Mergers and the cumbersome aftermath

Looking back, the continuous bank mergers (2011-2015) reflected the achievements and consequences of financial statements mergers. This was the peak of a hot credit growth period, pushing bad debts to a high level and forcing the Government to come up with a plan to handle bad debts.

After this period, the number of commercial banks sharply decreased from 42 to 34 (excluding Agribank). Among them, there were 3 banks that were acquired for 0 dong (GPBank, CBBank, and Oceanbank) and 1 bank under special control (DongABank).

The mergers aimed to restructure the banking system and handle bad debts after a long period of hot growth, resulting in some banks being “wiped out” from the system, such as Habubank, TinNghiaBank, Ficombank, Trustbank, Navibank, Western Bank, Phuong Nam…

From 3 banks – SCB, TinNghiaBank, and Ficombank, they merged into SCB. Habubank merged into SHB; PetroVietnam Finance Joint Stock Corporation (PVFC) and Western Bank merged into PVcomBank; DaiABank merged into HDBank, MHB merged into BIDV, MDBank merged into MSB, Phuong Nam merged into Sacombank.

Most recently, after the case involving Van Thinh Phat Group and SCB, investigation reports revealed a complex web of relationships among legal entities that pushed SCB into the special control status.

However, it is necessary to look back to 2011 when SCB entered the top 5 banks with the largest total assets in the system after the merger. The financial statements showed that the bank’s total assets increased 5 times – from 149,205 billion VND (2012) to over 761,177 billion VND (June 2022). SCB’s pre-tax profit remained stable around 60-230 billion VND and surged to 1,434 billion VND in 2021.

The truth reveals itself after the conclusion of a 300-page investigation report by the Investigative Police Agency (Ministry of Public Security). As of October 17, 2022, SCB’s total capital according to the accounting books was 713,420 billion VND.

The investigation results revealed the financial situation of SCB as of June 30, 2017, with a bad debt ratio of 20.92%, while SCB reported only 0.61%; the CAR safety ratio was 6.5% while SCB reported 10.06%; the proportion of real estate loans to total loans was 62.95% while SCB reported only 55%…

Accordingly, SCB did not classify bad debts for loans that had been restructured multiple times, did not set aside 25.025 trillion VND for risk provisions, and disregarded 35.526 trillion VND, not included in the CAR ratio. If calculated correctly, the negative equity would be 22.289 trillion VND, negative profit of 35.038 trillion VND, accumulated losses/shareholders’ equity and reserves -238%, CAR ratio -4.24%.

Independent audit results determined that as of September 30, 2022, SCB had negative equity of 443,769 billion VND, accumulated losses of 464,547 billion VND.

SCB is the aftermath of a successful merger but then manipulated to collapse the bank.

In 2015, when Sacombank acquired Southern Bank, in addition to expanding its network and increasing bad debts, almost all of the bank’s operational indicators declined, leading to the need for a restructuring process.

At the time of the merger, Sacombank became one of the top 5 largest banks in Vietnam, with total assets reaching 297,184 billion VND; equity of nearly 24,506 billion VND, of which charter capital was 18,853 billion VND; operating network expanded to 563 transaction points nationwide and in 2 countries Laos, Cambodia.

The bad debts from Southern Bank not only reduced the effectiveness of the bank’s credit operations but also reduced Sacombank’s profits, directly affecting Sacombank’s need to increase provisions.

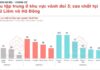

In the first year after the merger, Sacombank received bad debts/loans 7 times higher than in 2014. By 2016, this figure soared to 13,745 billion VND of bad debts, 1.3 times higher than in 2015. The bad debt ratio as a percentage of loans also increased steadily from 1.2% (2014) to 5.85% (2015) and 7% (2016). After nearly 10 years of active bad debt resolution, Sacombank has reduced the bad debt ratio to below the regulated level of 2.1% (end of 2023).

Sacombank has recovered strongly from a pre-tax profit of 156 billion VND (2016) to 9,595 billion VND (2023). Most importantly, it has completed 100% provisioning for VAMC non-recovered debts – one of the important targets of Sacombank’s restructuring project. With the completion of provisioning, Sacombank has solved one of the main factors that caused the bank’s profits to decline in recent years. This will help Sacombank improve asset quality and enhance profitability in the future.

SHB went through a similar process when it took over Habubank. The bank’s total assets increased to 116,538 billion VND, and its equity was raised to 8,868 billion VND (2012) from 4,816 billion VND (2011).

However, SHB’s pre-tax profit was not significantly affected, remaining in the range of 1,000 – 3,000 billion VND during the 2012 – 2020 period and soaring to 6,200 billion VND (2021) and 9,600 billion VND (2022).

SHB also had to deal with bad debts after the merger. The bad debt ratio at the end of 2012 was 8.8%, then increased to 9.04% just after six months. By the end of 2023, SHB’s bad debt/loan ratio had decreased to 2.8%.

It can be seen that after mergers and financial statement mergers, these weak banks expanded their scale, network, and staff. However, the issue that followed was how to handle bad debts and make banks healthier.

Due to these circumstances, when the revised Law on Credit Institutions was passed, it included provisions such as “Compulsory transfer of financial statements of commercial banks is not required”; “Commercial banks are exempted from mandatory financial statement mergers when calculating consolidated CAR”…

Therefore, whether to merge the financial statements of weak banks into the acquiring bank?

A report from SSI Securities commented that the revised Law on Credit Institutions mentions some benefits for acquiring banks such as selling and issuing shares to foreign investors without the need for financial statement mergers, relaxing some safety ratios, and refinancing with preferential interest rates. These favorable conditions can support acquiring banks in accessing larger capital to serve the restructuring of weak banks, but this process must be closely monitored to ensure proper use of capital.

Yuanta Securities also believes that the new law stipulates favorable conditions for acquiring and restructuring weak banks. Participating banks in the restructuring process include HDBank, MB, Vietcombank, and VPBank.

Associate Professor Dr. Dinh Trong Thinh – an economic expert also agreed with not merging the financial statements based on experience from previous bank mergers. If the financial statements of weak banks are merged into the parent bank, their activities will not be fully represented, including the activities of the weak banks themselves.

If they are separated, it will be clear what problems the weak banks are facing and can be easily resolved. It is easier to distinguish whether the activities of the weak banks are good or not after the restructuring process.

On the other hand, Dr. Nguyen Tri Hieu – a banking and financial expert disagreed. He believed that if the acquiring bank owns 100% of the weak bank, but does not include the losses of the subsidiary bank in the consolidated financial statements, it is a “trick”. According to legal terms, if the acquiring bank owns 100% of the weak bank, it must merge all the balance sheets of the weak bank. Now, if the law allows the financial statements not to be merged, it would contradict the accounting principles of Vietnam and the world.

If the weak bank continues to incur losses without accounting for them in the acquiring bank, it would be very inconsistent.

Associate Professor Dr. Nguyen Huu Huan – a lecturer at the University of Economics Ho Chi Minh City (UEH) evaluated that the advantage is that it can separate the operations of the two banks, but not merging the financial statements means that the parent bank only participates in the management activities of the weak bank.

It can also be understood implicitly that the large banks are investing in the small banks without violating the legal entity of the weak bank, as in previous cases.

The issue still lies in the transparency of accounting and capital investment transactions. In addition, some provisions are also intended to make acquiring and restructuring weak banks more attractive.

Law on Credit Institutions (revised): Good, but not enough.

How will the revised Law on Credit Institutions impact “the king stock”?

The revised Law on Credit Institutions has been officially passed by the National Assembly.

Cat Lam