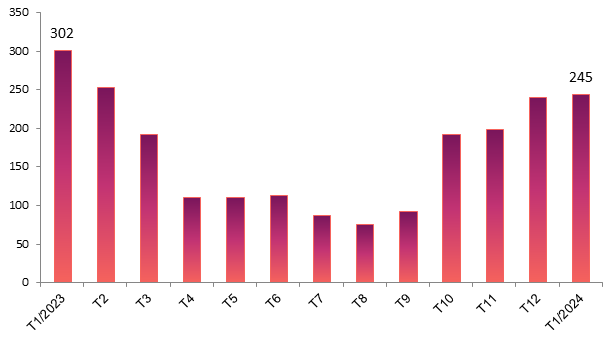

According to the recently published business report, jewelry retail chain PNJ recorded a net revenue of 3,829 billion VND and after-tax profit of 245 billion VND in January 2024, decreasing by 7.3% and 18.6% respectively compared to the same period.

|

Monthly after-tax profit of PNJ from 2023-2024

(Unit: Billion VND)

Source: PNJ, author’s compilation

|

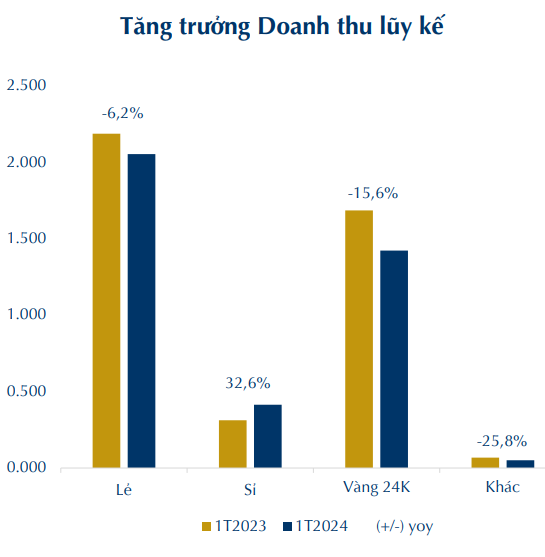

The company stated that in the context of weak purchasing power, during the Lunar New Year, the Year of the Dragon falls in February (later than the previous year), retail revenue and 24K gold revenue decreased by 6.1% and 15.6% respectively compared to the same period. However, these two segments still contribute significantly to PNJ’s revenue structure, accounting for 52.1% and 36.1% respectively, equivalent to 1,995 billion VND and 1,382 billion VND.

The only segment with positive growth is wholesale jewelry, increasing by 32.6% compared to the same period, contributing more than 402 billion VND in revenue (accounting for 10.5%), in the context of increasing orders for the Lunar New Year.

Source: PNJ

|

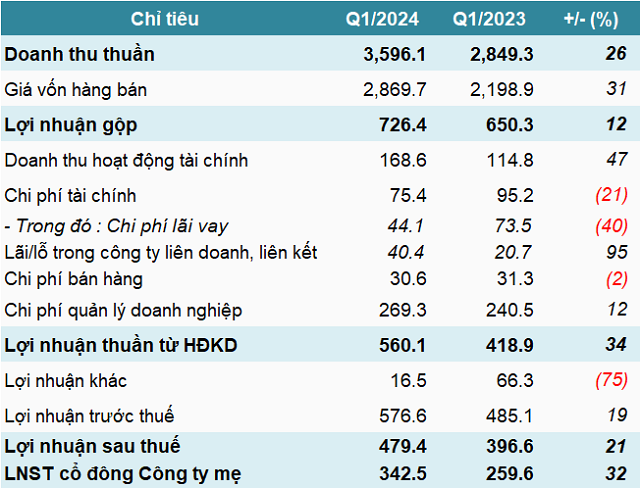

The average gross profit margin in January reached 17.2%, a decrease from 18.2% in the same period, due to changes in the product structure in the retail channel. Meanwhile, total operating costs were reduced by 3.7%.

As of January 31, 2024, PNJ had a total of 402 stores in 55 out of 63 provinces and cities, including 393 PNJ stores, 5 Style by PNJ stores, 3 CAO Fine Jewellery stores, and 1 wholesale business center.

Previously, PNJ announced its 2023 financial results with a revenue of over 33,100 billion VND, a decrease of 2.2% compared to 2022. However, gross profit increased, helping after-tax profit increase by 8.9% to over 1,970 billion VND, the highest level in the company’s 35-year history.

The company achieved 93% of its revenue target but exceeded the profit target set for 2023 by nearly 2%. The leadership attributed this to PNJ’s increased market share, attracting new customers, expanding its network, launching diversified products, and better customer engagement.

Illustrative image

|

Notably, the only segment with positive growth is 24K gold, bringing in over 10,400 billion VND in revenue in 2023, an increase of 21% compared to the previous year. This is the record figure that PNJ has reported since 2017, with an average daily sale of nearly 29 billion VND of 24K gold. As a result, this segment accounted for nearly 1/3 of the company’s revenue structure for the first time.

Although the revenue from gold bars has grown strongly, PNJ’s leadership believes that the profit margin in this segment is low, affecting the overall gross profit margin of the company. Gold bars usually account for less than 1% of the company’s gross profit.

In recent trading sessions, PNJ’s stock price has consistently closed in the red. On the Day of the God of Wealth (February 19, the 10th day of the Lunar New Year), the stock price plummeted by 1,800 VND/share (-1.99%) to 88,700 VND/share. On the morning of February 21, PNJ’s stock price decreased by 0.11% to 88,600 VND/share.

However, PNJ’s stock price has still increased by more than 3% since the beginning of 2024 and by 18% compared to the short-term bottom in late October 2023. Compared to the peak set in June 2022 (93,970 VND/share), the current stock price of PNJ is still 6% lower.

| PNJ stock price in the past year |