Illustrative image

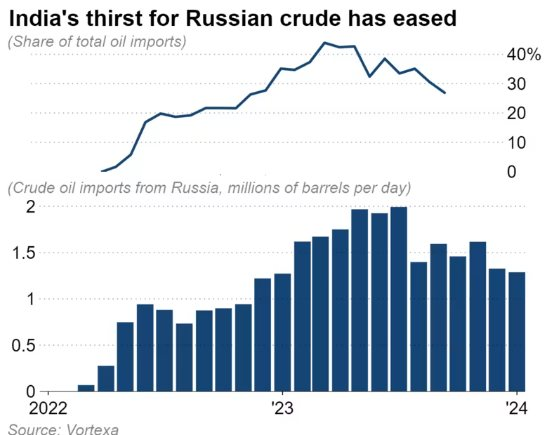

According to Nikkei Asia, India’s crude oil imports from Russia in January fell to the lowest level in a year, a decrease of nearly 35% compared to the peak of last year. The reason is that New Delhi is diversifying its supply sources.

Indian Minister of Petroleum Hardeep Singh Puri said this decline comes from efforts to provide energy at the cheapest prices to the public, making prices a priority for the country.

India increased its purchase of oil from Russia after the conflict in Ukraine in 2022, taking advantage of the sharp price drop due to Western sanctions. Data from research firm Vortexa shows that the country’s imports have risen from zero in January 2022 to 1.27 million barrels per day in January 2023.

Russia is the largest supplier of oil to India in 2023, accounting for about 30% of imports. Monthly figures reached a peak of 1.99 million barrels in July.

Imports of oil from Russia to India are sharply declining.

However, this volume has recently decreased to around 1.29 million barrels per day last month. India is currently buying more from other suppliers like Iraq, surpassing the record level of July – when Russian oil imports peaked.

When asked about Russia’s expected market share in India’s oil imports this year, the Minister of Energy and Natural Resources replied, “It is difficult to say.”

“Other countries may offer us more discounts,” he said.

The International Energy Agency predicts that India’s oil demand will increase by about 20% from 2023 to 2030 to 6.6 million barrels per day. Puri added, “India is one of the few markets that are growing rapidly. Suppliers are all interested in supplying more to India.”

Some observers see India’s reduced imports from Russia as a sign that US efforts and its partners to tighten sanctions against Moscow are beginning to take effect.

In December 2022, Europe imposed a price ceiling of $60 per barrel for Russian oil, enforced by blocking insurance coverage for shipments sold above that threshold. In October last year, Washington penalized two ships owned by companies in the United Arab Emirates and Turkey for violating this measure. In contrast, Moscow is said to have used a “shadow fleet” of old oil tankers to evade transport restrictions.

With Russia also facing financial sanctions, the Reserve Bank of India established a system in 2022 that allows commercial payments in rupees. However, according to local media, the use of this framework has been limited due to transaction risks and exchange rates. India is said to have paid for a significant portion of its crude oil purchases from Russia in USD or UAE dirhams.

Sanctions have prompted Russia to shift from the West to Asia as its main oil customer. Russia’s Finance Ministry said oil and gas revenues increased by 59% in January to about 680 billion rubles ($7.41 billion).

According to Nikkei Asia