VCAM has distributed nearly 5 million shares to 16 shareholders, increasing its circulating shares from over 15 million to 20 million, equivalent to a charter capital of VND 200 billion.

According to the minutes of the Board of Directors’ meeting on July 07, 2025 (the date of approval for the capital increase plan), the additional shares issued will not be restricted for transfer. The additional charter capital will be used for business development and financial investments, including but not limited to capital contributions, investments in fund certificates, stocks, and other securities.

Vietnam Securities Investment Fund Management Joint Stock Company, also known as VCAM, was established in 2006 and is headquartered in Ho Chi Minh City. The company specializes in establishing and managing securities investment funds, discretionary investment portfolios, and providing securities investment advisory services in Vietnam.

The current Chairman and co-founder of VCAM is Ms. Nguyen Thanh Phuong. Ms. Phuong also serves as the Chairman of Vietcap Securities Joint Stock Company (HOSE: VCI) and Vice Chairman of Vietnam Thuong Tin Commercial Joint Stock Bank (UPCoM: BVB).

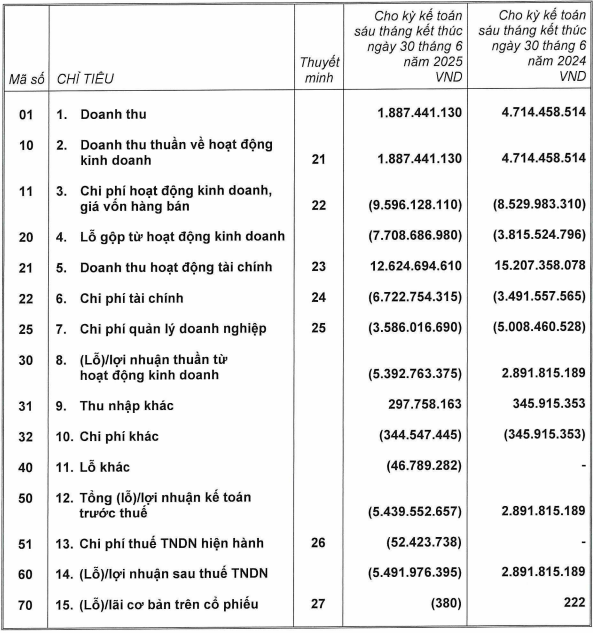

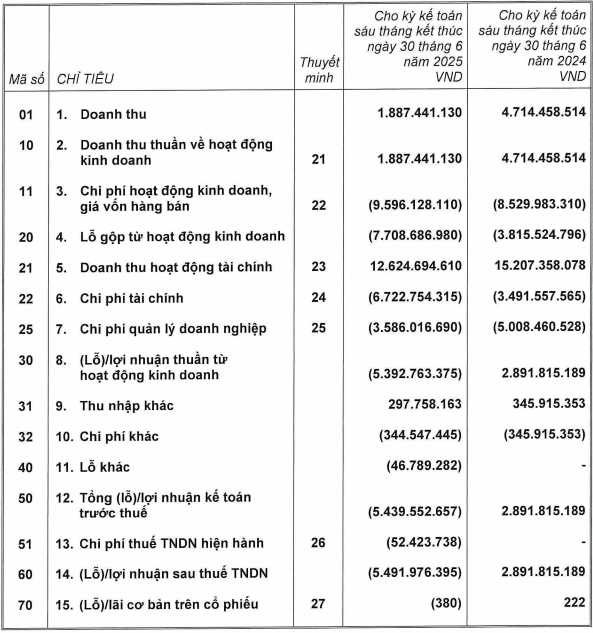

In the first half of 2025, VCAM recorded a decrease in net revenue, amounting to VND 1.9 billion, a 60% decline compared to the previous year. The majority of this revenue was generated from fund management activities, contributing over VND 1.5 billion.

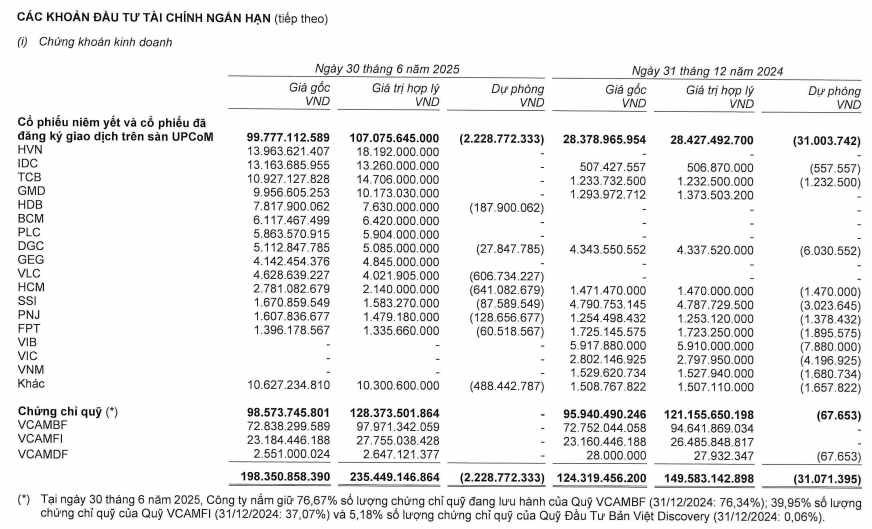

As of June 30, 2025, VCAM managed three open-ended funds: the Balanced Investment Fund (VCAMBF), with a net asset value (NAV) of nearly VND 128 billion; the Bond Investment Fund (VCAMFI) with a NAV of over VND 69 billion; and the Discovery Investment Fund (VCAMDF) with a NAV of over VND 51 billion.

During this period, the company operated at a gross loss of VND 7.7 billion, compared to a loss of VND 3.8 billion in the same period last year. Operating expenses were mainly attributed to employee salaries and management costs.

Financial performance showed a decline, with a profit of only VND 5.9 billion, compared to VND 11.7 billion in the previous year. This decrease in profitability was due to lower gains from the liquidation of short-term investments, increased losses, and higher provisions for impairment of investments.

A positive note was the reduction in management fees, which decreased from over VND 5 billion to nearly VND 3.6 billion. Ultimately, the company incurred a loss of nearly VND 5.5 billion, compared to a profit of almost VND 2.9 billion in the previous year.

Source: VCAM’s 2025 Semi-annual Reviewed Financial Statements

|

By the end of the second quarter, VCAM’s total assets exceeded VND 232 billion, a 4% increase from the beginning of the year. The majority of these assets were short-term financial investments totaling over VND 197 billion, a 59% rise since the start of the year. The company primarily directed its cash flow towards securities, amounting to over VND 198 billion. It is important to note that the total fair value of these investments exceeded VND 235 billion.

The investment portfolio included prominent stocks from the banking (TCB, HDB), securities (HCM, SSI), and real estate (IDC, BCM) sectors, as well as stocks from other industries such as HVN, GMD, PLC, DGC, GEG, VLC, PNJ, and FPT. Additionally, VCAM invested in its own funds: VCAMBF (holding 76.67% of the circulating fund certificates), VCAMFI (39.95%), and VCAMDF (5.18%).

Source: VCAM’s 2025 Semi-annual Reviewed Financial Statements

|

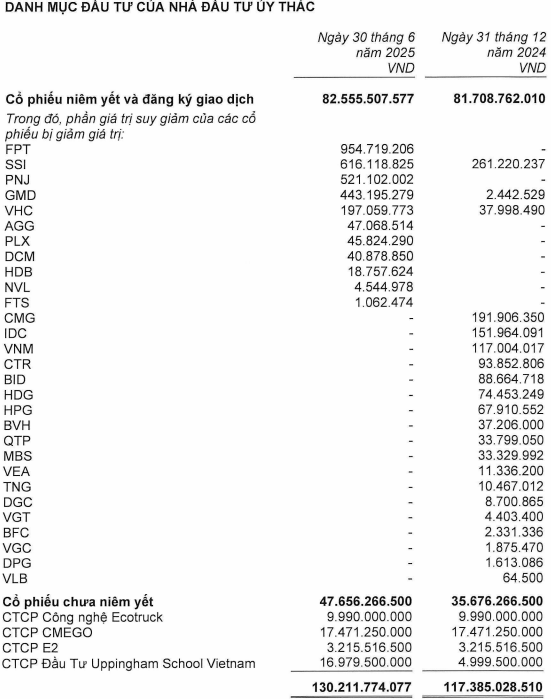

Notably, off-balance sheet indicators revealed a managed investment portfolio of over VND 130 billion, entirely from domestic investors, reflecting an 11% increase since the beginning of the year and accounting for 56% of total assets.

Source: VCAM’s 2025 Semi-annual Reviewed Financial Statements

|

– 6:00 PM, August 15, 2025

Liquidity Soars, Will Brokerage Sector Boom in Q3?

In the context of a slight dip in liquidity in Q2 2025 compared to the previous year, the ‘zero fee’ policy has intensified the competition among securities companies to capture market share. Understandably, brokerage business performance faced challenges during this period. However, the landscape is predicted to change significantly in Q3.

A Sunny Outlook for the Cement Industry: Profits Soar to 12-Quarter High

The cement industry has seen a remarkable turnaround in the second quarter of 2025, with a stunning recovery in profits. The sector reported a whopping 216 billion dong in earnings, a nearly three-year high and a massive 6.4 times increase compared to the same period last year. This impressive performance marks a significant shift for the industry, with many businesses turning their fortunes around and moving from losses to impressive gains.

The Stock Market’s Dark Horse: HKT Soars to Historic Highs Amidst Regulatory Hurdles

After a streak of three consecutive sessions of surging stock prices, HKT shares of Green Investment Joint Stock Company have hit an all-time high amidst the company facing administrative sanctions from the State Securities Commission of Vietnam (SSC).

The Attention-Grabbing Move of the Company Associated with Duc Hoang Anh

“The thriving Hung Thinh Loi Gia Lai Company, with a majority stake held by Hoang Anh Gia Lai Joint Stock Company, has just launched an enticing investment opportunity. The company has issued 10,000 bonds, coded HTL12501, offering a fixed interest rate of 10.5% per annum. These bonds have a maturity date of August 8, 2028, presenting a stable and attractive investment prospect for discerning investors.”