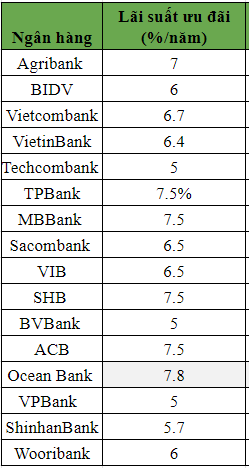

Our survey shows that as of February 2024, the interest rates for home loans at banks have significantly decreased compared to mid-2023. Some banks have reduced the average interest rate for home loans to 5-6% per year during the promotional period. After the promotional period, the floating interest rate for home loans ranges from 9-11% per year.

(Illustrative photo)

The preferential interest rate for home loans at the Big 4 banks ranges from 6-7% per year. Specifically, BIDV applies the lowest preferential interest rate for real estate loans at 6% per year, followed by Vietinbank with 6.4% per year.

Agribank applies an interest rate of 7% per year for the first 2 years. The interest rate after the promotional period is floating. However, Agribank has a loan term of 5 years.

In the group of private commercial joint-stock banks, the interest rate for home loans ranges from 6-11% per year.

The lowest current preferential interest rate is 0% per year, applied at TPBank. Accordingly, this bank applies an interest rate of 0% per year for the first 3 months, 9% per year for the next 9 months for customers borrowing less than 65% of the total asset value. The preferential interest rate for customers borrowing for 12 months is 7.5% per year, for 24 months is 8.6% per year, and for 36 months is 9.6% per year. For customers borrowing more than 65% of the total asset value, the preferential interest rate is 8.5% per year for the fixed 12-month loan package, 9.6% per year for the 24-month/year package, and 10.6% per year for the 36-month package. In the case of a 3-month loan package, the preferential interest rate for the first 3 months is 1% per year and 9% per year for the next 9 months.

Techcombank currently applies an interest rate of only 5% per year for the first 3 months of the loan. 6% per year for the first 6 months of the promotional period or 6.8% per year for a 12-month period. The prepayment penalty for the first 3 years is 2%, from the 4th to the 5th year is 1%, and from the 6th year onwards, the bank waives the prepayment fee.

BVBank also has the lowest bank loan interest rate at only 5% per year, and the range after the promotional period is 2% per year.

Meanwhile, the preferential interest rate that VPBank applies is 5.9% for the first 6 months of the year. After the promotional period, the floating interest rate is calculated by adding a 3% margin to the reference rate each year.

The interest rate for home loans at ACB Bank is 7.5% per year for the first 2 years. After the promotional period, the interest rate for loans is calculated by adding the base interest rate plus a 3.5% margin. Customers can prepay up to VND 200 million per month without a penalty fee.

In foreign banks, the preferential interest rate for home loans has also decreased to below 6% per year. For example, Wooribank applies an interest rate of 5.7% per year for the first 6 months. For the next 54 months, the interest rate is 8.7% per year. For customers choosing the fixed 1-year package, the preferential interest rate is 6% per year, and for the 2-year package, the preferential interest rate is 6.4% per year. For the fixed 3-year package, the preferential interest rate is only 6.8% per year. After the promotional period, the floating interest rate is 3.5% per year.

For Shinhan Bank, the fixed interest rate for the first 6 months is 5.8% per year and 7.5% per year for the next 54 months. The interest rate for the fixed 1-year package is 6.1% per year, for the 2-year package is 6.5% per year, and for the 3-year package is 6.9% per year. The penalty fee ranges from 1-2% per year. The interest rate for home loans is still reduced by 0.1-0.3% per year for customers using the bank’s credit cards or having loans of more than VND 3 billion.

Preferential interest rates for home loans at some banks. (Information is for reference only)

According to the 2024 Outlook Report by Vietcombank Securities, the unit states that: The interest rate for home loans is starting to decrease according to the deposit interest rate. This may stimulate homebuyers to resume real estate purchase plans for long-term residence and investment purposes. At the same time, the deep loss product supply from homebuyers using high leverage in the vibrant market phase has been significantly absorbed.

According to a survey conducted by the PropertyGuru Vietnam market research unit at the end of 2023 with approximately 2,000 participants. The survey results show that 44% of respondents consider a home loan interest rate below 8% to be reasonable for them to manage their finances. Approximately 33% of people are willing to borrow if the interest rate ranges from 8-10%. The remaining 14% agree to borrow with an interest rate from 10-13%.