The leading Korean screen manufacturers LG and Samsung are gradually falling behind, leaving some of their market share to Chinese screen and smartphone manufacturers, even with the technology they pride themselves on the most – OLED screens.

In this battle, Samsung closed its last LCD screen production plant in China in 2021 and is expected to rely on competitors from China to produce screens for its products.

At the same time, LG is also looking to sell its remaining LCD plant in China after sales plummeted.

The last bastion

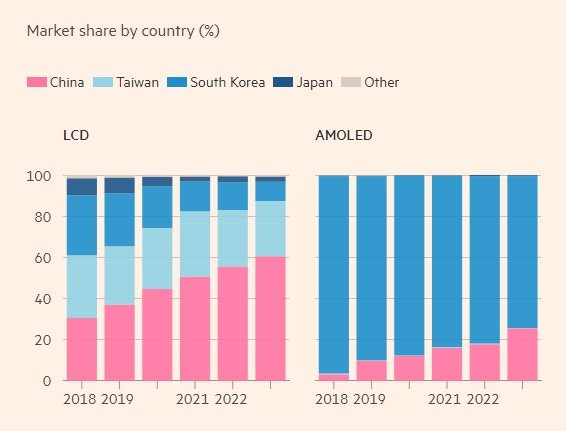

Conquering the cheap LCD screen market, Chinese screen manufacturers are gradually penetrating the “last bastion” of Korean technological superiority in OLED screens. The leader is none other than BOE Technology, which has built a $9 billion OLED screen factory in Chengdu.

Analysts say China’s screen industry is facing a fate similar to Japan’s $160 billion market. The most notable case is JOLED, a joint venture between Panasonic and Sony, which went bankrupt last year with $250 million in debt.

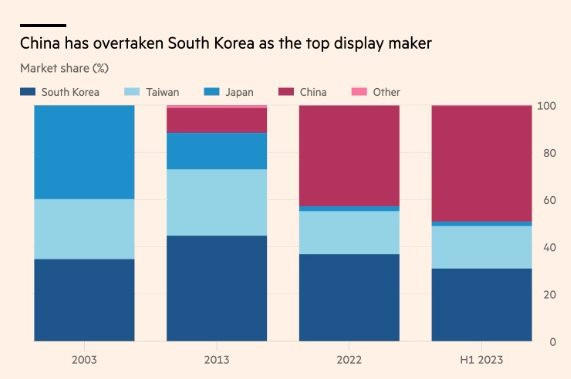

China has now overtaken Korea to become the world’s leading screen supplier.

“The rapid expansion of China’s display panel manufacturing capacity and price competitiveness has forced Korean panel manufacturers to leave the LCD supply chain under pressure to incur losses,” said Iris Yu, an analyst at the consulting firm TrendForce in Taiwan.

Need each other to “get out”

Instead, both of Korea’s giants are investing in OLED screens for high-end TVs, smartphones, and tablets, as well as micro OLED screens for the next generation of augmented reality and virtual reality devices like Apple’s Vision Pro glasses. LG Display is the world’s largest OLED panel manufacturer, although OLED TVs represent only about 3% of the global TV market.

China currently dominates the LCD market and is developing rapidly in the OLED screen segment.

“Now Korea has made a lot of progress in quality OLED screens, but Chinese panels are much cheaper,” said Yi Choong-hoon, an expert on screens at UBI Research. “China, despite losing a lot, still provides cheap OLED panels to increase market share and can defeat competing rivals as it did in the LCD market,” he added. “China will surpass Korea in the OLED market unless something changes.”

According to data from the South Korean government, they have copied more technology from the screen sector than any other industry except chips.

Last year, Samsung Display filed a complaint with the US International Trade Commission to prevent BOE from selling screens in the US, using what it claimed was stolen technology. BOE denied the allegations and responded with a series of lawsuits against some Samsung subsidiaries in China.

After cutting ties with BOE, Samsung now orders LCD screens from LG Display’s plant in Guangzhou, China. This cooperative relationship is also a lifeline for LG Display, which has suffered seven consecutive quarters of losses before reporting a profit in the fourth quarter of 2023.

“Samsung and LG need each other because the screen battle between Korea and China has spread to the high-end segment,” said Nam Sang-uk, a researcher at the Korean Institute for Economic and Trade Policy.

Source: FT