I. VIETNAM STOCK MARKET WEEK 04-08/08/2025

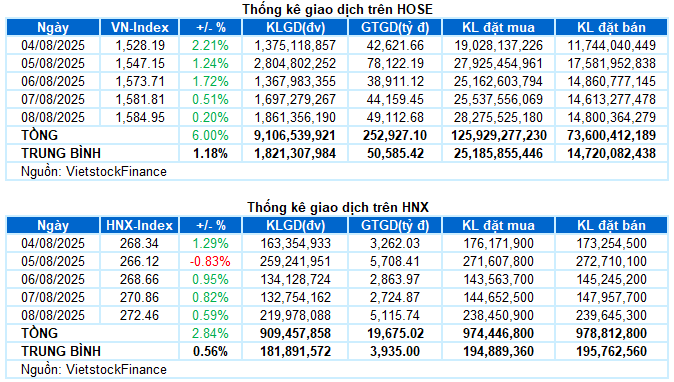

Trading: The main indices continued to rise in the last session of the week. VN-Index ended the week at 1,584.95 points, up 0.2% from the previous session; HNX-Index also increased by 0.59% to 272.46 points. For the whole week, the VN-Index gained a total of 89.74 points (+6%), while the HNX-Index added 7.53 points (+2.84%).

After a sharp correction in the previous week, the Vietnamese stock market quickly regained its upward momentum with five consecutive positive sessions. Despite facing strong pressure when approaching new highs, buying power remained robust, pushing the VN-Index higher. The VN-Index ended the week at 1,584.95, a significant 6% increase from the previous week.

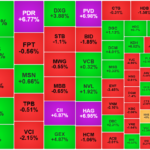

In terms of impact, VIC played a leading role, contributing 1.8 points to the VN-Index. This was followed by VPB, GEE, and GEX, which added a total of 2.5 points. On the other hand, BID, TCB, and HPG were the biggest drags on the overall index, causing the VN-Index to lose nearly 3 points in the final session.

The majority of industry groups maintained a positive performance. Notably, the media and communications services group led the market with a 4.48% gain, mainly driven by VGI (+6.27%), CTR (+1.4%), YEG (+1.01%), VNZ (+0.98%), and VTK (+2.86%).

The energy group also stood out in the final session, rising by 3.55%. The gains were broad-based, with notable names such as BSR (+2.74%), PLX (+2.96%), PVS (+8.96%), OIL (+3.25%), PVT (+4.12%), PVC (+7.26%), and PVD hitting the ceiling price. Additionally, the real estate group significantly contributed to the overall index due to its large market capitalization. Strong buying interest was observed in CEO (+7.56%), DIG (+3.4%), DXG (+3.88%), VIC (+1.74%), TCH (+2.69%), KDH (+6.02%), and PDR, which also hit the ceiling price.

On the flip side, the non-essential consumer industry group witnessed the most substantial decline due to notable corrections in several stocks, including VPL (-1.06%), DGW (-1.4%), MSH (-1.36%), VGT (-1.53%), TCM (-1.2%), HAX (-2.96%), and GIL (-2.03%).

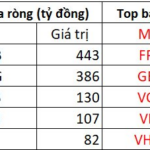

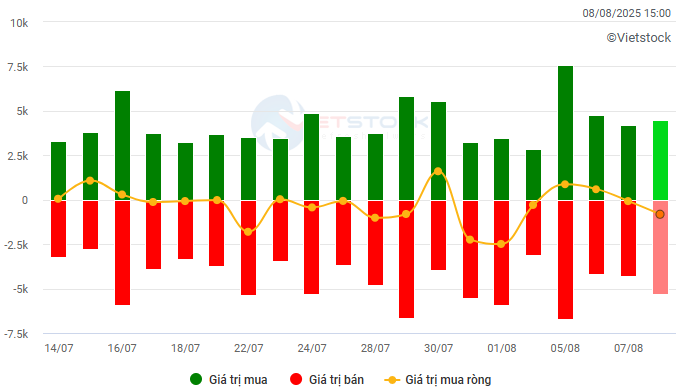

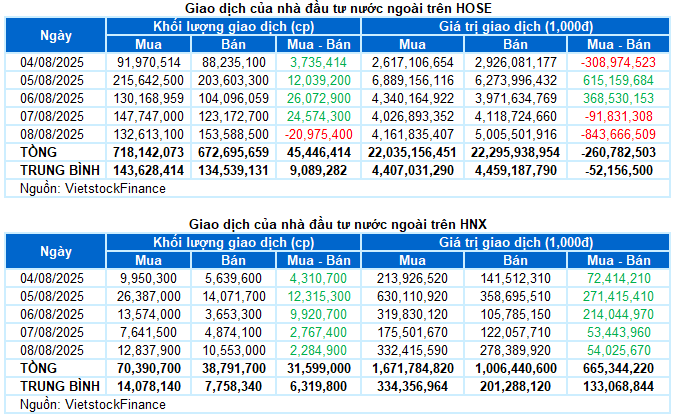

Foreign investors recorded net buying with a value of over VND 404 billion on both exchanges during the week. While they net sold nearly VND 261 billion on the HOSE exchange, they net bought more than VND 665 billion on the HNX exchange.

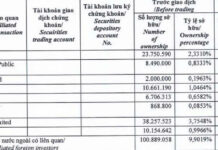

Trading value of foreign investors on HOSE, HNX, and UPCOM by day. Unit: VND billion

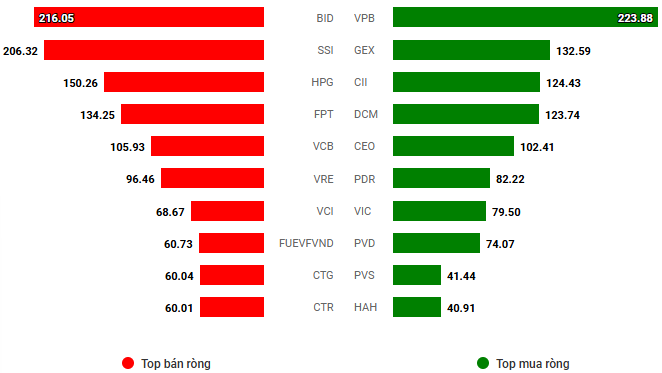

Net trading value by stock code. Unit: VND billion

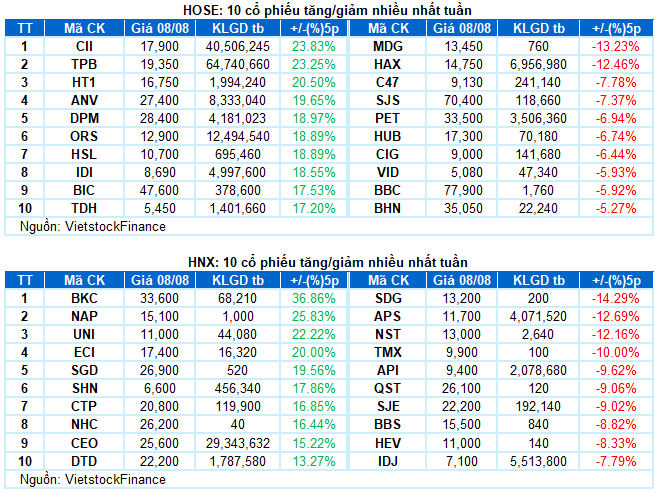

Stocks with notable performance during the week: CII

CII rose 23.83%: CII formed a Rising Window candlestick pattern and concluded the week on a positive note with five consecutive strong gains. Trading volume remained high above the 20-session average, reflecting investors’ optimism.

Currently, the MACD indicator continues to widen the gap with the Signal Line since providing a buy signal in early July 2025, suggesting that the upward trend of the stock is being reinforced.

Stock with the most significant decline during the week: HAX

HAX fell 12.46%: After dropping below the Middle Bollinger Band, the price trend weakened further as it crossed below the SMA 50-day and SMA 200-day moving averages.

Meanwhile, the MACD indicator continued to decline after giving a sell signal, and the gap with the Signal Line widened. Risks may increase if this indicator falls below the zero level in the near future.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic and Market Strategy Division, Vietstock Consulting

The Power of Persuasion: Crafting Compelling Headlines

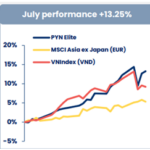

“Unleashing the Potential: PYN Elite’s Stellar Performance with Two Stock Codes”

In July 2025, PYN Elite Fund, a foreign-owned investment fund, boasted an impressive 13.25% return, the highest it has seen in 55 months since January 2021. This remarkable performance surpasses the VN-Index’s 9.2% gain, which peaked at a historic high of 1,557 points on July 28.

The Business is in the Red, but Stock Prices Soar: What do Experts Make of It?

Stock price increases are merely symptomatic; discerning investors must focus on the underlying causes. Is it a reflection of improved financial performance, positive news, or perhaps a result of price manipulation? Savvy investors delve beyond surface-level indicators to uncover the true drivers of stock price movements.

“Taking the Plunge”: Embracing Contrarian Strategies for Profitable Trading

The morning sell-off sent the VN-Index plunging over 16 points (-1.03%), indicating a potential disappointing end to the week. However, a resilient bottom-fishing cash flow in the afternoon session pulled the index back up, resulting in a positive close with a gain of 3.14 points (+0.2%).