Decreasing interest rate for home loans

According to a survey by Tiền Phong with some banks, at the moment, most banks apply 2 interest rates, which are preferential interest rates applied in the short term from 3-12 months and the interest rate after the preferential period. The adjustment range of interest rates between preferential and post-preferential periods in popular banks is from 2-3.8%.

According to the survey, the preferential interest rate for home loans at commercial banks in February 2024 ranged from 5-10.5% per year. After the preferential period, the floating interest rate falls between 8-13% per year.

Among them, state-owned banks (Agribank, Vietcombank, Vietinbank, and BIDV) apply interest rates for home loans in the first year ranging from 6.4-7% per year. Specifically:

BIDV: from 6-7% per year for a term of 6-36 months and a minimum loan term of 36-60 months, applied from now until December 31, 2024; VietinBank: applies a rate of 6.4% per year, applied during the initial preferential interest rate period;

Agribank: applies a fixed interest rate of 7% per year for medium and long-term loans, the duration of this preferential interest rate is from 12-24 months; Vietcombank: the interest rate for a loan term of the first 18 months is 6.7% per year, then increases to 6.8% per year (2 following years), 7.5% (3 years), 9.5% (5 years), 10.5% (7 years), 11% (10 years). After the preferential period, the bank’s interest rate is calculated based on the 12-month savings interest rate plus a margin of 3.5%.

The lowest interest rate for home loans in the market today belongs to BVBank with 5% per year. (Photo: Lộc Liên)

For joint stock commercial banks, home loan interest rates range from 5-10.5% per year. Among them, BVBank has the lowest bank loan interest rate with only 5% per year, and the margin after the preferential period is 2% per year. Next is VPBank, which applies a rate of 5.9% for the first 6 months of the year. After the preferential period, the floating interest rate is calculated based on the reference interest rate plus a margin of 3% per year.

HDBank, Sacombank, MSB, ACB, OCB… also have preferential interest rates in the first year for home loans ranging from 6.5-8% per year.

Meanwhile, foreign banks have also adjusted their lending rates. Specifically, UOB and Wooribank apply a 6% interest rate for the first 12 months. If home buyers choose a package with a fixed interest rate of 8% for the first 2 years or a fixed interest rate of 8.7% for the first 3 years. After the preferential period, the floating interest rate of these banks ranges from 8.6-8.9% per year. Shinhan Vietnam Bank also offers an interest rate of only 5.9% for the first 6 months and 8% for the next 54 months.

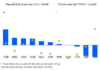

Money has not yet returned to the real estate market

Recently, following the direction of the State Bank of Vietnam (SBV), many commercial banks have continuously reduced deposit interest rates to support consumer loans and limit excess money in banks. Currently, after multiple adjustments, the deposit interest rate at many banks has reached a record low level, fluctuating around 5% per year for terms of 12 months and above, which is lower than the interest rate level during the COVID-19 period.

Experts believe that the reduction in deposit interest rates is expected to stimulate money flow into real estate, which is seen as a more attractive investment channel compared to saving in banks. However, according to recent data released by SBV, money has not yet returned to the real estate market, especially for high-value properties.

Money has not yet returned to the real estate market, especially for high-value properties.

The Vietnam Real Estate Brokers Association (VARS) believes that in the current difficult economic situation and the continued negative impact on the real estate industry, transactions mostly focus on products priced under 3 billion VND from customers with available cash. Conversely, high-value investment products still remain in stock due to complex and strict loan mechanisms and conditions, making many people reluctant to invest in real estate with large capital.

In addition, the difference between deposit interest rates and lending rates is still high, causing concern among people about borrowing due to the possibility of interest rate increases. Even after Circular 06/2023/TT-NHNN reduced interest rates, borrowing procedures are still complex and costly, making many people hesitate.

Therefore, VARS suggests that in order to stimulate demand and recover investment, banks should further reduce lending rates by about 2% per year with more flexible and simplified conditions and procedures.