Impressive Q2 2025 Profit Results

According to Maybank, the overall market profit exceeded estimates by 10 percentage points, reflecting a 34% year-on-year growth. This impressive performance was driven by robust growth across most sectors.

Export-oriented industries (e.g., maritime logistics, up 25%) benefited from early deliveries, while service exports (e.g., information technology, up 21%) were negatively impacted by weak demand due to tariff-related project delays. Domestically, sectors related to infrastructure investment (steel, up 26%, and real estate, up 64%) were boosted by the government’s proactive infrastructure development policies.

These policies also supported strong bank credit growth (up approximately 10% since the beginning of the year, equivalent to a 19% year-on-year increase), despite increasing competition affecting NIM and bank profit growth (up 16% year-on-year). Consumer sectors continued to lag, but effective cost management helped maintain positive results. Meanwhile, air logistics stood out with a remarkable 152% year-on-year growth, fueled by the tourism boom.

Expectations for Slower but Higher-Quality Growth in the Second Half of 2025

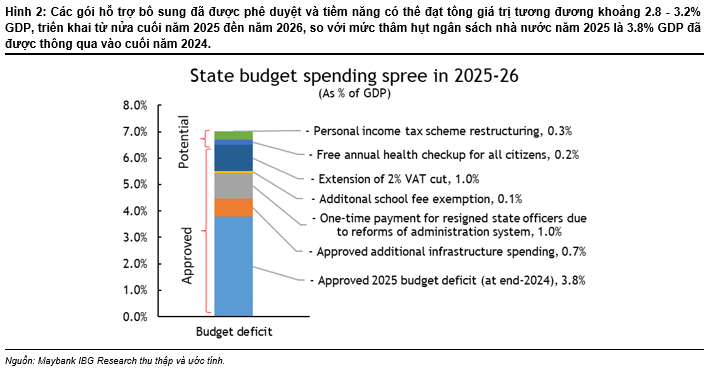

The impact of the 20% tax rate appears manageable, and with uncertainties subsiding, Vietnam remains an attractive FDI destination. Domestically, the government is aggressively pursuing an 8% GDP growth target through proactive fiscal measures.

|

Maybank forecasts that domestic deposit rates may increase by 0-50 basis points due to rising funding demands, but the State Bank of Vietnam (SBV) is likely to maintain its accommodative policy stance if the Fed continues with rate cuts.

Government and corporate investments will remain the primary growth drivers in the second half, while personal consumption is expected to recover later, supported by improved consumer confidence, favorable policies (e.g., potential personal income tax reforms), and wealth effects from rising real estate and stock markets. This will contribute to more widespread and higher-quality growth in the latter part of 2025. Maybank has upgraded its market profit growth forecast for 2025 by 3.4 percentage points to 18.5%.

Raising VN-Index Target by 20% to 1,800 Points

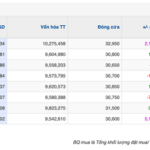

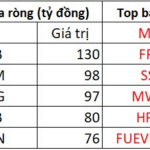

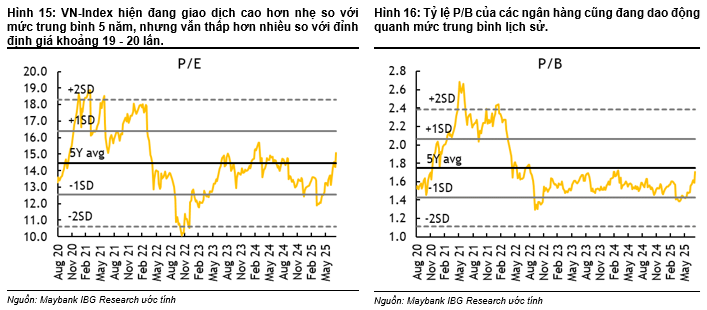

The VN-Index is experiencing one of its most impressive rallies in history, surging 15.2% since the beginning of the quarter and reaching a new peak of 1,584 points as of August 8. Average daily trading liquidity hit a record high of VND32.8 trillion in July 2025, bolstered by tax policies, expectations of an upgrade, and abundant liquidity.

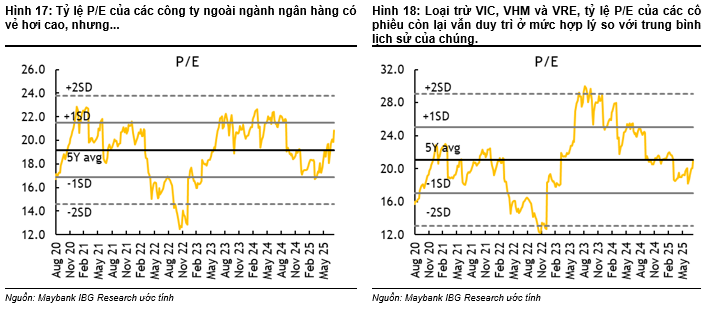

The positive sentiment surrounding the anticipated upgrade is expected to continue driving the market in August and September 2025, despite historical data indicating a high risk of a “sell on news” event. Overall, while two-thirds of the year’s gains have already been realized, market valuations remain around the five-year average and are not stretched, allowing the uptrend to persist.

Maybank maintains a positive outlook for the second half of 2025 and raises its year-end VN-Index target by 20% to 1,800 points, based on a target P/E of 14.5x (equivalent to the five-year average) and an estimated EPS growth of 18.5% year-on-year.

Preferred sectors include those benefiting from infrastructure investment (steel and real estate), strong credit growth (banking), and structural demand (information technology and aviation).

|

|

– 10:09 15/08/2025

The Sky’s the Limit: TAL Soars on HOSE Debut, Surpassing VND 10,000 Billion Market Cap

“Since its uplisting on August 1, Taseco Land’s stock, trading as TAL, has surged nearly 30% in just under 10 sessions on the Ho Chi Minh Stock Exchange (HOSE). This impressive performance witnessed an eightfold increase in trading volume compared to its yearly average, catapulting the company’s market capitalization to over VND 10,000 billion.”

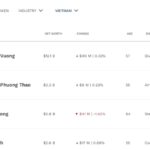

The Stock Market Soars to New Heights: A Peek Into the Portfolios of Vietnam’s Billionaires.

Recently, the stock market has been on a record-breaking streak, causing a significant shift in the fortunes of Vietnam’s billionaires on the Forbes rich list.

Stock Market Update: Riding the Wave or Missing Out?

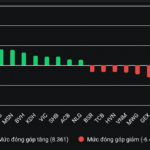

Today’s session (August 13th) saw the VN-Index fluctuate around the 1,600-point mark multiple times. The intense back-and-forth movement at this strong resistance level has put investors in a tricky situation: buying now risks buying at the peak, but selling early could mean missing out on potential gains. Experts suggest that if the market undergoes a technical correction until the end of August, it would present an opportunity to enter instead of rushing to buy at higher prices.