Urgently complete the valuation of weak banks to promptly implement the mandatory transfer policy

|

The government has issued a Resolution on the implementation of the economic-social development plan for January 2024; the direction, tasks for February and the coming time.

According to Resolution 20, the government requires the State Bank of Vietnam (SBV) to closely coordinate with the State Audit Office to urgently complete the valuation of weak banks to promptly implement the mandatory transfer policy; complete and report to the competent authority the plan for handling the Saigon Commercial Joint Stock Bank. Effective solutions for bad debt control, ensuring system safety; enhancing the effectiveness of banking inspection, supervision, and monitoring, timely preventing, detecting, and strictly handling violations, ensuring monetary market security and discipline.

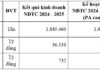

There are 4 weak banks under restructuring, including DongA Bank and 3 mandatory acquisition banks which are Construction Bank (CB), Oceanbank, and GPBank. These banks are also under special monitoring by the State Bank of Vietnam.

Previously, the State Audit Office had commented that the prolonged handling process led to the risk of consuming resources when having to provide special loans to support weak banks. At the same time, the agency also suggested that the State Bank of Vietnam speed up the mandatory transfer progress with the above units.

The State Bank of Vietnam previously stated that the reason for the prolonged restructuring process, developing transfer plans with credit organizations was the difficulty in finding and negotiating commercial banks that meet the conditions for receiving mandatory transfers (financial capacity, management, experience in restructuring weak credit institutions). The banks also need time to persuade shareholders, especially major shareholders, foreign strategic shareholders to agree to participate in the mandatory transfer.

In addition, the government also requires the State Bank of Vietnam to closely monitor market developments to actively, flexibly, timely, and effectively implement monetary policies, coordinate coherently, harmoniously, closely with fiscal policies and other macroeconomic policies to contribute to macroeconomic stability, promote growth, control inflation, ensure major balances of the economy. Closely monitor the implementation of credit limits in 2024, flexibly, timely manage and meet the capital needs for the economy and the safety of credit institutions system, direct credit towards priority sectors, growth drivers; tightly control credit in potential-risk sectors, resolutely combat negative phenomena in credit supply.

Continue reviewing loan conditions, simplifying favorable, open, flexible, feasible, reasonable loan procedures to enhance credit accessibility; promote disbursement of the VND 120 trillion and VND 15 trillion credit packages.

Closely monitor global and domestic gold price movements to timely implement measures to stabilize the gold market according to the Prime Minister’s direction in Official Letter No. 1426/CD-TTg dated December 27, 2023; strengthen inspections, promptly detect and strictly handle violations in gold and foreign currency trading, and the improper exchange of money in accordance with the law.

Instruct credit institutions, relevant agencies to ensure the stable, safe, smooth operation of the payment system, serving the payment and cash withdrawal needs of the people, businesses, and tourists before, during, and after the 2024 Lunar New Year of Horse.