Hanoi Stock Exchange-listed Securities Joint Stock Company EVS (Code: EVS) has just announced a resolution of its Board of Directors approving a transaction with Board member Vu Manh Tien.

According to the agreement, EVS Securities will use 16 million EVS shares owned by Mr. Vu Manh Tien and related assets as collateral for a loan between EVS Securities (borrower) and Mr. Nguyen The De (lender) under Loan Agreement No. 1908/2025/HĐVV/EVS-NĐT.

The assets related to the 16 million EVS shares owned by Mr. Vu Manh Tien, which are also mortgaged and disposed of simultaneously with the disposal of the mortgaged assets, include: the right to receive dividends from the mortgaged assets; the right to receive refund amounts, compensation for the mortgagor from the obligor in the event of a refund, compensation for any reason, including insurance events arising from/related to the mortgaged assets; all other rights, interests, and property rights arising from and/or related to the mortgaged assets.

As of June 30, 2025, Mr. Vu Manh Tien was the largest shareholder in EVS, owning 16 million shares, equivalent to a rate of 9.71% out of a total owner’s equity of VND 1,648 billion.

Illustrative image

This is not the first time that EVS Securities has agreed to use the assets of insiders as collateral for borrowing. Previously, on July 30, the EVS Board of Directors also passed a resolution agreeing to use 3.7 million EVS shares owned by Board member Vu Hai Anh to guarantee payment obligations to Mr. Mai Anh Tien.

Also related to borrowing, on August 6, the EVS Board of Directors passed a resolution approving the plan to receive credit in 2025 at Vietcombank – Thanh Xuan Branch with a maximum limit of VND 300 billion to invest in government bonds and local government bonds. The maximum loan term is 6 months.

The resolution also stated that EVS agrees to mortgage/pledge the company’s assets or third-party assets to secure all repayment obligations under the loan agreements.

As of June 30, 2025, EVS had a total financial debt of over VND 329 billion, down 29% from the beginning of the year, all of which were short-term individual loans. Most of the loans are unsecured, with a term not exceeding 6 months, aiming to supplement working capital for the company’s business and investment activities.

Meanwhile, EVS Securities’ business performance was less favorable, reporting a post-tax loss of nearly VND 8 billion in Q2/2025, significantly lower than the profit of over VND 17 billion in the same period last year.

According to explanations, in the second quarter of 2025, the market experienced many fluctuations, and trading volume decreased, leading to a decline in brokerage and margin lending revenue. At the same time, proprietary trading revenue also decreased. In addition, the decrease in stock prices led to an increase in the allowance for losses on financial assets compared to the same period last year.

In the first half of this year, EVS Securities made a post-tax profit of nearly VND 2.5 billion, down 92% compared to the first half of 2024.

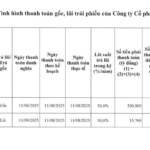

Revolutionizing the Industry: Tasco’s Subsidiary Raises an Impressive 500 Billion VND

“VETC, a subsidiary of Tasco, successfully raised 500 billion VND through the issuance of its ETC42501 bond series. This significant milestone underscores VETC’s strong standing in the market and highlights the confidence that investors have in the company’s prospects and financial stability.”

The Capital Conundrum: Strategies for Navigating the Financial Maze.

“Capital flows freely as banks introduce a plethora of loan packages with attractive interest rates. However, many small and medium-sized enterprises (SMEs) are left behind due to various reasons such as ineligible requirements, lack of collateral, and other factors that prevent them from accessing these financial opportunities.”