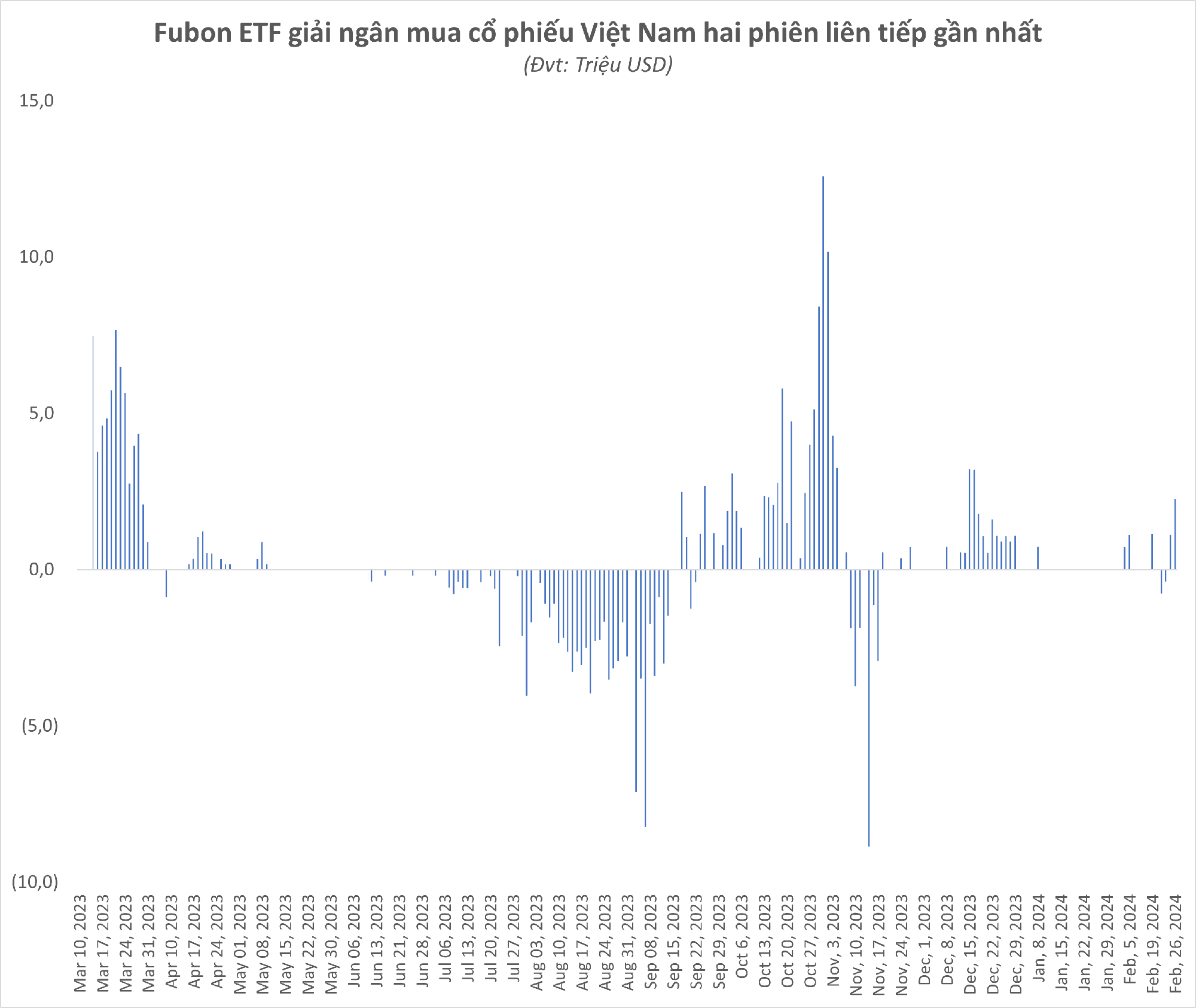

According to Fubon FTSE Vietnam ETF, on the trading session of February 26th, the fund issued a net of 6 million fund certificates, equivalent to about 2.3 million USD. The issuance amount of Fubon ETF was about 55 billion VND and the whole amount was disbursed to buy Vietnamese stocks.

This is the second consecutive net withdrawal session of this ETF fund and also recorded the highest net withdrawal value in over 2 months (since December 18th, 2023). In total, after two sessions from February 23rd to 26th, Fubon ETF net withdrew 8.3 billion VND.

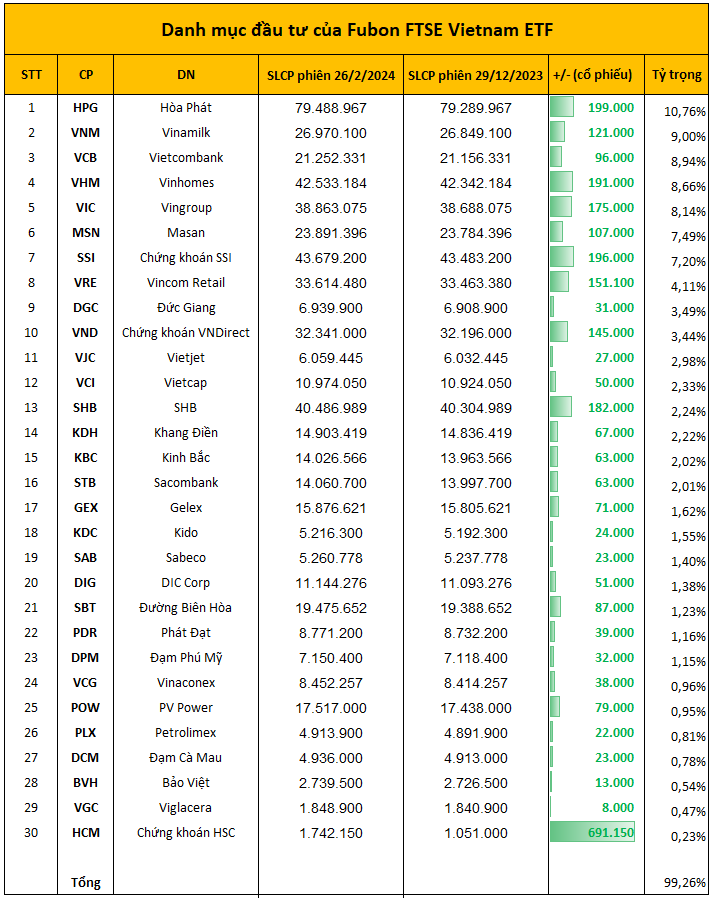

At the end of February 26th, the scale of Fubon FTSE Vietnam ETF’s portfolio reached more than 27.5 NTD, equivalent to over 21,500 billion VND, with 100% of the fund invested in Vietnamese stocks based on the benchmark FTSE Vietnam 30 Index. In the portfolio composition, HPG stock accounted for the largest proportion with 10.76% (holding 79.5 million shares), followed by VNM (8.997%), VCB (8.94%), VHM (8.66%), VIC (8.14%)…

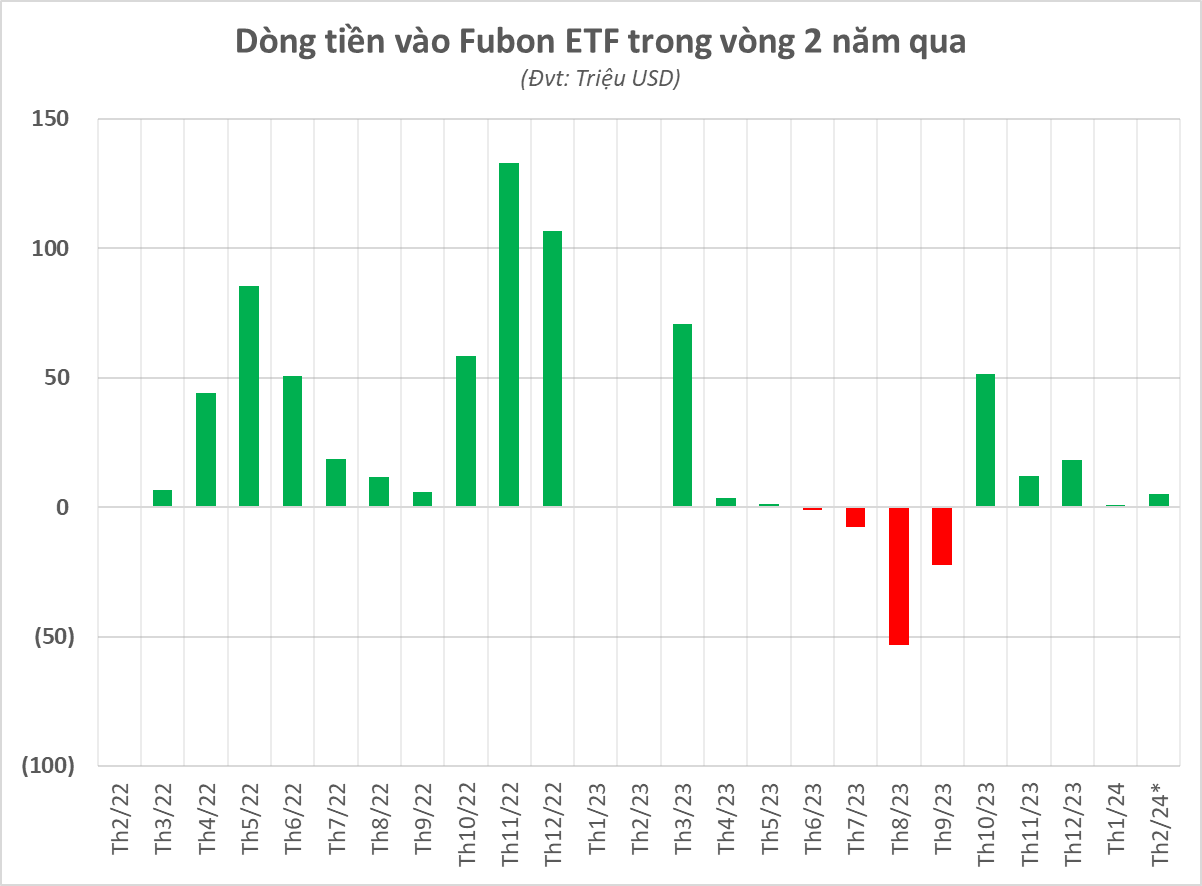

Accumulated from the beginning of 2024 to the present, Fubon ETF issued a net of 16 million fund certificates, equivalent to a net withdrawal of nearly 150 billion VND. Before that, Fubon ETF recorded a net withdrawal of more than 73 million USD (~1,800 billion VND) in 2023.

The net buying move of Fubon FTSE Vietnam ETF took place in the context of foreign investors in general being in a strong net selling trend with a net selling value on the transaction matching channel since the beginning of 2024 of about 5,000 billion VND.

According to statistics, Fubon ETF net bought all 30 stocks in the portfolio during the period from the beginning of the year until now, in which it strongly bought HCM Securities shares with 691 thousand shares, in addition to net buying HPG with 199 thousand shares, SSI with 196 thousand shares, VHM with 191 thousand shares…