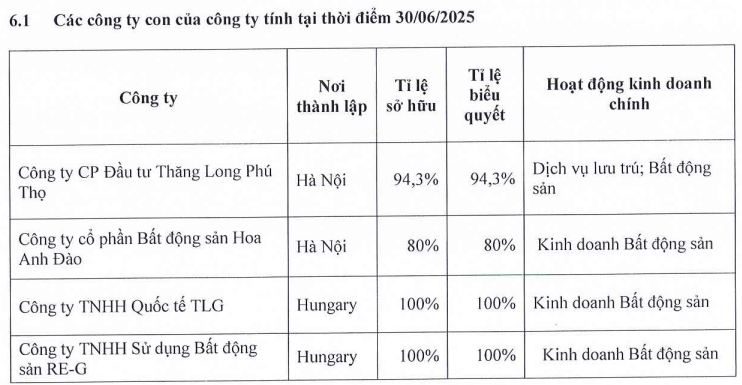

On August 20, TIG’s Board of Directors approved the transfer of its entire investment in RE-G Ingatlanhasznosító Korlátolt Felelõsségũ Társaság (REG Real Estate LLC), headquartered at 9 Berzenczey Street, 1094 Budapest, Hungary.

The transaction is expected to be completed in the third or fourth quarter of 2025, with the price determined by market value to maximize benefits for TIG. The transferee is an investor or group of investors who meet the criteria in terms of price and conditions as stipulated by Vietnamese and Hungarian laws.

As of the end of 2024, REG Real Estate had a charter capital of 3 million HUF (equivalent to over 230 million VND), wholly owned by TIG. Its main business lines include real estate development, buying and selling of private assets, and leasing and operating owned and leased properties.

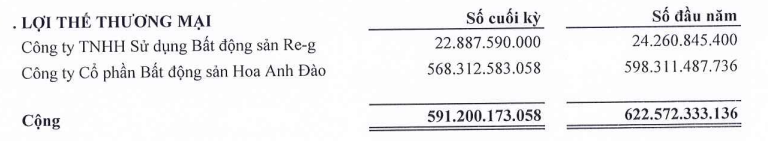

Notably, despite its relatively small scale, this company was recognized by TIG as having a commercial advantage of nearly VND 23 billion as of Q2 2025, a 6% decrease compared to the beginning of the year.

Source: TIG

|

In addition to REG Real Estate, TIG also owns another legal entity in Hungary, TLG International LLC, established in April 2023 with a charter capital of 3 million HUF, wholly owned by TIG. This company specializes in real estate business operations, including Airbnb rental services (an online platform for finding accommodation).

Moreover, TIG also maintains another branch in Hungary with a charter capital of 500 thousand HUF (nearly VND 40 million). This branch primarily engages in real estate trading and related activities.

As of the end of June 2025, TIG’s total assets in this European country amounted to nearly VND 105 billion, accounting for approximately 3% of the group’s capital.

For the year 2025, TIG continues to develop the European residential real estate market with a series of projects and products in Budapest, Hungary, catering to the needs of Vietnamese and foreign investors looking to invest in European real estate. This includes exploring residency-by-investment programs and generating rental income.

The company is also researching the deployment of residency-by-investment real estate products and residency permits in Europe, thereby opening up opportunities for foreign investment cooperation in Hungary, Slovenia, Germany, and Bulgaria.

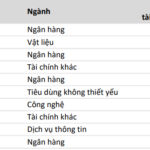

In addition to its Hungarian entities, TIG also owns Thang Long Phu Tho Investment Joint Stock Company with a charter capital of VND 640 billion, focusing on accommodation services and real estate, and Cherry Blossom Real Estate Joint Stock Company with a capital of VND 350 billion.

Source: TIG

|

TIG’s decision to divest from REG Real Estate comes amid the company’s lackluster performance in Q2 2025, with a revenue of over VND 259 billion, a 17% decrease compared to the same period last year. Hungary contributed over VND 32 billion, equivalent to 12% of the total revenue.

Net profit plunged by 89%, amounting to nearly VND 8 billion. The company attributed this decline to a decrease in financial revenue and a commercial advantage arising from the acquisition of Cherry Blossom Company in Q4 2024, which impacted profits.

| TIG’s Financial Performance from 2020 to 2025 |

In the first half of 2025, revenue reached nearly VND 642 billion, and net profit was over VND 46 billion, a decrease of 11% and 61%, respectively, compared to the same period in 2024. Compared to the set plan, TIG achieved 63% of its revenue target but only a quarter of its profit target.

Thanh Tú

– 15:43, August 22, 2025

“VinaCapital-VESAF Fund Targets Mid-Small Cap Equities”

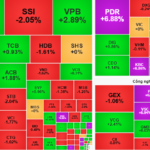

In the latest update report by VinaCapital-VESAF, the fund revealed that the VN-Index witnessed an impressive 18.6% growth in the first seven months of 2025. However, approximately 60% of this growth is attributed to stock groups associated with the Vingroup conglomerate and GELEX. These two stock groups have never been among the fund’s large investment portfolios.

The New Industrial Revolution: Unveiling the Northwest Hoa Xa Industrial Park – The Epicenter of Investment in North Central Vietnam

On August 19, 2025, the groundbreaking ceremony for the Tay Bac Ho Xa Industrial Park Infrastructure Investment and Business Project (Tay Bac Ho Xa Industrial Park) took place in Vinh Linh district, Quang Tri province. This event marked a significant turning point in the province’s journey towards sustainable industrial development post-merger.

The Real Estate and Oil Stocks are Rocking the Boat

Kicking off the new trading week, domestic stocks regained their upward momentum, shrugging off profit-taking pressures on many large-cap stocks. Today, August 18th, saw the real estate and oil & gas sectors making waves and driving the market higher.

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.