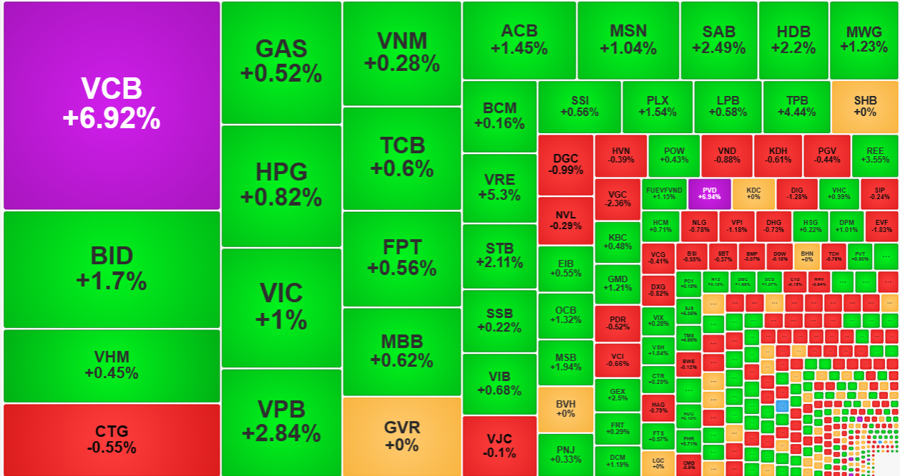

The market unexpectedly changed rapidly in the afternoon session, with the “explosion point” being the trading of the largest capitalized stocks, especially VCB. This development not only reflects the strength of market capitalization, but also spreads to many other banking stocks, leading to a significant increase in the number of shares. The VN-Index closed at its highest point of the day, up 1.38% to reach 1,254.55 points, surpassing the closing level at the peak of 2023.

The trading activity of VCB was extremely surprising, closing the morning session at a new reference price with low liquidity, which did not promise an explosive afternoon session. As soon as the market reopened, VCB showed a strong buying force, pushing the price up. Within just 30 minutes, the stock skyrocketed from the reference price to the ceiling price.

This change happened too quickly and there is still a lot of skepticism, as reflected by the market breadth that clearly shows investors’ cautious observation. At the end of the morning session, the VN-Index had 238 gainers/200 losers. While VCB was surging and pushing the index up, by 1:30 pm there were still only 223 gainers/250 losers, meaning that the stocks were even weaker.

However, in the remaining time, VCB began to stimulate other banking stocks. All of these stocks in the VN30 basket improved their prices and continued to maintain their upward momentum until the end of the session: BID reversed by 2.67% compared to the morning closing price, an increase of 1.7% from the reference price at the close. TPB soared by 4.44% at the end of the session, meaning it had gained an additional 4.17% during the afternoon. VPB also rose by 1.53%, resulting in an overall increase of 2.84%. Even weak performers like CTG – which had the biggest drop in the group in the morning, losing 1.11% – only closed down 0.55% from the reference price… The significant gains considerably improved trading sentiment. HoSE closed with 309 gainers/180 losers.

VCB officially reached a new all-time high today, with more than 89% of the trading volume concentrated in the afternoon session, demonstrating a determined effort to push prices up. The total trading volume of this stock today reached nearly 4.22 million shares, valued at VND 401.5 billion. This is also a record-breaking liquidity level.

The VN30 basket, compared to the morning session, had only 6 decliners which were GAS, GVR, PLX, POW, VIC, and VJC, while the rest all increased significantly. 9 stocks increased by more than 1% during the afternoon session, focusing heavily on banking stocks, with FPT, HPG, and VRE also included. The VN30-Index closed up 1.4% compared to the reference price, with only 2 stocks CTG and VJC ending in red.

The 17.09-point increase of the VN-Index was heavily influenced by banking stocks, especially VCB. Besides the largest pillar of the market, BID increased by 1.7% and VPB increased by 2.84%, also leading the way. These 3 stocks alone contributed more than 11 points, with VCB alone contributing 8.7 points. Among the top 10 stocks that had the strongest positive impact, TPB, ACB, and HDB were also in the banking sector.

The good market breadth at the closing where the VN-Index increased strongly and closed at the highest point of the day indicated a completely dominant buying force. Although the proportion of gainers/losers also indicated significant “herding” behavior, meaning stocks followed in the wake after the pillar group boosted the index, the widespread spread also reflected the induced sentiment.

However, it should be noted that although the market increased sharply today, stock prices were not overheated. Among the 309 gainers, only 87 increased by more than 1%, with 50 increasing by more than 2%. There were 6 stocks that hit the ceiling price. The Midcap group even had a weak increase of 0.3%, and Smallcap increased by 0.35%. Accordingly, not all stocks benefited from the afternoon surge. There were even 55 stocks among the 180 decliners that decreased by more than 1%.

The VN-Index closed today surpassing the highest level of 2023 according to the closing price (the peak was 1,245.5 points on September 6, 2023). If measured by the amplitude, this session has not clearly surpassed the previous high. The highest level the index reached in the session on September 7, 2023 was 1,255.11 points, which was still higher than today’s session (1,254.55 points). Today’s session also witnessed the unexpected strength of VCB, while other blue-chip stocks did not show significant breakthroughs. Therefore, the true explosive potential of the VN-Index still depends on the ability to maintain strength in VCB or other major stocks in the coming sessions.