According to the investigation conclusion, due to the lack of receipts for investment and borrowing, when Truong My Lan was arrested, Nguyen Cao Tri fabricated and signed procedures to liquidate the equity transfer contract of Van Lang Company, investment trust contract … to misappropriate the received amount of 1,000 billion VND.

Nguyen Cao Tri is known as the Chairman cum CEO of Capella Holdings Group, and is the legal representative of Van Lang University, Binh Duong University of Technology and Economics, Văn Lang Education Investment and Management Group, Saigon Dai Ninh Tourism Investment Joint Stock Company, US Talent International – UTI Co., Ltd., and so on.

Capella is the name most closely associated with Tri’s reputation. Capella Holdings itself owns 9 well-known brands in the fields of Entertainment (Air 360 Sky Bar, Chill Bar, La Vie En Rose Live Music & Bar) and Conference – Wedding Center (Riverside Palace, Claris Palace, Capella Park View, Capella Center). Among them, Chill Sky Bar (AB building, District 1, HCMC) and Air 360 Sky Lounge (Ben Thanh Tower, District 1, HCMC) are famous entertainment destinations.

Tri was also a member of the Board of Directors of IRC Investment and Development Joint Stock Company in 2022, but he was not re-elected after the annual shareholders’ meeting in 2023, which took place in late April.

The investigation conclusion noted that Tri and Lan agreed to transfer 65% of IRC’s charter capital for USD 45 million. In which, Lan paid Tri an amount of USD 21.25 million, equivalent to more than 476 billion VND, to purchase 31.22% of the charter capital owned by Tri.

Tri served on the BOD for several years before not being re-elected in 2023

IRC is an enterprise formerly known as the Rubber Cooperative Federation, established in 1976. The main business activity of IRC is rubber tree planting, including seed production, tree planting, rubber tree care, business of rubber wood products, rubber latex, rubber wood, … In addition, the company also has a business segment of residential infrastructure investment.

According to the 2022 Financial Report, Nguyen Cao Tri’s remuneration in 2022 from IRC reached 95.3 million VND, equivalent to the Chairman of the BOD of the company. At the IRC’s annual shareholders’ meeting in late April 2023, Tri was the only member not to be re-elected in the BOD list, replaced by Nguyen Cao Duc, director of Capella’s member companies.

This move took place a few days before the media reported that the Department of Justice of Lam Dong Province had requested notary public organizations in the area not to notarize contracts for buying, selling, transferring, giving … assets including land use rights, home ownership rights, and other assets attached to the land of Nguyen Cao Tri until there is a decision from the competent authority.

IRC’s charter capital is set at 175 billion VND. The capital ownership structure of IRC has not changed for many years. As of December 20, 2022, domestic shareholders still held 34.02% of the capital (individuals held 19.02% and organizations held 15% of the capital). IRC does not disclose specific major shareholders, but Capella Holdings Group is known to be one of the major shareholders of the company.

4 consecutive quarters of losses

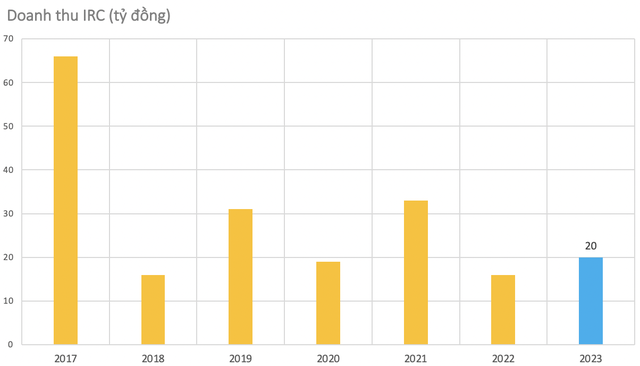

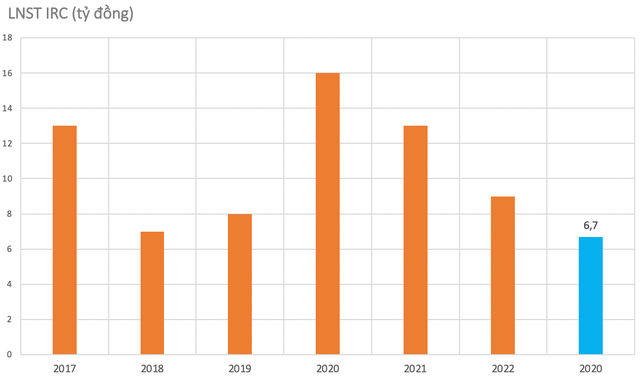

In terms of business, the company’s revenue fluctuated significantly during the period from 2017 to 2022. Similarly, net profit after tax decreased in the 3 years from 2017 to 2019, before reaching its peak in 2020 and gradually decreasing afterwards. In which, the main revenue of the company comes from the activity of exploiting and selling rubber latex, but recently the revenue has often been below cost or the gross profit margin is very low and cannot offset operating expenses.

In Q4/2023, the company recorded a sharp increase in revenue to over 9 billion VND. Deducting costs, IRC still had a net loss from business activities of over 7 billion VND. However, thanks to the generation of other income from “selling, liquidating assets” of nearly 22 billion VND, IRC returned to profit in the last quarter of the year.

For the whole year 2023, the company achieved revenue of nearly 20 billion VND, after-tax profit of 6.7 billion VND – a decrease compared to the previous year. Compared to the planned targets, IRC only achieved nearly half of the revenue target but exceeded the profit target.

As of December 30, 2023, IRC’s total assets are recorded at 196 billion VND, accounting for nearly half of the total assets being fixed-term deposits worth over 100 billion VND. Term deposits up to 12 months are divided and deposited in banks such as Eximbank, Sacombank, BIDV, MB, Vietinbank, Agribank, HDbank, Nam A, … with interest rates ranging from 7-10% per year. It is these deposits that regularly provide financial income for IRC.

The remaining assets of IRC are concentrated in fixed assets, inventories, unfinished basic construction costs, and investments in other units.

The total liabilities to be paid by IRC are over 14 billion VND, mainly short-term debts. The company has no loans and only has outstanding payments for taxes, rewards funds, and benefits.