Hanoi Metro’s financial report for the first half of the year revealed impressive figures, with revenue surpassing VND 390 billion, marking a 54% increase compared to the same period last year. What’s more, net profit reached nearly VND 10 billion, an impressive threefold increase year-over-year.

A closer look at Hanoi Metro’s financial statement reveals that the majority of this profit did not come from their core business of public passenger transport (ticket sales), but rather from financial investments.

The Nhon-Cau Giay urban railway in operation.

During the first half of the year, the company’s financial income exceeded VND 23.6 billion, a 2.6-fold increase compared to the previous year. Hanoi Metro attributed this surge to interest income from deposits and lending activities. As of June 30, the company had over VND 1,200 billion in bank deposits.

For the full year, Hanoi Metro has set ambitious targets, aiming for a total revenue of VND 878.4 billion, representing a 40% increase from 2024. Their goals for pre-tax and net profit stand at VND 27 billion and VND 20.7 billion, respectively.

As of the end of June, Hanoi Metro had already achieved half of its annual revenue target and was close to reaching 50% of its net profit goal.

Hanoi Metro is the operator of Hanoi’s first two urban railway lines: Cat Linh-Ha Dong and Nhon-Ga Hanoi. The Cat Linh-Ha Dong line, with a length of 13km, has been in operation since November 2021 and currently serves approximately 35,000 passengers daily. Tickets for a single trip cost VND 15,000. The Nhon-Ga Hanoi line, on the other hand, spans 12.5km, with the Nhon-Cau Giay section measuring 8.5km. This line was inaugurated in August 2024 and quickly gained popularity, recording an average of 50,000 to 60,000 daily passengers. The fare for a full trip on this line is VND 12,000.

The Future of FPT: Unveiling Adjusted Growth Plans and Their Impact on the Bottom Line

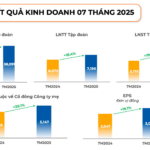

In the first seven months of the year, FPT recorded remarkable financial performance with revenue surpassing VND 38,000 billion and after-tax profit attributable to the parent company reaching VND 5,147 billion. These figures represent an impressive growth of 11.2% and 20.1%, respectively, compared to the same period in 2024.

“Subsidiary Liquidation: SHI’s Uninvested Water Venture Dissolves After 5 Years”

On August 12, the Board of Directors of Son Ha International Joint Stock Company (HOSE: SHI) approved the dissolution of its subsidiary, Son Ha Clean Water Business Operation and Management Co., Ltd., as part of a strategic restructuring of its subsidiary operations.

Yuanta Securities Adjusts 2025 Business Plan

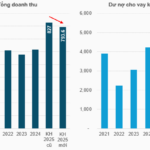

On August 12, the Board of Directors of Yuanta Securities Vietnam JSC convened a meeting to discuss and approve significant matters, including the adoption of a new business plan for 2025. This revised strategy projects an average margin lending balance of VND 5.042 trillion and a total revenue of VND 793.6 billion, reflecting a 9% and 4% decrease, respectively, from the initial plan.

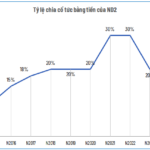

A Record-Breaking Dividend for PWS, While Shark Lien’s Aqua One Dominates

“Phu Yen Water Supply and Drainage Joint Stock Company (UPCoM: PWS) has finalized its list of shareholders eligible for a 10% cash dividend for the year 2024 (VND 1,000 per share) as of August 5th. Shareholders can expect to receive their dividends starting August 28th.”