On August 7, the Board of Directors of Dragon Capital Vietnam passed a resolution to adjust the record date for shareholders and the date for the first dividend payment of 2024. According to the new decision, the record date is August 18, and the payment will commence on August 21. These timelines differ from the initial plan outlined in the Board of Directors’ resolution on July 29, which stated a record date of July 31 and a payment start date of August 8.

The company will distribute dividends from the accumulated undistributed profit balance as of December 31, 2024, totaling over VND 131 billion, equivalent to VND 4,200 per share (a ratio of 42%). It is important to note that this dividend will go to the related group of shareholders.

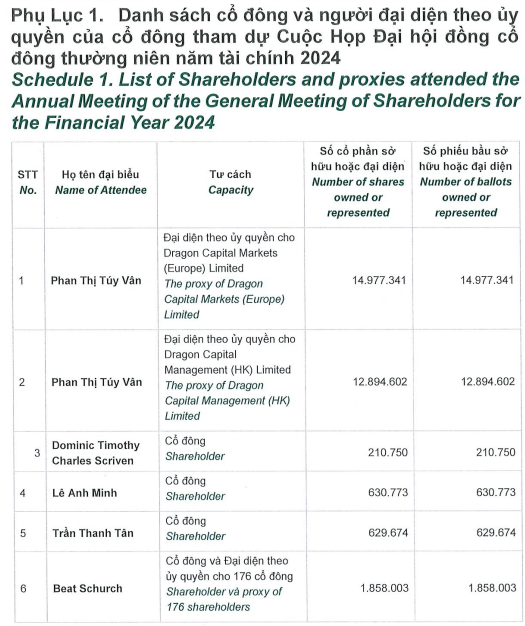

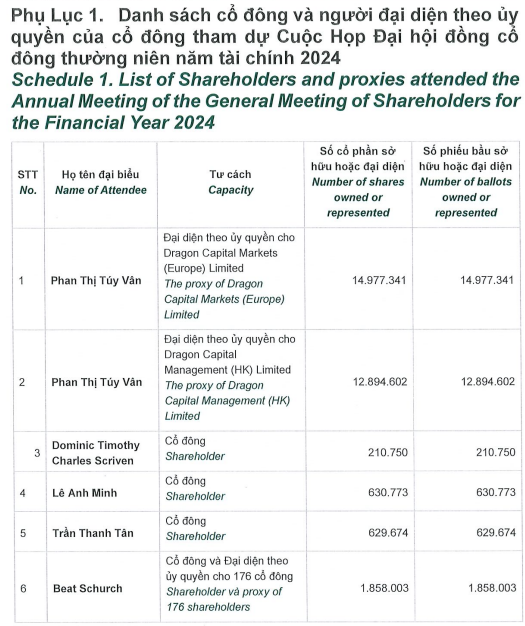

Based on the list of shareholders and authorized representatives who attended the 2024 Annual General Meeting of Shareholders held on April 16, 2025 (with a record date of March 20), the structure recorded two major shareholders: Dragon Capital Markets (Europe) Limited and Dragon Capital Management (HK) Limited, holding 48% and 41.33%, respectively. Following them are a series of leaders, including Chairman Dominic Timothy Charles Scriven with 0.68%, Board member Le Anh Minh with over 2.02%, and Vice Chairman Tran Thanh Tan with nearly 2.02%.

The remaining 5.95% is held by 177 other shareholders, including those represented by Mr. Beat Schurch – who will step down as Dragon Capital’s CEO and be replaced by Mr. Le Anh Tuan from October 1. According to Dragon Capital, Mr. Beat will continue as a Board member of Dragon Capital Group and DCVFM.

Source: Resolutions and Minutes of the 2024 Annual General Meeting of Dragon Capital

|

In 2024, Dragon Capital has carried out two dividend distributions. The first was the fourth-quarter 2022 cash dividend of VND 3,000 per share on March 28, totaling over VND 93 billion. The second was the first-quarter 2023 cash dividend of VND 3,600 per share on December 30, totaling over VND 112 billion.

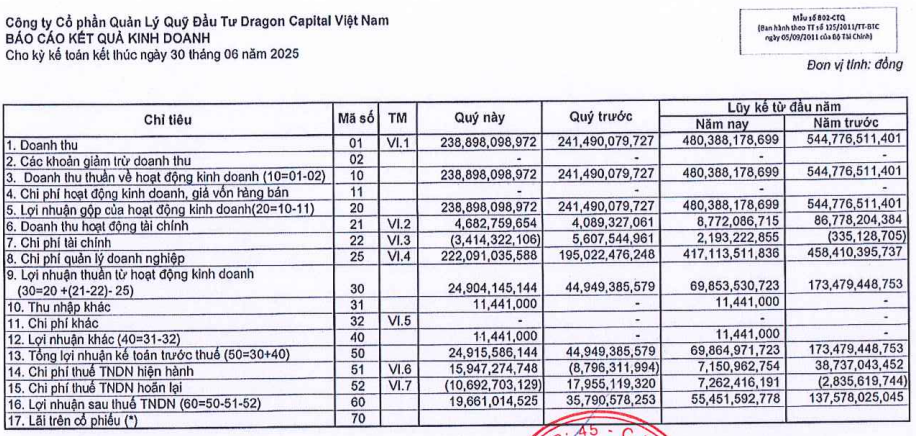

Regarding business performance, in the second quarter of 2025, Dragon Capital generated nearly VND 234 billion in revenue and nearly VND 20 billion in post-tax profit. For the first half of the year, the company achieved over VND 480 billion in revenue and over VND 55 billion in post-tax profit, representing decreases of 12% and 60%, respectively, compared to the same period last year.

Breaking down the revenue structure, investment advisory services continue to contribute the largest proportion at 67%, amounting to nearly VND 324 billion, a 17% decrease from the first half of 2024. Other significant revenue contributors include securities investment fund management and securities investment companies, accounting for 32% or over VND 152 billion, a slight increase from the previous year. The remaining activities include investment portfolio management and voluntary pension fund management.

Source: Q2/2025 Financial Statements of Dragon Capital

|

As of the end of the second quarter, Dragon Capital’s total assets exceeded VND 1,042 billion, a slight decrease from the beginning of the year. This primarily comprises short-term investments of nearly VND 452 billion, cash and cash equivalents of over VND 271 billion, trade receivables of over VND 98 billion, and fixed assets of nearly VND 166 billion.

Out of the nearly VND 452 billion in short-term financial investments, the company mainly invested in fund certificates, totaling approximately VND 444 billion, with the remaining VND 17 billion invested in stocks. Concurrently, the company has set aside over VND 7 billion in provisions for investment depreciation.

Looking at off-balance sheet metrics, the size of the entrusted investment portfolio exceeded VND 666 billion, a 15% increase from the beginning of the year. In terms of structure, the entire entrusted amount originates from domestic investors, including over VND 360 billion from institutions and nearly VND 306 billion from individuals.

– 09:43, August 11, 2025

155 Masan Employees Get a Great Deal on ESOP Shares

“Masan has concluded its distribution of 7.56 million ESOP shares to 155 employees. The offering price was VND 10,000 per share, a significant 86% discount on the market price. This move underscores Masan’s commitment to recognizing and rewarding its talented workforce, fostering a culture of ownership and long-term commitment to the company’s success.”

“Dragon Capital Vietnam Appoints Le Anh Tuan as Chief Executive Officer”

Dr. Tuan will succeed Mr. Beat Schuerch, who will continue in his role as a Board Member of Dragon Capital Group and DCVFM.