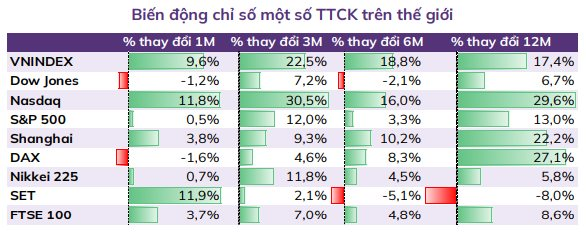

The An Binh Securities (ABS) August 2025 investment strategy report revealed a positive trajectory for global stock markets in July, with key indices such as the S&P 500, DJI, US30 (USA), HIS (China), NKY225 (Japan), Kospi (South Korea), and European indices on an upward trend.

Vietnam’s stock market continued this momentum, reaching new heights and aligning with significant global indices. Meanwhile, vital asset and commodity markets, including real estate, gold, and oil, showed signs of stabilization, potentially driving positive sentiment towards Vietnam’s stock market in August 2025.

“The outlook for Vietnam’s stock market in its upcoming ‘growth spurt’ is promising, reflecting a strong recovery and increased confidence from both domestic and international investors,” the report emphasized.

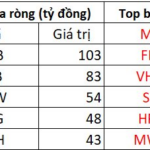

It continued, “Domestic capital is flowing robustly into the market, and foreign capital has turned to strong net buying, indicating optimism and expectations of stable economic growth.”

In terms of valuation, with the continued upward momentum in July and positive Q2 financial results from listed companies, the P/E ratio of the VN-Index for the last four quarters increased from 14.1x on July 9 to 14.37x on August 8, slightly higher than the VN-Index’s 2-standard deviation level of 14.25x over the past three years.

Large-cap stocks in the VN30 are valued at a P/E of 13.15x, significantly lower than mid and small-cap stocks in the VNMID (18.72x) and VNSML (12.59x). Except for the VNSML index, these P/E levels are higher than the 1-standard deviation of the 3-year average.

Regarding mid-term trends, ABS anticipates a potential upside for the VN-Index, expecting it to reach 1,792 – 1,864 points based on money flow and range factors.

In the short term, the analysis team predicts that if the weekly closing price surpasses 1,590 points, money flow in the short term will remain robust, exceeding 50 trillion VND per session. The market is poised to conquer higher thresholds, with near-term resistance levels at 1,636-1,695 and 1,727-1,740.

However, after two vigorous rallies, the market’s euphoric ascent may lead to a depletion of upward momentum at these price levels, followed by a correction for the overall market and stocks that have surged over the past four months.

These technical adjustments within the primary uptrend could present attractive buying opportunities as stock prices retreat to suggested support levels, offering portfolio restructuring prospects for investors following the recent rallies.

ABS maintains a bullish outlook for the short and mid-term, with aligned trends on daily and weekly trading frames. This presents safe buying opportunities for stocks that haven’t witnessed significant price appreciation and those concluding their short-term corrections. Nonetheless, the analysis team cautions that a short-term market pullback to retest previous highs is likely in August before resuming its upward trajectory.

Vietnam’s stock market is on the cusp of an upgrade

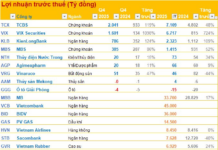

July witnessed an impressive <26.1% growth in Q2/2025 financial results for listed companies, aided by sustained low fuel prices, controlled inflation, and historically low-interest rates, which facilitated access to cheap capital and bolstered business operations.

Robust social investment disbursements (record credit growth in the first seven months and surging FDI), expansionary fiscal policies, and accelerated public investment projects, including school construction, poverty alleviation initiatives, and booming tourism, are factors that ABS Research believes will sustain corporate profit growth in the foreseeable future.

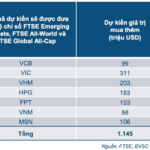

Simultaneously, institutional reforms and supportive policies have enhanced the investment landscape, bolstered investor confidence, and encouraged long-term capital inflows. Notably, vigorous efforts to upgrade the stock market status indicate a high likelihood of Vietnam’s promotion to the ’emerging market’ category in September 2025. This milestone could attract additional international funds with billions of dollars in assets under management.

7 Stocks That Could Attract Over $1.1 Billion in Foreign Capital as Vietnam’s Market is Upgraded

The story of the market’s upgrade has an obvious silver lining: it could attract billions of dollars in foreign capital into Vietnam’s stock market.

“Billionaire Investor: The Rise of F88 Chairman Phung Anh Tuan’s Empire with a Net Worth of Over $1 Billion”

With a market capitalization surpassing 324.88 million USD (equivalent to over 8.447 billion VND), the company has established itself as a prominent player in the industry.