Investment Development and Construction Joint Stock Company – DIC Corp (DIG-HOSE ticker) has recently announced the results of its bond offering.

Accordingly, DIG has issued bonds with the code DIGH2326001, with a maturity period of 3 years, issued on December 29, 2023, and due on December 29, 2026. The face value of the bonds is VND 600 billion, with an interest rate of 11.25% per year.

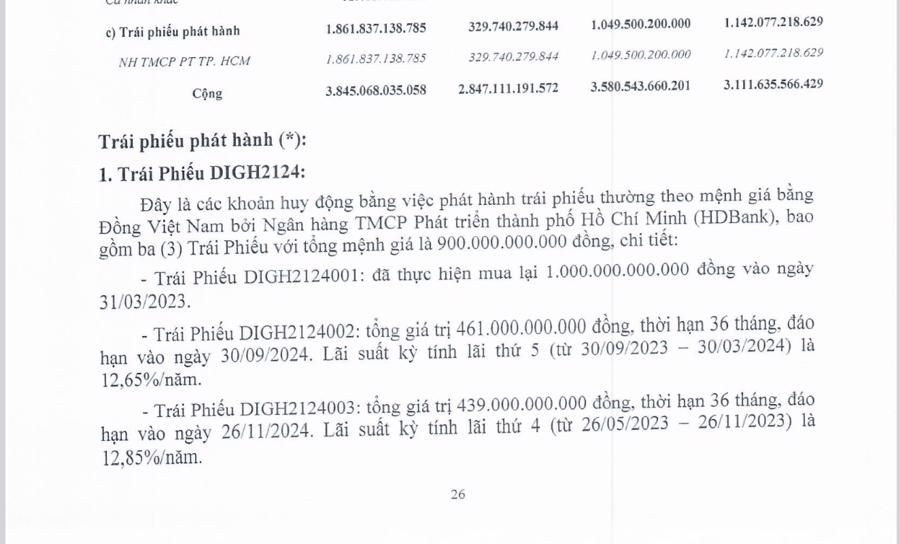

According to the consolidated financial statements for the fourth quarter of 2023, DIC Corp has repurchased its bonds before maturity, reducing its bond debt to approximately VND 720 billion, from VND 1,861.8 billion to VND 1,142.1 billion – Among them, the DIGH2124002 bond with a total value of VND 461 billion, due on September 30, 2024, and interest calculated from September 30, 2023 to March 30, 2024, with an interest rate of 12.65% per year;

The DIGH2124003 bond with a total value of VND 439 billion, due on November 26, 2024, and interest calculated from May 26, 2023 to November 26, 2023, with an interest rate of 12.85% per year;

And the DIGH2326001 bond, with a total value of VND 300 billion, due on December 29, 2026, and interest calculated from December 29, 2023 to June 29, 2024, with an interest rate of 11.25% per year.

Therefore, compared to the 3 outstanding bonds, the newly issued bond by DIC Corp has a lower interest rate.

Recently, Ms. Le Thi Ha Thanh, the wife of Mr. Nguyen Thien Tuan, Chairman of DIG, has successfully sold 940,000 DIG shares as registered, accounting for 0.16% of the company’s capital through matching or negotiated transactions to meet personal financial needs on February 6, 2024. After the successful transaction, the Chairman of DIC Corp’s wife only holds 4,902 shares, equivalent to 0%.

Previously, during the period from December 11, 2023, to January 9, 2024, Ms. Thanh registered to sell 200,000 DIG shares, but at the end of the trading period, only 35,300 shares were sold, accounting for 17.7% of the registered shares due to the price not meeting expectations.

It is known that DIG announced its revenue for the fourth quarter of 2023 reaching VND 434 billion, an increase of 11% compared to the same period thanks to the handover of primarily Gateway Vung Tau, Cap Saint Jacques, Nam Vinh Yen, and Hau Giang projects.

Meanwhile, the after-tax profit after minority shareholders’ benefits for the fourth quarter of 2023 increased 15 times compared to the same period to reach VND 66 billion, mainly thanks to the profit from joint venture and associate companies reaching VND 36 billion (11 times higher than the same period; and compared to VND 3 billion in the first 9 months of 2023).

In 2023, DIG’s revenue decreased by 46% compared to the same period to reach VND 1.03 trillion – in line with VCSC’s forecast, while the after-tax profit after minority shareholders’ benefits of the company increased by 20% compared to the same period to reach VND 173 billion – 38% higher than VCSC’s forecast mainly due to the profit from associate companies in the fourth quarter of 2023.

At the end of 2023, DIG’s cash (including short-term deposits) increased to VND 2.5 trillion compared to VND 403 billion at the end of the third quarter of 2023.

According to VCSC, this increase mainly comes from the increase in other short-term payables (including the amount of customer deposits for real estate purchases, which increased from VND 171 billion at the end of the third quarter of 2023 to VND 2.25 trillion at the end of 2023). Therefore, DIG’s net debt-to-equity ratio reached 7.6% at the end of 2023, compared to 30.5% at the end of the third quarter of 2023 and 43.9% at the end of 2022.