As of the July 31, 2025 adjustment, Eximbank (EIB) increased interest rates for term deposits of 12 months and above by 0.1 percentage points. Specifically, interest rates for 1-month term deposits remain unchanged at 3.5%/year, 3-month term deposits at 6%/year, 6-9 month term deposits remain at 4.7%/year; 12-month term deposits increased to 5%/year and over 12-month term deposits increased to 5.5%/year.

Meanwhile, TPBank (TPB) increased interest rates for all terms less than 12 months by 0.1 percentage points compared to the previous adjustment period. Interest rates for 1-month term deposits increased to 3.6%/year, 3-month term deposits to 3.9%/year, 6-month term deposits to 4.7%/year, and 9-month term deposits to 5%/year.

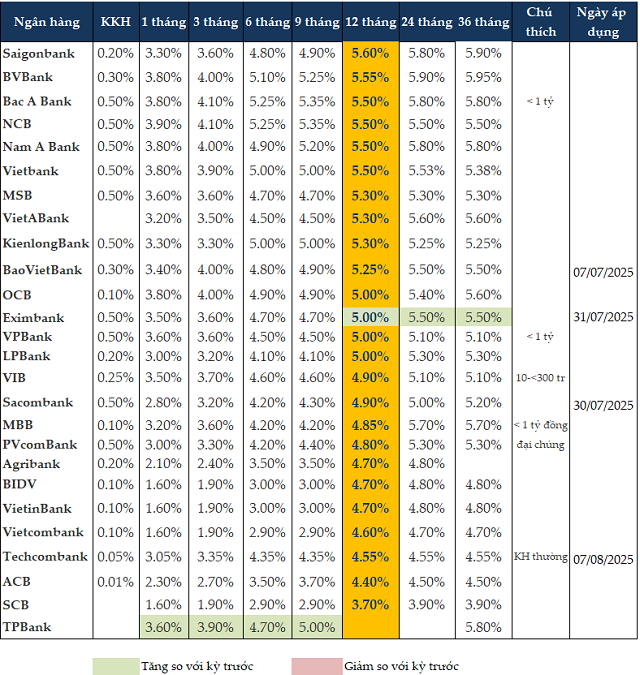

As of August 8, 2025, interest rates for term deposits from 1-3 months ranged from 1.6 – 4.1%/year, 6-9 month term deposits ranged from 2.9 – 5.25%/year, and 12-month term deposits ranged from 3.7 – 5.6%/year.

For the 12-month term, Saigonbank offered the highest interest rate at 5.6%/year, followed by BVBank at 5.55%/year. NCB, Nam A Bank, Bac A Bank, and Vietbank all offered rates of 5.5%/year.

For the 6-month term, Bac A Bank and NCB offered the highest interest rate at 5.25%/year, followed by BVBank at 5.1%/year.

For the 3-month term, Bac A Bank and NCB offered the highest interest rate of 4.1%/year. BVBank, BaoVietBank, Nam A Bank, and OCB offered rates of 4%/year.

|

Personal term deposit interest rates at banks as of August 8, 2025

|

Mr. Dinh Duc Quang, Director of Monetary Business Block, UOB Vietnam Bank, opined that the current economic situation puts pressure on expectations for VND interest rate cuts to support production and business and promote high growth in line with the government’s orientation of achieving a GDP growth rate of over 8% in 2025.

According to Mr. Quang, the State Bank (SBV) has temporarily not adjusted the VND policy interest rates in the short term. Mr. Quang assessed that the SBV will continue to monitor the domestic macro economy, USD interest rate trends, and the impacts of the new tax policy that took effect from August 1 before making a decision on VND interest rates.

Mr. Quang forecasted that the SBV may quickly reduce VND interest rates by about 0.5% if the USD interest rates are cut in the September Fed meeting and the trend of USD interest rate reduction becomes clearer in Q4/2025 and Q1/2026.

Commercial banks are unlikely to significantly reduce deposit and lending interest rates in the last months of the year. The deposit interest rates in August 2025 are lower than the same period in 2025 by about 0.2-0.4% depending on the term, and are appropriate in the overall correlation with international USD interest rates and USD/VND exchange rate fluctuations in recent months. At these interest rates, the market also recorded a high credit growth of 10% in the first six months; and the credit growth for the whole of 2025 is likely to reach 18-20%, which is a strong supportive factor for economic growth.

On August 5, the SBV also requested credit institutions to synchronously implement solutions to stabilize and strive to reduce deposit interest rates, contributing to stabilizing the monetary market and creating room for lending interest rate reduction. This is one of the key tasks to implement the Government’s and Prime Minister’s directions in the context that the economy is continuing to recover and needs cheap capital to support growth.

To achieve the goal of reducing lending interest rates, the SBV requires credit institutions to more drastically implement the directions related to cost-saving. Specifically, banks need to promote the application of information technology, promote digitization in the entire operation and customer service process. At the same time, simplifying administrative procedures is also considered an urgent task to facilitate people and businesses in accessing capital.

In addition, the SBV requested to maintain the public announcement of the average lending interest rates, the gap between deposit and lending interest rates, as well as preferential credit programs on the credit institution’s website to enhance transparency and help customers easily look up information in the process of accessing credit.

At the Conference on Implementing Solutions to Stabilize Deposit Interest Rates and Reduce Lending Interest Rates on August 6, representatives of many banks also committed to reducing lending interest rates and shared about the actual situation as well as proposed measures to more effectively support the economy.

Mr. Nguyen Viet Anh – Deputy General Director of TPBank said that the bank is restructuring, reducing headcounts, and investing in digital banking to automate processes and reduce costs, thereby creating a premise for reducing lending interest rates. The bank has also diversified capital mobilization, increased non-term deposits (CASA), foreign capital, maintained low interest rates, and stabilized capital mobilization. In the last six months of the year, TPBank committed to maintaining stable interest rates, supporting production, consumption, and export.

Ms. Pham Thi Trung Ha – Deputy General Director of MB said that since the beginning of the year, MB has developed a credit growth plan for key sectors of the economy, while actively participating in preferential credit programs and new orientations from the SBV.

MB has implemented specific solutions to promote credit, especially for production and business activities and to support individuals. However, the trend of home buying loans for individual customers tends to decrease. Nevertheless, production credit increased strongly, making a significant contribution to GDP growth in the first half of the year.

To maintain low lending interest rates, MB focuses on cost-saving, promotes digitization, and strictly complies with the SBV’s directions. At the same time, Ms. Ha emphasized that deposit interest rates need to be managed synchronously to avoid a situation where a few banks cause fluctuations in customer and market psychology.

VPBank’s representative shared that the bank always strictly complies with the Government’s and SBV’s orientations. In the first six months of the year, VPBank significantly reduced deposit interest rates for both short and long terms. The average lending interest rate for individual customers decreased by about 0.79%, and for enterprises by 0.22%.

VPBank also recorded a 27% increase in individual customer deposits and has disbursed international loans for sustainable development. However, since July, the growth momentum of capital mobilization has shown signs of slowing down as money flows into investment channels such as securities and real estate. Therefore, it is necessary to promote the disbursement of public investment, increase flexibility in managing interest rates, and consider loosening the ratio of lending to total deposits (LDR) to support the system’s liquidity.

– 10:00 11/08/2025

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a special credit package for reasonably priced housing to further stimulate credit growth.

Unlocking the Secrets to Effective Real Estate Investment: A Comprehensive Guide by the Ministry of Construction

The growth rate of credit for real estate across many banks has reached an impressive 20-30%, an astounding threefold increase compared to the overall credit growth rate of the system. The Ministry of Construction suggests that the State Bank should develop a credit package for reasonably priced housing to further boost this credit growth.