Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (CII) has just submitted a report to the State Securities Commission (SSC) regarding changes in the plan for using proceeds from the public offering of convertible bonds.

According to the report, CII successfully distributed 20 million convertible bonds, which can be converted into ordinary shares, with no collateral and no attached warrants, to 155 individual and institutional investors during the offering period, which ended on August 18, 2025. The expected bond delivery date is between September and October 2025.

With an offering price of VND 100,000 per bond, CII raised a total of VND 2,000 billion from this issuance.

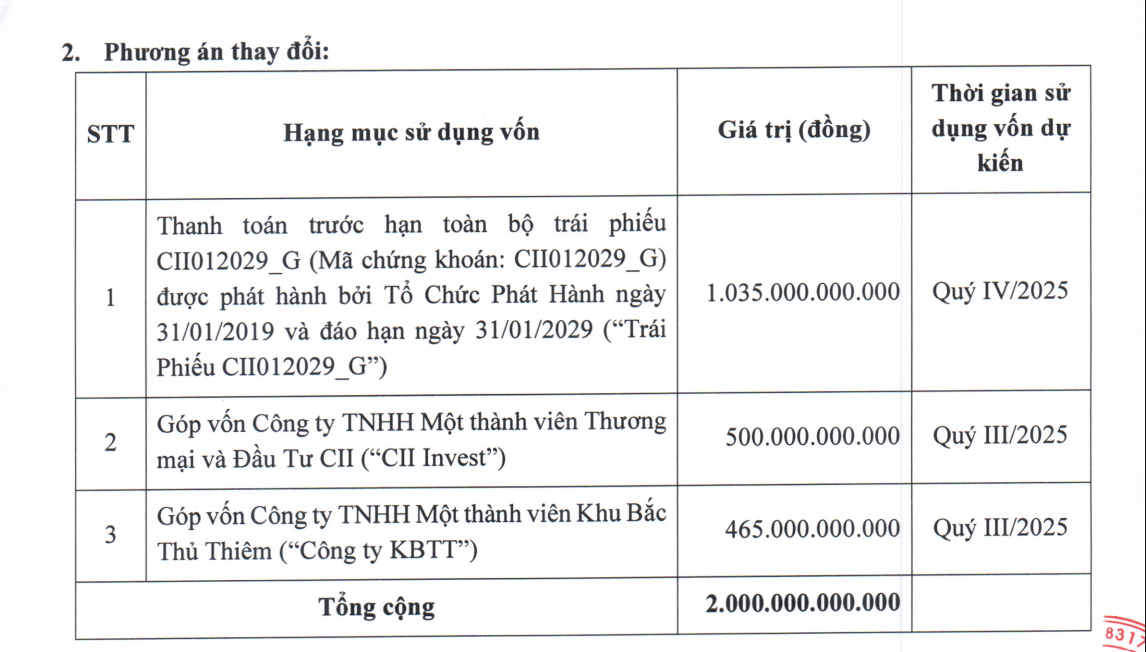

Initially, CII planned to use VND 1,035 billion to prepay the entire CII012029_G bond issue, VND 300 billion to prepay the entire CIIB2426001 bond issue, and VND 200 billion to prepay the entire CIIH2427002 bond issue. The remaining VND 465 billion was intended to be used for early repayment of principal on loans from Vietnam Joint Stock Commercial Bank for Industry and Trade and Tien Phong Commercial Joint Stock Bank.

However, considering the company’s current financial situation, CII has decided to prioritize repaying high-interest and/or near-term debts within the CII Group to improve capital efficiency within the group.

Source: CII

Therefore, in the revised plan, while the allocation of VND 1,035 billion for full prepayment of CII012029_G bonds remains unchanged, CII now intends to use VND 500 billion for capital contribution to CII Trading and Investment One Member Limited Liability Company (CII Invest) and VND 465 billion for capital contribution to Thu Thiem North Urban Area One Member Limited Liability Company (Thu Thiem North).

CII further explained that the capital contribution to CII Invest will enable the company to repay its loan from Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank), while the contribution to Thu Thiem North will facilitate the repayment of its loan from the Bank for Investment and Development of Vietnam (BIDV).

In another development, on August 6, 2025, CII distributed over 76.7 million bonus shares to 42,311 shareholders of the company, with the remaining 2,461 fractional shares to be canceled.

The entitlement ratio was 100:14, meaning that for every 100 shares held on the record date, shareholders received 14 new bonus shares. These shares are freely transferable. The expected share delivery date is in August 2025.

The total issuance value, based on par value, is over VND 767.4 billion, funded from surplus capital, investment funds, and undistributed post-tax profits as per the audited financial statements for the fiscal year ended December 31, 2024.

Following this issuance, CII’s outstanding shares increased from nearly 548.2 million to nearly 624.9 million, and its charter capital increased from nearly VND 5,481 billion to over VND 6,249 billion.

Revolutionizing the Industry: Tasco’s Subsidiary Raises an Impressive 500 Billion VND

“VETC, a subsidiary of Tasco, successfully raised 500 billion VND through the issuance of its ETC42501 bond series. This significant milestone underscores VETC’s strong standing in the market and highlights the confidence that investors have in the company’s prospects and financial stability.”