year, and core credit growth at 5.5%. These achievements resulted from FE CREDIT’s proactive adaptation to market changes, product improvements, handling of old loans, and expansion of distribution channels through strategic partners such as The Gioi Di Dong and other retail chains.

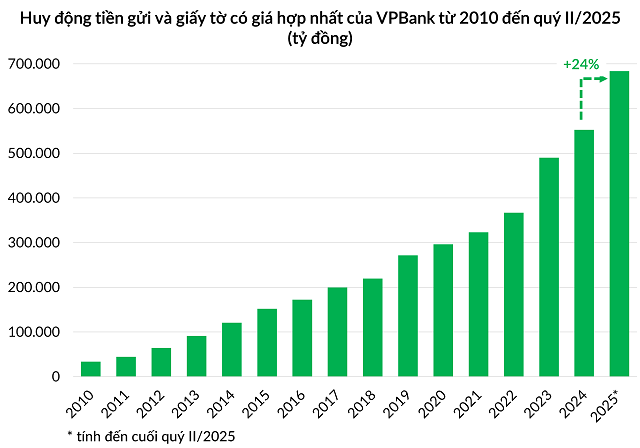

VPBank’s deposit and paper-based fundraising grew among the fastest in the banking industry in the first half of 2025.

|

In parallel with strong credit growth, VPBank continued to record high fundraising, four times the industry average, while effectively controlling capital costs. The bank diversified foreign capital sources and promoted new initiatives to attract non-term deposits (CASA).

Mr. Phung Duy Khuong, Vice Chairman and Director of the Southern Region and the Retail Banking Division, and Head of the Recovery and Debt Management Division, shared that VPBank’s CASA balance at the end of June reached nearly 100,000 billion VND, a nearly 40% increase, bringing the CASA ratio to 158%. The main driver was the “Super Profit” product, which offered superior mechanisms compared to market alternatives. “Super Profit” contributed 10,000 billion VND to CASA growth. VPBank expects this product to bring in twice as much CASA in the last six months of the year compared to the first half.

The bank also made its mark by pioneering the implementation of modern payment tools such as the “VPBank Pay by Account” solution, along with a series of initiatives like QR codes, attractive account numbers, and solutions dedicated to household businesses. Additionally, the VPBank K-star Spark in Vietnam mega-concert created a positive effect, leading to significant growth in new account openings, CASA balances, and brand recognition for VPBank.

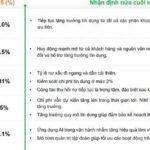

Based on these solid foundations, VPBank’s management assessed that the second half of 2025 holds challenges but also ample growth potential. The bank will continue to pursue its growth strategy set at the beginning of the year, focusing on all customer segments and priority areas such as infrastructure, renewable energy, and green finance…

At the same time, VPBank remains committed to building a sustainable balance sheet through domestic and foreign fundraising, ensuring proactiveness and readiness for the second half of 2025’s growth plans.

With the legalization of Decree 42, VPBank will enhance debt recovery activities, maintain bad debt ratios, and keep credit costs below 2%. Simultaneously, the bank will boost credit growth to offset the impact of narrowing NIM. Initiatives for automation, AI applications, and operational cost optimization will be accelerated, helping VPBank maintain a competitive cost-to-income ratio (CIR) and improve productivity.

“With the results achieved in the first half of the year and a challenging yet opportunity-filled environment, we are confident in achieving the plans committed to the General Meeting of Shareholders,” emphasized Ms. Luu Thi Thao, Vice Chairman and Senior Executive Director of VPBank.

GPBank turns profitable in June

Along with positive business results, VPBank’s management provided an update on the progress of GPBank’s restructuring. Vice Chairman Luu Thi Thao shared that immediately after the mandatory transfer in mid-January 2025, VPBank initiated the first steps to outline a comprehensive restructuring roadmap for GPBank. Specifically, in the past six months, GPBank has completed a transformation of its operating model, reorganized its human resources, and separated the sales force (consisting of 79 branches) from the management team responsible for functions like credit approval, finance and accounting, and human resources.

“Not only did we lay the groundwork, but we also immediately assigned business plans to the sales team,” emphasized Ms. Thao. “The initial plans were conservative, but within just five months, GPBank demonstrated positive progress.”

Concretely, fundraising increased by 20%, and core credit grew by 3%, in parallel with debt purchases from VPBank. Notably, after years of difficulties, GPBank recorded a profitable June in 2025, marking a significant turning point in its restructuring process. For the full year of 2025, VPBank set a pre-tax profit target of approximately 500 billion VND for GPBank.

Along with positive financial information, Ms. Thao also provided an update on VPBank’s long-term vision for GPBank. “When we participated in the mandatory transfer, our initial goal was to develop an action program to offset accumulated losses. But our larger ambition is to transform GPBank into a modern and reputable bank in the market, and we have already established a distinct mission for GPBank,” shared the Vice Chairman of VPBank.

Ms. Thao added that GPBank has been working with leading consultants and completed the development of its business strategy, accompanied by technology and data strategies. In Q3 2025, the bank will announce its new brand strategy and image.

Minh Tai

– 08:36 08/08/2025

A Buzzing July: Trade and Tourism Thrive

The estimated total retail sales of goods and consumer services revenue in July reached VND 576.4 trillion, a 1.1% increase from the previous month and a 9.2% surge compared to the same period last year.

“FE Credit Bounces Back: VPBank Confident in 2025 Plan as GPBank Turns a Profit”

In the first half of 2025, VPBank recorded a consolidated profit of over VND 11,200 billion and successfully mobilized a record loan of $1.56 billion. Based on the results of the first half and the 4-pronged strategy, the leadership affirmed their confidence in achieving the set business goals for the year.

“VPBank Secures a Monumental $350 Million Agreement for Sustainable Growth.”

“VPBank joins forces with renowned global development institutions, SMBC, BII, EFA, FinDev Canada, and JICA, in a groundbreaking partnership. Together, they have secured a landmark loan, a pivotal step towards financing Vietnam’s sustainable and eco-friendly future. This collaboration marks a significant milestone in the country’s journey towards a greener tomorrow.”