According to Yuanta, short-term risks remain low and the market may only experience technical adjustments and stock groups may diverge, with the banking sector still potentially undergoing corrections, while money flows may seek out other stock groups.

The stock market has just had its 6th consecutive day of gains, driven by large-cap stocks, especially Vingroup, with slight adjustments in the banking and securities groups. VN-Index closed the session on February 19th with an increase of 15.27 points (+1.26%) to 1,224 points.

Liquidity also surged with a trading value of nearly 23,000 billion Vietnamese dong on the HoSE market. Foreign investors made an unprecedented net purchase of 1,812 billion Vietnamese dong in the entire market, mostly through agreements in the BHI code. On HOSE alone, foreign investors had a net purchase with an approximate value of 138 billion Vietnamese dong.

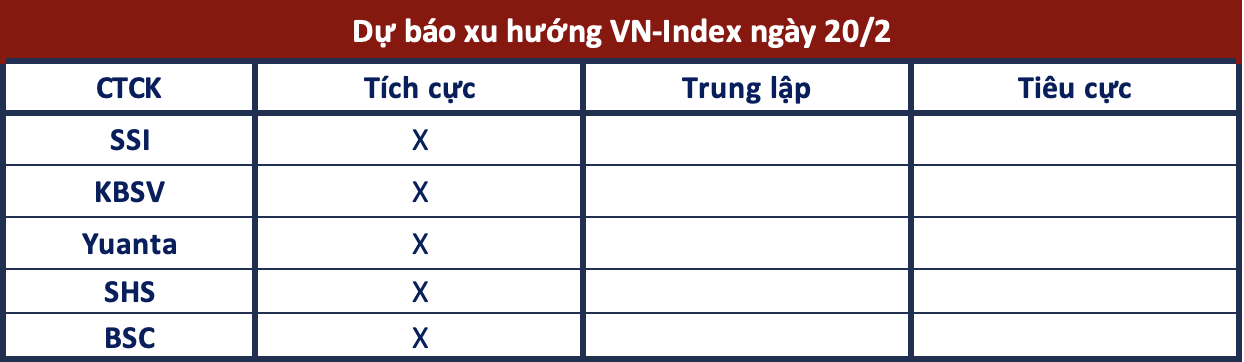

The majority of securities firms have given optimistic predictions about the market in the coming sessions:

Continued upward trend

SSI Securities: VN-Index continues to surpass the range of 1,213 – 1,215 with positive technical indicators RSI and ADX, demonstrating the strength of the sustained trend. The VN-Index can continue its upward trend towards the range of 1,227 – 1,229 in the short term.

Inertia in the lead

KBSV Securities: VN-Index increased with an expanded range towards the end of the session on February 19th. Money flow continues to have a positive spread in large-cap stocks, acting as the main driver for the index and creating a positive trading effect for the entire market.

Technical signals show an overbought trading state and the risk of a short-term correction still exists, but KBSV expects that the inertia to increase points will still have an advantage with the main driver coming from pillar stocks and increased liquidity.

Continued growth

Yuanta Securities: The market may continue its upward trend in the next session and VN-Index is heading towards the 1,245 point level. At the same time, short-term risk remains low and the market may only have technical correction periods and groups of stocks may diverge, with the banking group possibly continuing to correct while money flow may seek other groups of stocks.

In general, money flow has not shown signs of leaving the market, but the negative point is that the market’s upward trend is heavily influenced by Vingroup stocks, which may make the market’s upward trend unsustainable and lead to profit-taking psychology in other groups of stocks.

Maintaining the upward trend

SHS Securities: VN-Index continues to maintain its upward trend and is heading towards approaching the upper resistance level of the medium-term accumulation channel, expected around 1,250 points. In the medium term, VN-Index maintains its movement in the balance zone to form a new accumulation base and SHS expects the market to form an accumulation base within the range of 1,150 points – 1,250 points.

Targeting the resistance at 1,250 points

BSC Securities: The good increase on February 19th, supported by liquidity, is a stepping stone for VN-Index to continue returning to the resistance level of 1,250 points.