Ha Do Group Joint Stock Company (Ha Do; stock code: HDG) has just announced its consolidated financial statements for the fourth quarter of 2023, recording a gross profit of VND 585.8 billion, a decrease of 4.5%. Net profit after tax reached VND 372.5 billion, an increase of 10.2% compared to the fourth quarter of 2022.

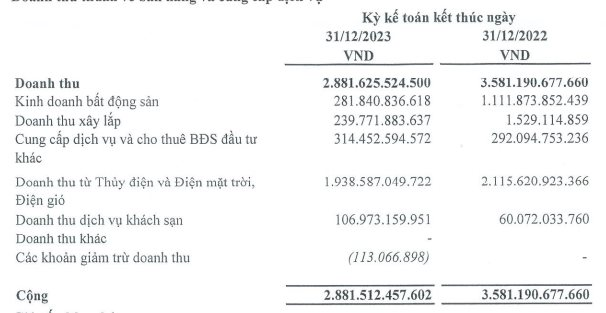

The accumulated revenue for the year 2023 brought in VND 2,881 billion, a decrease of 19.5%. In which, the revenue from real estate business “evaporated” almost 75% to VND 281.8 billion; Revenue from Hydropower and Solar Power, Wind Power was VND 1,938 billion, a decrease of 8.4% – nevertheless, this continues to be the core business area for the enterprise.

On the other hand, revenue from construction brought in VND 239 billion, this figure in 2022 was VND 1.5 billion; Revenue from providing other real estate investment services and leasing brought in VND 314 billion, an increase of 7.7%; Revenue from hotel services brought in VND 106.9 billion, an increase of 78%.

However, the cost of goods sold only decreased by 14.8% to VND 1,165 billion, which caused the gross profit to decrease by 22.4% to VND 1,715 billion.

In addition, financial operating revenue brought in VND 40 billion, a decrease of 51.9%; Other profit brought in VND 2.2 billion, this figure in 2022 was a loss of VND 10.2 billion.

In 2023, Ha Do’s expenses all increased significantly compared to the previous year such as: Financial expenses reached VND 571.8 billion, an increase of 10.6%; Selling expenses reached VND 8.2 billion, an increase of 78.4% and Enterprise management expenses reached VND 171 billion, an increase of 7.5%.

As a result, Ha Do reported a profit of VND 905.8 billion in 2023, a decrease of 33.5% compared to the previous year. This is the first time this business has lost the profit milestone of over VND 1,000 billion after 4 years.

As of December 31, 2023, Ha Do’s total assets were VND 10,946 billion, a decrease of 4.2% compared to the beginning of the year. In which, current assets accounted for VND 3,661 billion, a decrease of 7.3%. Cash and cash equivalents decreased by 30.2% to VND 208 billion; Inventories were VND 1,050 billion, a decrease of 22.5%.

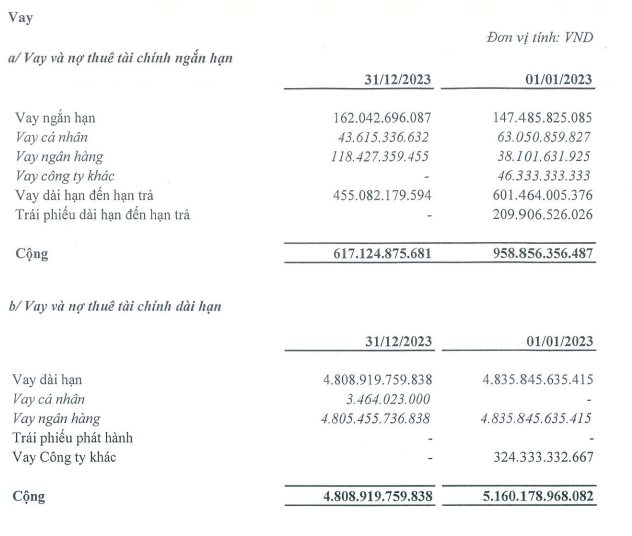

On the other side of the balance sheet, as of the end of 2023, Ha Do’s liabilities were VND 7,292 billion, a decrease of 15.6% compared to the beginning of the year. In which, short-term liabilities were VND 2,395 billion, a decrease of 28.5%. Financial borrowings (both short-term and long-term) were VND 5,426 billion, a decrease of 11.4%.

It is worth noting that by the end of 2023, Ha Do’s bond debt was equal to 0. Thus, in 2023, this company successfully completed the payment of nearly VND 210 billion in long-term bonds due.

Another notable point is the Net cash flow from operating activities of Ha Do decreased from VND 1,941 billion at the beginning of the year to VND 461 billion at the end of 2023, a decrease of 76.2%; Net cash flow from investing activities was negative VND 231.7 billion, this figure at the beginning of the year was negative VND 79.6 billion; Net cash flow from financing activities was negative VND 667.6 billion, this figure at the beginning of the year was negative VND 1,308 billion.

In the stock market, at the end of the trading session on February 16, HDG’s stock price was at VND 27,050 per share, a decrease of 0.55% compared to the previous trading session, with a trading volume of over 1.5 million shares.