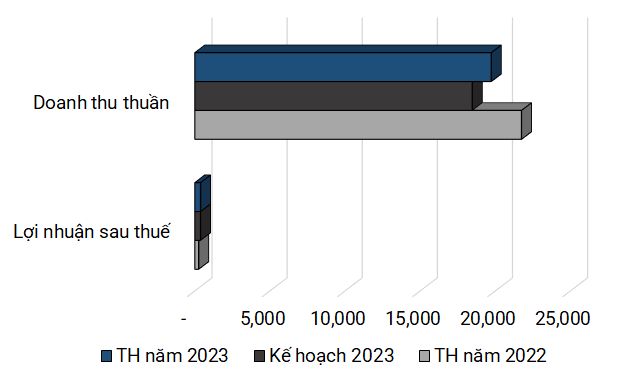

| Net profit of VTP from Q1/2023 |

Viettel Corporation (UPCoM: VTP) recorded a revenue of 5.1 trillion VND in the fourth quarter of 2023, a slight decrease of 3% compared to the same period. However, a 5% decrease in cost of goods sold helped VTP achieve a gross profit increase of 67%, reaching nearly 240 billion VND.

Contributing to VTP‘s positive results, the financial operating income increased by 19%, mainly from interest income from deposits and loans. The interest expense decreased slightly by 6%, no longer recognizing exchange rate differences, and there was a significant reduction of 28% in other operating expenses in cash.

The only negative trend was the almost five-fold increase in selling expenses, reaching 24 billion VND, most of which were other operating expenses in cash.

The 104 billion VND profit in the fourth quarter was attributed to the expansion of business activities and efficient resource utilization by VTP. In contrast, the fourth quarter of 2022 resulted in a loss due to adjustments based on the recommendations of the State Audit.

Source: VietstockFinance

|

Similarly, the full-year net profit of VTP in 2023 increased by 49%, primarily due to a higher reduction in cost of goods sold and an additional 30% increase in financial operating income, reaching 137 billion VND despite the overall increase in expenses.

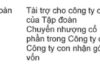

At the beginning of the year, the company set a target of total revenue of 18.4 trillion VND and after-tax profit of 376 billion VND. The adjustment of the revenue target was due to the company’s plan to decrease revenue from selling prepaid phone cards while expecting a 30% increase in the express delivery and logistics sector. Thus, VTP successfully achieved the pre-set targets.

|

Actual Results vs Plan of VTP in 2023 (Unit: billion VND)

Source: VietstockFinance

|

At the end of 2023, there were significant changes in the company’s balance sheet. For example, cash and cash equivalents doubled compared to the beginning of the year, increasing by over 400 billion VND. A prepayment of 290 billion VND to CTCP Thương mại Hà Anh was made. The company’s business expansion was partially aided by a short-term payable which increased by 95% to 650 billion VND.

Some newly recognized construction assets include the purchase of trucks worth 57 billion VND, the construction of vehicle management software worth 4.7 billion VND, and the Logistics Center project in Da Nang worth 609 million VND.

The amount of borrowed money, as well as principal repayments, reached nearly 33 trillion VND, an increase of nearly 90% compared to the same period last year. This is the highest level of borrowing by VTP to date, mainly from Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV, HOSE: BID) and Military Commercial Joint Stock Bank (HOSE: MBB).

| Repayment and borrowing amount of VTP from 2010 |

In 2023, VTP also invested heavily in fixed assets, with a total expenditure of 471 billion VND, compared to only 29 billion VND in the previous year, creating a new record. The expenditure included 132 billion VND for transportation and transmission vehicles, and 55 billion VND for machinery and equipment.

From a shareholder’s perspective, one of the positive points is that VTP continued to maintain a high dividend payout ratio compared to the earnings in recent years.

| Payout ratio and net profit of VTP from 2010 |