The market saw a series of profit-taking and adjustments in today’s session, and the result was a strong rebound in the final minutes, reversing the price direction successfully. The VN-Index recovered from a more than 3.5-point decline to surpass the reference level and gain 8.57 points, closing at the highest level of the day, equivalent to +0.68%.

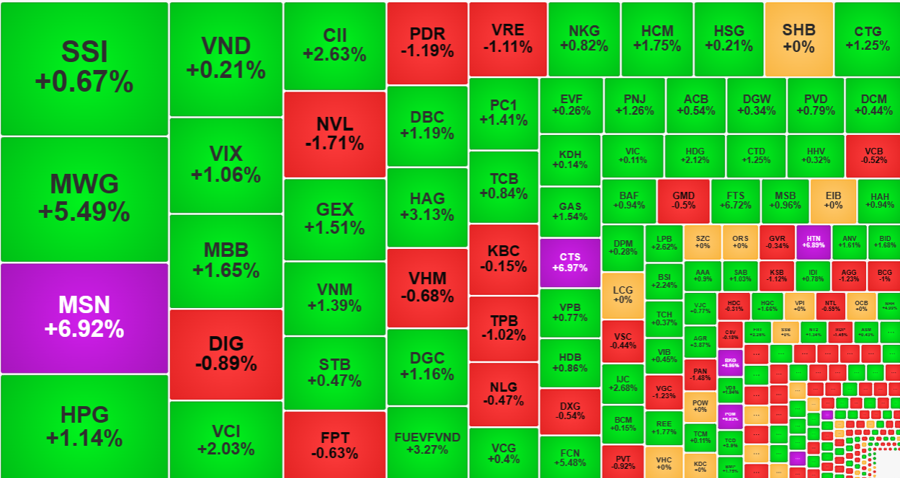

In fact, the entire increase in the index was achieved within the last 15 minutes of continuous matching and the ATC session, with an additional increase of about 3.3 points. The surge of leading stocks created a notable combined momentum, with BID up 1.68%, MWG up 5.49%, GAS up 1.54%, CTG up 1.25%, VNM up 1.39%… Even weaker pillars like VHM and VIC improved from their earlier declines. VIC even closed slightly higher, up 0.11%.

The strong performance of large-cap stocks that rose significantly had a significant impact on the indices. The VN-Index continued to decline in the first half of the session and only started to pick up momentum at 2:15 PM. From a breadth perspective, at 2:15 PM there were 177 gainers/301 losers, but by 2:30 PM it became 237 gainers/239 losers. At the close, the VN-Index recorded 258 gainers/212 losers. The change in breadth was also positive, indicating spread of price increases instead of just being driven by a few stocks.

The VN30-Index closed the session with a 0.92% increase, with 20 gainers/6 losers, completely reversing the morning session. 9 stocks in the group closed above their reference prices with gains of more than 1%, led by MSN with a limit-up price. This stock remained the strongest point gainer, contributing more than 1.7 points. However, MSN did not contribute to the index’s rally in the last 15 minutes because its price had risen earlier. The stock hit the ceiling price around 2:10 PM. MSN today set a record in terms of liquidity measured by trading value since the beginning of 2022, reaching VND 959.2 billion, and its price also reached a four-month high.

Thanks to the positive spread of price increases following the leading stock group, the overall stock market performed very well this afternoon. At the close of the morning session, HoSE had only 55 stocks up more than 1%, but it doubled to 101 stocks at the end of the session. The liquidity of this group accounted for 44.7% of the total trading value of the market, showing a very strong money flow. The leading stock in terms of liquidity was MWG with VND 1,087.5 billion, and its price increased by 5.49%. HPG, VIX, MBB, VCI, CII, GEX, VNM, DBC, HAG, DGC were other stocks with liquidity above VND 300 billion.

There were 9 stocks at the ceiling price and most of them had good liquidity. In addition to MSN, CTS had VND 159.6 billion, HTN had VND 65.9 billion, BKG had VND 37.8 billion, POM had VND 35.4 billion, NBB had VND 14.5 billion.

Although the Midcap index increased by only 0.73% and Smallcap increased by 0.53%, weaker than the VN30’s 0.92% gain, many stocks that rose by 2-5% were not blue-chip stocks. Only 9 out of 30 VN30 stocks increased by more than 1%. Many stocks performed very well and had above-average liquidity, such as FTS, NHH, TCD, AGR, EVG, HCD, CNG, IJC, FRT, BSI…

The impressive turnaround in the final minutes also came with fairly good liquidity: In the afternoon alone, HoSE saw a trading value of VND 12,090 billion, an increase of 20% compared to the morning session. The VN30 basket’s trading volume increased nearly 44% with a large amount of money pouring into MSN, MWG, HPG, MBB, SSI, with transactions totaling from VND 400 to 600 billion. This could be a signal of slower money flow or late return of retail investors. However, due to the relatively slow trading during the morning session, the overall trading volume of the two exchanges still decreased by 15.4% compared to the previous session, reaching VND 23,710 billion.

The final breakthrough pushed the VN-Index to 1,269.98 points, breaking out of the stagnant state of the previous 3 sessions. The continued upward trend of the index and the ability to maintain a very high trading volume show that investors still have high expectations.