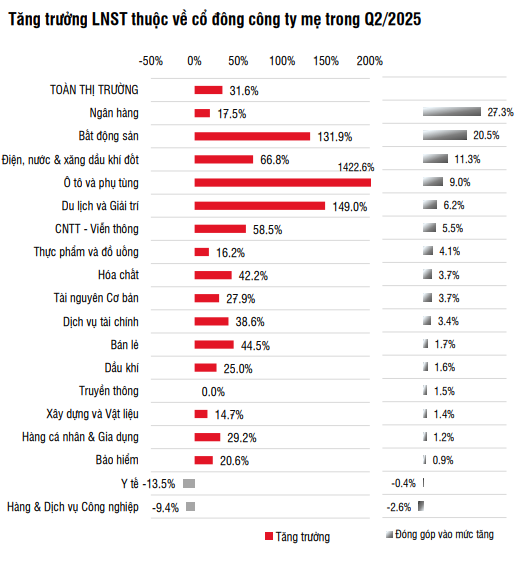

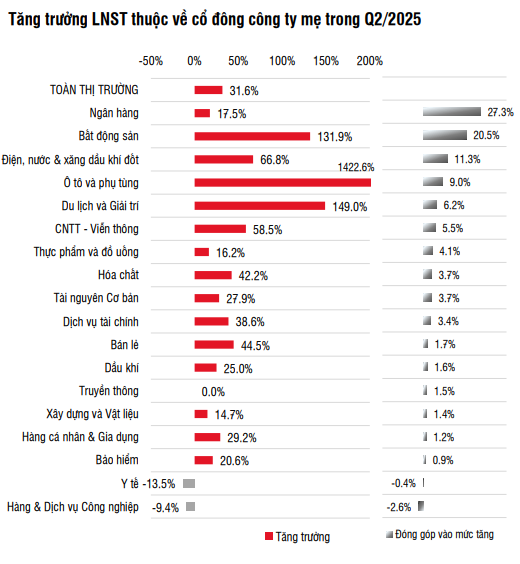

Profit growth in Q2 spreads across most sectors

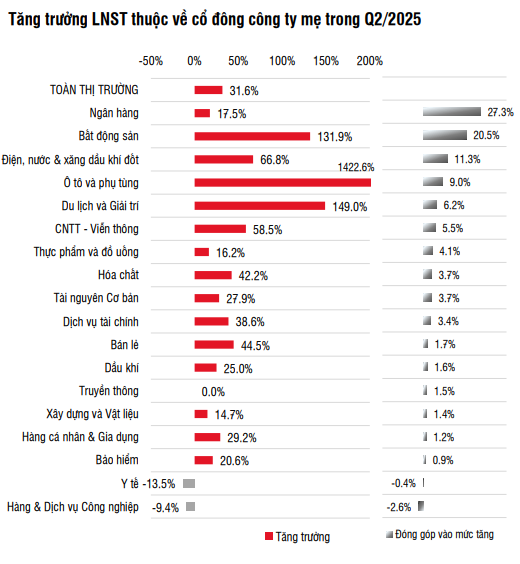

Total revenue in Q2 2025 recorded a modest growth of 6.9% year-on-year, while net profit surged by 31.5%, outpacing the 20.9% growth in Q1 2025.

Most sectors witnessed positive profit growth, except for the industrial sector. Sectors that exceeded SSI Research’s expectations include retail, fertilizers, utilities, banking, and industrial parks. In contrast, some sectors such as food and beverage (F&B) and select residential real estate stocks fell short of expectations.

Seven stocks, VIC, NVL, VGI, HHS, HVN, PGV, and VIX, accounted for 6.7% of the total market profit and 14.4% of the capitalization, contributing approximately 50% to the absolute profit growth in Q2 2025. Excluding the impact of these stocks, the market’s profit growth stood at 14.8%.

Banking remained the primary growth driver, contributing 44% to the total market net profit and 28% to the growth. This was followed by real estate (8% net profit, contributing 20% to growth) and utilities (7% net profit, contributing 12% to growth).

Source: SSI Research

|

Heading towards the 1,750 – 1,800 range in 2026

Despite potential short-term volatility due to increased profit-taking pressure after the high margin period in late July, SSI Research expects the VN-Index to target the 1,750 – 1,800 range in 2026.

The main driver is the robust profit growth recovery, supported by four factors: the real estate market recovery and public investment; a favorable interest rate environment; easing concerns over tariff risks; and, especially, the market upgrade expectation in October.

SSI Research maintains its forecast for the market’s net profit growth in 2025 at 13.8%, corresponding to a 15.5% growth in the last six months, although there may be slight adjustments after the financial reporting season ends.

The market’s projected P/E has increased from 8.8x (April 9) to 12.6x (August 6) but remains below the five-year average of 13x and the peak range of 15-17x in the market’s previous peak.

Source: SSI Research

|

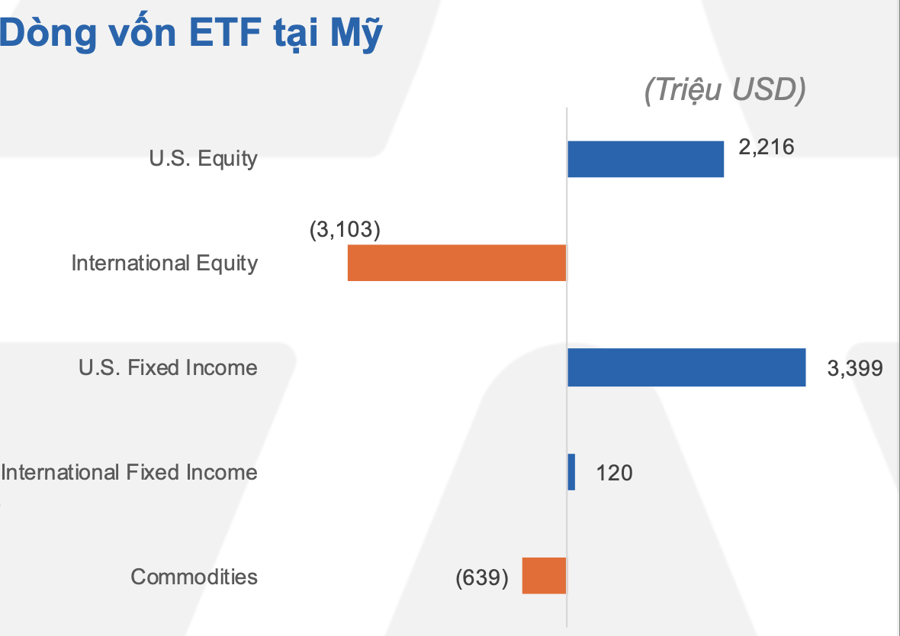

Attracting capital inflows with market upgrade expectations

In the report, SSI Research maintains its expectation that Vietnam will be announced as an Emerging Market by FTSE Russell in October 2025. This event could attract approximately $1 billion in capital inflows from ETF funds tracking the index.

Observations from other markets show that markets often perform positively in the run-up to an upgrade due to expectations of increased foreign capital inflows and improved investor sentiment. This will be one of the critical factors supporting the Vietnamese market in the second half of 2025.

Notable investment themes highlighted by SSI Research include real estate and public investment; decreasing input costs; benefiting from policies; and the market upgrade.

Huy Khai

– 11:04 14/08/2025

The Sky’s the Limit: TAL Soars on HOSE Debut, Surpassing VND 10,000 Billion Market Cap

“Since its uplisting on August 1, Taseco Land’s stock, trading as TAL, has surged nearly 30% in just under 10 sessions on the Ho Chi Minh Stock Exchange (HOSE). This impressive performance witnessed an eightfold increase in trading volume compared to its yearly average, catapulting the company’s market capitalization to over VND 10,000 billion.”

Móng Cái Rising: Vera Diamond City Embracing the New East

In the post-pandemic reshaping of the global economy, new growth poles are emerging beyond familiar metropolitan areas. Forward-thinking investors are increasingly turning their attention to regions once considered “off the map.”

“Luxury Apartment Livestream: Securing a Deal at 20.9 Billion”

On August 12, NobleGo – Sunshine Group’s groundbreaking real estate livestream bidding platform – once again grabbed the market’s attention. This time, it featured an ultra-luxurious President Sky Villa, bearing the distinctive label A2.06-02, from the prestigious Noble Crystal Long Bien project.