IVS plans to double its charter capital, which was mentioned in the extraordinary General Meeting of Shareholders (EGM) in 2024 scheduled for March 12th.

Specifically, IVS will issue 69.35 million shares, equivalent to 100% of the issuance rate. The selling price will be determined by the Board of Directors based on actual conditions during the implementation process. The additional shares sold to existing shareholders will not be subject to transfer restrictions.

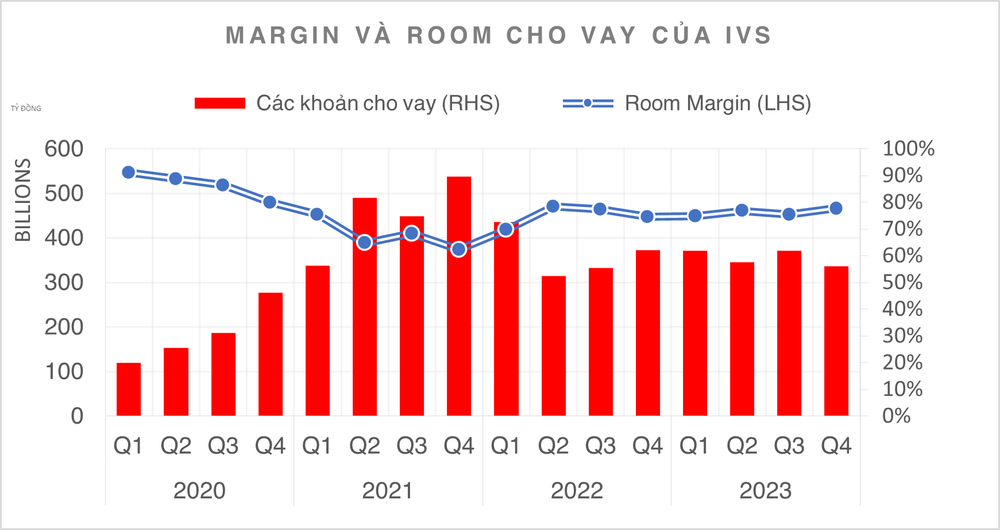

IVS stated that 75% of the proceeds from the offering will be used to supplement the margin funding source. The remaining 25% will be used to expand derivative operations and supplement the capital support for the investment banking business.

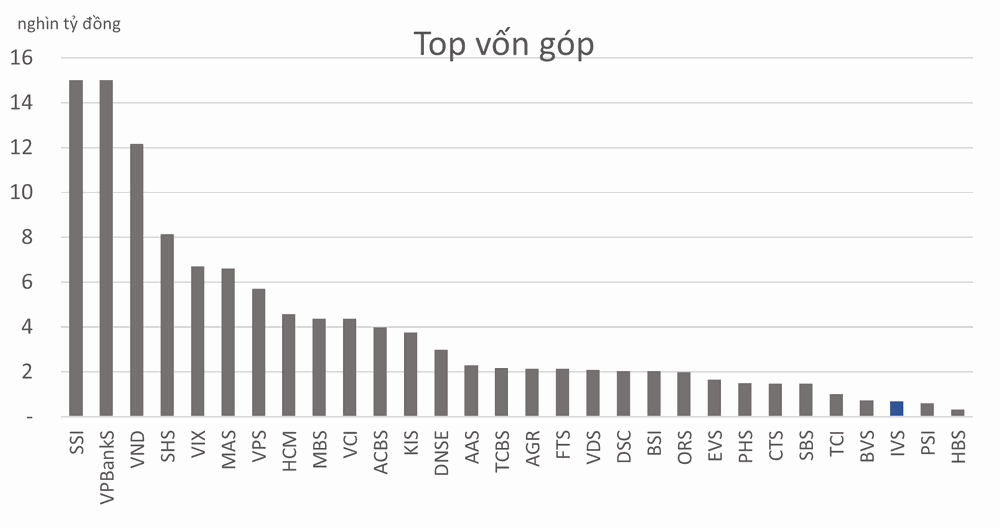

It is expected that IVS’s charter capital will increase to nearly VND 1,400 billion. This scale is still not among the top 20 in the industry and will only be equivalent to some securities companies such as CTS, PHS, SBS.

Meanwhile, a series of other securities companies are actively implementing plans to increase capital at the beginning of 2024, such as HSC with an offering of 228.6 million shares, DNSE with an IPO of 30 million shares to raise VND 900 billion, and ORS with an additional offering of 100 million shares in the ratio of 2:1…

Charter capital of 30 securities companies as of December 31, 2023.

The latest time IVS raised capital was in 2019, when the company issued shares to increase its charter capital from VND 340 billion to VND 693.5 billion. The buyer was Guotai Junan International Holdings Limited, a member of Guotai Junan Securities Co. Ltd, established since 1995 in Hong Kong (China).

At that time, IVS was still known as Vietnam Investment Securities JSC. Although Guotai Junan Securities later owned over 50% of IVS’s shares, it was not until July 2021 that the company changed its name to Guotai Junan Securities JSC (Vietnam Branch).

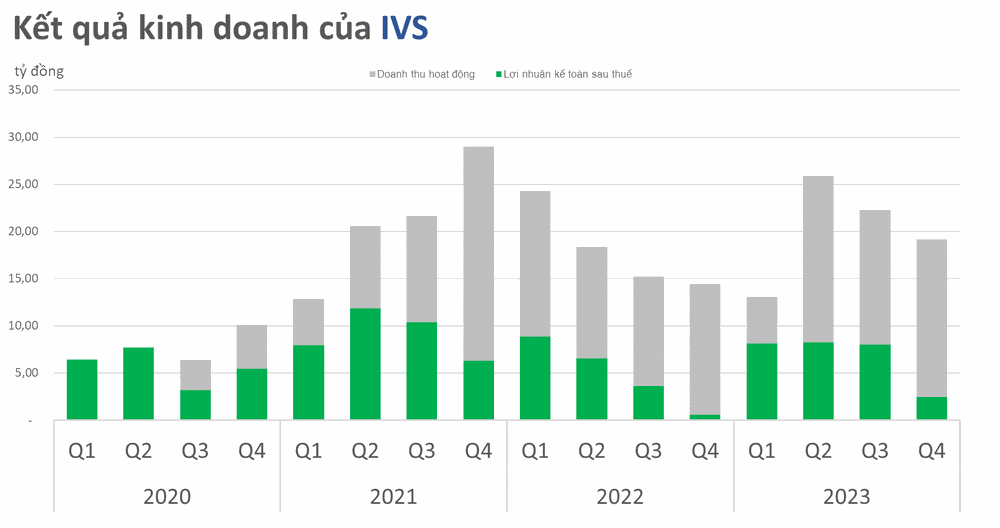

In 2023, IVS achieved revenue of over VND 8 billion, with after-tax profit increasing by over 50% to VND 27 billion.

The company allocated nearly 44% of total assets for margin lending activities. As of December 2023, the value of IVS’s margin loans and receivables was VND 336.3 billion.

IVS’s stock has been sideways in the first two months of 2024 despite strong gains in 2023.

Currently, IVS’ stock is listed on HNX and has been trading sideways since the beginning of 2024. However, in 2023, IVS increased by 92.6%.