According to data released by Governor Nguyen Thi Hong at the regular July Government meeting, system-wide credit in the first seven months of the year increased by approximately 10% compared to the end of 2024. The securities sector witnessed a higher growth rate than the overall average and accounted for 1.5% of total outstanding loans.

Despite the higher growth rate in credit outstanding in the securities sector compared to the average, the Governor assured that it does not pose systemic risks. The State Bank also affirmed that it constantly monitors safety indicators.

Based on data released by the State Bank, it is estimated that total credit outstanding in the economy by the end of July exceeded VND 171 trillion, of which credit outstanding in the securities sector amounted to approximately VND 257 trillion.

Financial reports from many large securities companies in the market also acknowledged a significant increase in bank borrowings in the first half of 2025.

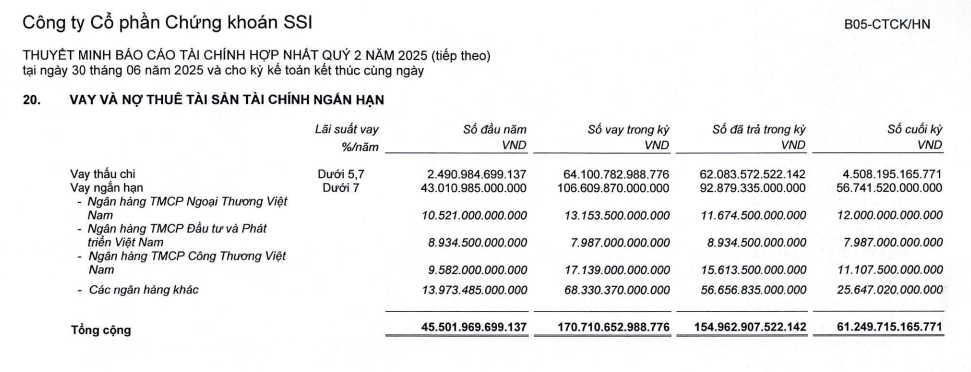

According to the financial statements of SSI Securities, as of June 30, 2025, the company’s bank borrowings exceeded VND 61,200 billion, entirely in the form of short-term debt. Compared to the beginning of the year, SSI’s bank borrowings increased by more than VND 15,700 billion, equivalent to nearly 35%. Vietcombank, VietinBank, and BIDV were the primary lenders to SSI, providing VND 12,000 billion, over VND 11,100 billion, and nearly VND 8,000 billion, respectively, while other banks contributed over VND 25,600 billion.

HSC also witnessed a nearly 17% increase in short-term borrowings in the first half, bringing its total debt to over VND 24,300 billion. Of this, domestic short-term bank borrowings amounted to more than VND 20,400 billion, reflecting an over 71% increase compared to the beginning of the year.

VNDirect’s bank borrowings witnessed a similar trend, increasing by nearly 17% to reach nearly VND 25,500 billion. Vietcombank, VietinBank, BIDV, and other banks provided nearly VND 7,900 billion, over VND 2,600 billion, nearly VND 2,200 billion, and approximately VND 12,800 billion, respectively.

As of June 30, TCBS reported short-term bank borrowings of over VND 27,400 billion, a 33% increase compared to the end of 2024. Nearly VND 18,800 billion of this was borrowed from domestic banks, including VPBank (VND 4,000 billion), MSB (VND 2,500 billion), TPBank (VND 2,000 billion), and VietBank (VND 1,900 billion).

MBS also increased its bank borrowings from over VND 10,300 billion at the beginning of the year to above VND 11,600 billion as of June 30, 2025. These short-term bank borrowings, with tenors ranging from one to twelve months and interest rates from 3.1% to 5.8% per annum, were used for working capital purposes and secured by fixed deposits at the bank.

The Profit Sprint: Unlocking Banking’s Q2 Success

The latest Q3 business trend survey by the Forecasting and Statistics Department – Monetary and Financial Stability (SBV) revealed that credit institutions have slightly raised their credit growth expectations for the year to 16.8%, surpassing the actual figure for 2024. This growth forecast is considered a significant impetus, promising to maintain the upward trajectory of profits for the entire banking sector compared to the previous year.

“Banking on Loans: Real Estate and Stock Markets Attract Capital”

According to the State Bank of Vietnam, the credit growth of the whole system reached approximately 10% after seven months, a significant surge compared to the 6% recorded in the same period last year.

Dr. Nguyen Tri Hieu: “Lowering Interest Rates to Support Growth is Logical, but it Also Harbors the Risk of Asset Bubbles”

The banking sector is the “backbone” of the economy, providing capital and making an ever-increasing contribution to the state budget. However, behind these impressive figures lies the pressure of a high credit-to-GDP ratio, maturity and interest rate risks, and the urgent need for digital transformation to stay in the global race.

The Great Capital Injection: Unlocking Economic Vitality

The banking sector is actively injecting capital into the economy to achieve high growth targets. To this end, credit standards will be slightly relaxed for businesses in priority sectors, allowing for a significant boost in lending.