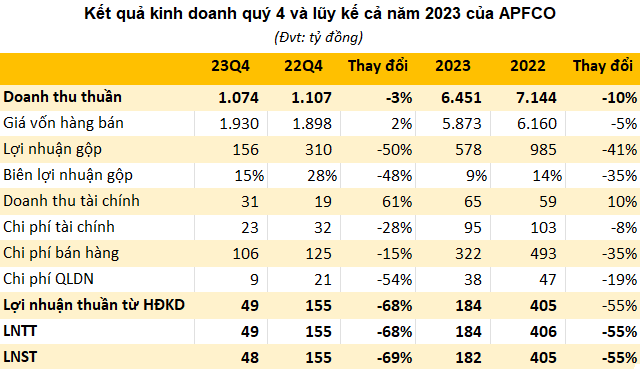

Quang Ngai Agricultural and Food Products Joint Stock Company (APFCO, stock code: APF) has announced its Q4/2023 financial statement with a net revenue of VND 1,074 billion, a slight decrease of 3% compared to the same period last year.

The cost of goods sold slightly increased, leading to a narrowing gross profit margin from 28% to 15%, equivalent to a gross profit of VND 156 billion.

During the period, operating revenue increased by 61% to VND 31 billion, while financial expenses decreased by 28% to VND 23 billion. Selling expenses and administrative expenses were also reduced to VND 106 billion and VND 9 billion, respectively.

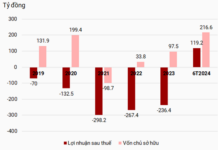

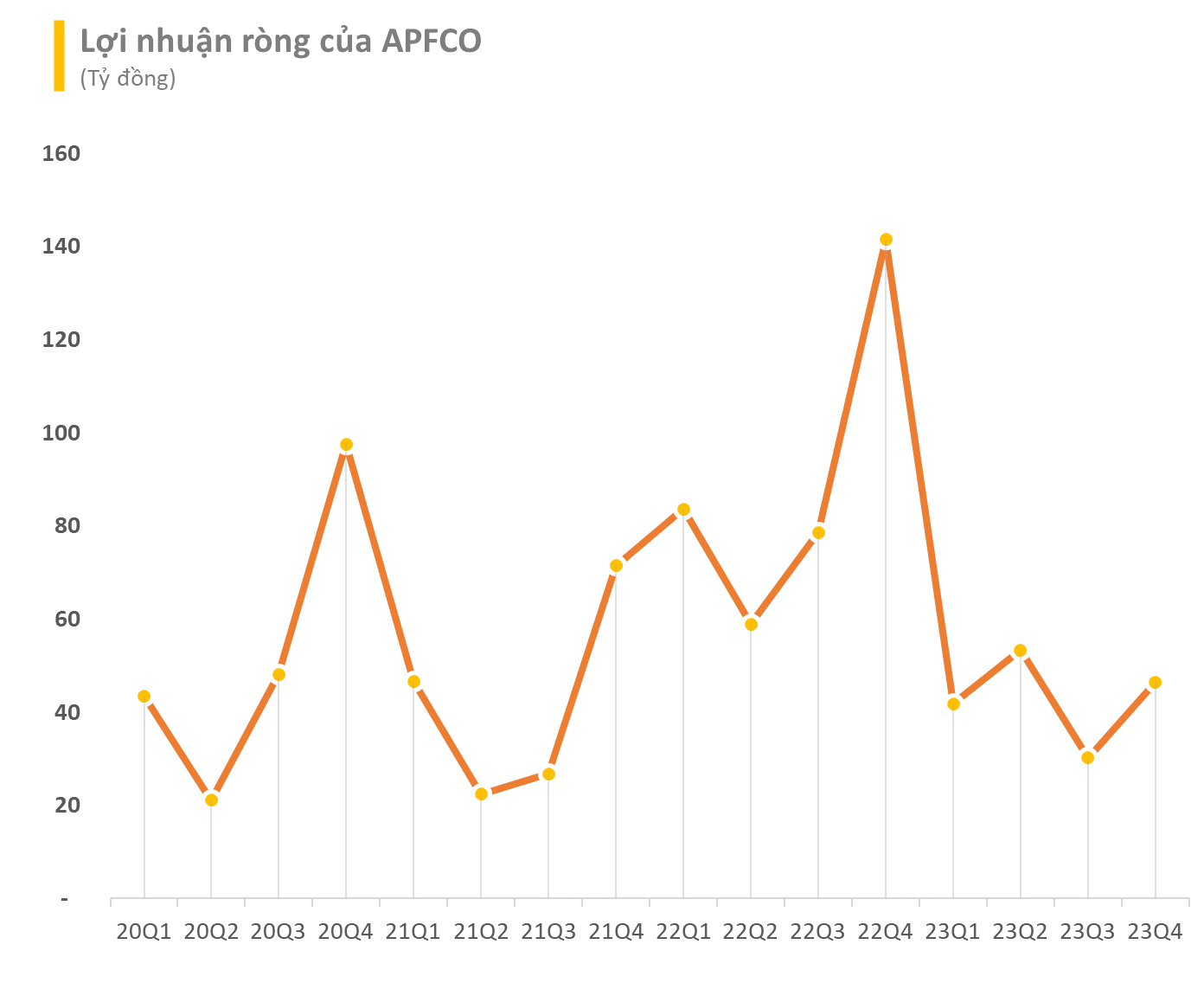

As a result, APF reported a pre-tax profit of VND 49 billion in Q4, a decrease of 68% compared to Q4/2022. Net profit also decreased by 69% to VND 48 billion compared to the same period.

Accumulated for the whole year of 2023, APF’s net revenue reached approximately VND 6,415 billion, a decrease of 10%. Net profit after tax was more than VND 182 billion, a decrease of 55% compared to the first half of 2022. The company’s consolidated net profit attributable to the parent company reached VND 171 billion.

At the beginning of 2023, APFCO set a target of total revenue of VND 6,600 billion and net profit attributable to the parent company of VND 270 billion, a decrease of 8% and 26% respectively compared to the previous record numbers of 2022. With the above results, APF has achieved over 97% of the revenue plan and 63% of the profit plan.

As of December 31, 2023, APF’s total assets reached VND 3,166 billion, a slight increase of VND 27 billion compared to the beginning of the year. The company had VND 131 billion in cash, in addition to VND 448 billion in accounts receivable and VND 1,014 billion in inventory. Regarding capital sources, APF recorded VND 2,058 billion in liabilities, including VND 1,678 billion in debt. Owner’s equity reached VND 1,109 billion, an increase of VND 18 billion compared to the beginning of the year, including VND 432 billion in undistributed net profit.

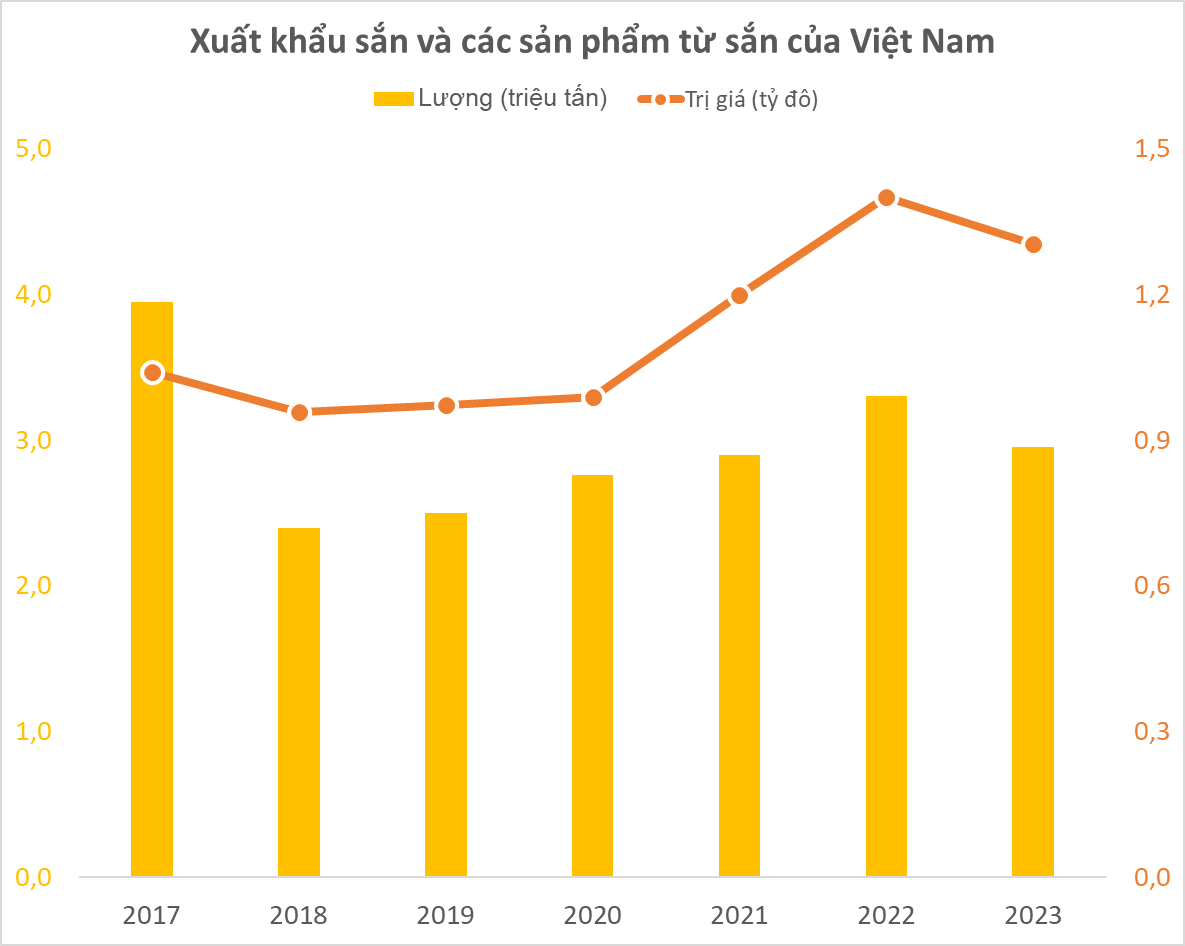

APFCO is known as a leading company in the production of cassava starch and ethanol. Currently, APFCO’s products mainly serve export to Asian countries such as China and Japan. However, after the boom in 2022, the cassava industry has recorded a slowdown, with the value of Vietnam’s cassava starch exports in 2023 decreasing despite the continued increase in selling prices.

Specifically, the average export price in 2023 increased by 4% to $441/ton, but the export volume only reached nearly 3 million tons, a decrease of 10%. The total export value was more than $1.3 billion, a decrease of about 7% compared to 2022.

On the stock market, APF shares closed at VND 58,700/share on January 29, 2024, an increase of nearly 7% compared to the beginning of the year.