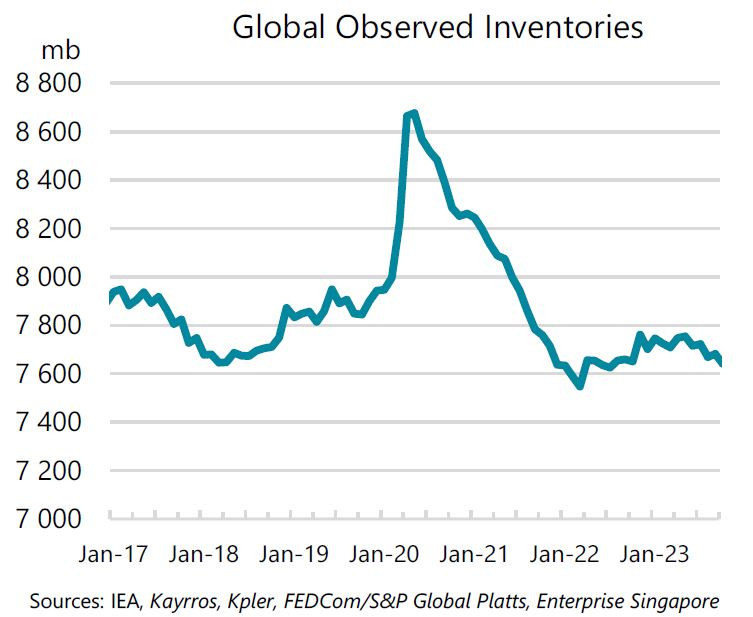

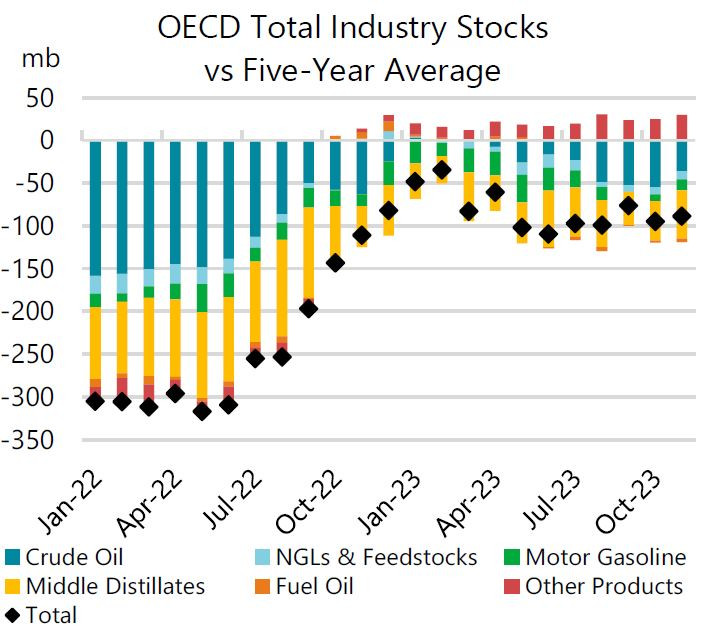

The global oil stockpiles have seen a severe depletion due to supply disruptions related to sanctions against Russia in mid-2022, as well as OPEC+ (The Organization of Petroleum Exporting Countries and its allies) extended production cuts. So far, global oil inventories have barely recovered and traders cannot justify this phenomenon as being due to oil storage costs.

Disruptions in shipping in the Red Sea due to rebel attacks by the Houthis have increased concerns about supply, prompting oil importers to rebuild their reserves.

Morgan Stanley in its quarterly report on oil market prospects released on Tuesday (13th February) raised its forecast for Brent crude oil prices to an average of $82.50 per barrel in the first and second quarters of 2024 – versus previous levels of $80 and $77.50 respectively – indicating the bank’s current view that the oil market will enter a state of tightening supply this year. The bank lowered its forecast for non-OPEC output growth from 1.7 million barrels per day (mbpd) previously to 1.5 mbpd, and raised its forecast for global demand growth to 1.5 mbpd from 1.3 mbpd.

Consultancy firm FGE said data from the start of the year to date showed crude oil and fuel inventories falling sharply seasonally, down almost 29 million barrels versus a typical average build of 20 million barrels in January for the years 2015-2019.

The International Energy Agency, on the other hand, noted that global oil stocks fell by 8.4 million barrels in November last year – the latest month for which complete data is available – to their lowest level since July 2022, with preliminary data for December pointing to an increase.

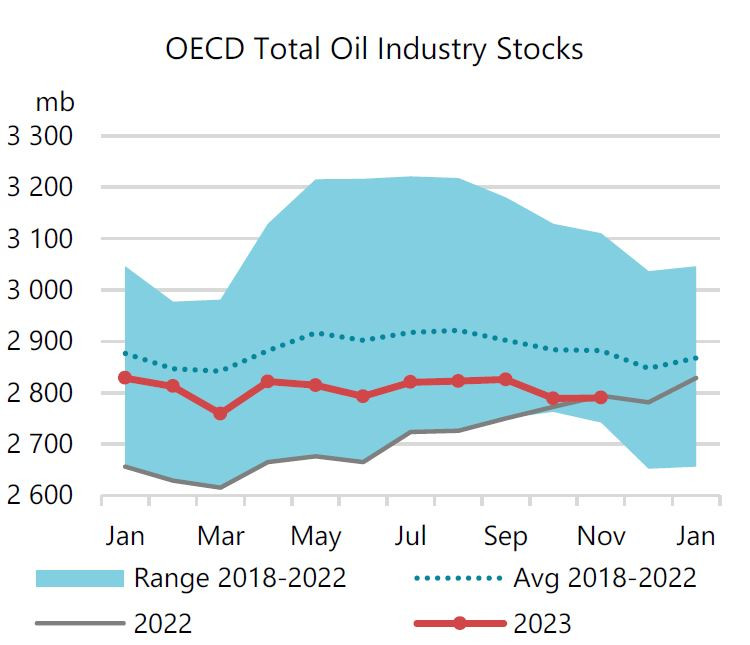

Global oil stockpiles.

OECD oil storage versus recent 5-year average.

Countries are replenishing reserves

Traders say they are seeing strong buying demand from China, Europe and the US.

China is buying a lot of oil – being shipped in this spring – to replenish its reserves, while the US is gradually adding to the Strategic Petroleum Reserve after selling record amounts from government inventories in 2022.

Reuters quoted a trader at a European refinery as saying: “The amount that China buys is high because they will replenish stocks in the first half of the year.” “US and Europe buying power in February has also increased as the situation of oil supply from the Suez East could worsen at any time.”

“Considering the days of demand coverage (from oil reserves), assuming OPEC+ continues to trim supply to the market until the first half of 2025, we predict that the amount of stored oil in countries’ inventories will reach approximately 67 days of use by the end of 2025 compared with the current 64 days, still higher than about 60 days before the pandemic,” said Citi’s energy strategist, Francesco Martoccia.

Total OPEC crude inventories.

OPEC+ has sought to limit supply to support prices by cutting output since 2022.

These plans were emphasized when Saudi Arabia suspended its plan to increase maximum production capacity. The Saudi Arabian Energy Minister said on Monday that the motive behind this decision was to support the energy transition process, while also adding that the kingdom has ample spare capacity to support the oil market.

Last month, the oil market was virtually unaffected by this decision, as demand for reserves from many countries was high, but supply from non-OPEC+ countries also surged, so the announcement by Saudi Arabia to suspend its plan to increase maximum production capacity went unnoticed.

Analysts at HSBC said “we continue to see a long-term supply-demand imbalance.”

In a recent release, when Brent crude oil rose to nearly $80 per barrel, J.P. Morgan analysts predicted a $10 further increase in May (assuming no political shocks and Saudi Arabia and Russia bring a combined 400,000 barrels per day back to the market starting April).

However, the oil market is still in a precarious situation. Barclays recently lowered its forecast for Brent crude oil prices for this year from $8 to $85 per barrel and believes that supply will increase and the sharp decline in inventory levels was not realized in the fourth quarter of 2023 due to a slowdown in demand and stronger-than-expected supply.

Nevertheless, Barclays also noted that oil seems to be underpriced, and it expects a gradual increase in demand and a significant slowdown in non-OPEC+ supply growth in 2024.

Futures prices for crude oil fell more than 10% in 2023 in a year of volatile trading amid political unrest and uncertainty about production levels of major oil producers worldwide.

Reference: Reuters