Out of 61 electricity companies that released their Q4/2023 financial statements, according to statistics from VietstockFinance, there were 24 companies that reported an increase in profit (1 turned losses into profits), 25 companies reported a decrease in profit, and 2 companies reported losses. However, when looking at the cumulative results for the whole year, most companies in the industry recorded a significant decrease in profit compared to the previous year.

Thermal Power Sector: Declining

|

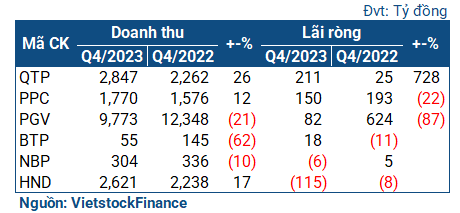

Q4 results of thermal power companies

|

In Q4, the overall results of the thermal power group were declining, although there was still some relative differentiation with some companies reporting significant increases in profit. Quang Ninh Thermal Power (QTP) was the company that saw the strongest growth in profit in this group, with a net profit of 211 billion VND (more than 8 times higher than the same period last year), thanks to a sharp increase in electricity production for commercial purposes during the period.

| Business performance of QTP since Q1/2020 |

On the positive side, Bac Lieu Thermal Power (BTP) recorded a net profit of 18 billion VND in Q4 (compared to a loss of 11 billion VND in the same period last year), despite a 60% decrease in revenue due to a significant reduction in mobilized capital compared to the same period last year.

In fact, BTP also had a gross loss of nearly 2.2 billion VND (compared to a loss of just over 33 million VND in the same period last year). However, the dividend payment (over 28 billion VND) and the reduction of exchange rate differences helped the company achieve a profit in Q4/2023.

The remaining companies in the group showed less positive results. Pha Lai Thermal Power (PPC) reported a 22% decrease in profit, reaching 150 billion VND, mainly due to the recognition of a large provision for repairs by 174 billion VND and an increase in other expenses by 134 billion VND. In addition, labor costs also increased due to higher approved wage funds than planned.

| Business results for PPC during the period |

EVNGenco3 (PGV) fell even further, with a 87% decrease in profit compared to the same period last year, reaching 82 billion VND. The company stated that the reason for the decrease in profit was due to the low utilization of thermal power sources in order to prioritize renewable and wind power sources from transitional projects. In addition, the contracted electricity output (Qc) of Phu My Thermal Power Plant and Vinh Tan 2 Power Plant in December 2023 was significantly lower than planned, leading to a sharp decrease in electricity sales in Q4 (a decrease of 1.12 billion kWh compared to the same period last year).

Ninh Binh Thermal Power (NBP) and Hai Phong Thermal Power (HND) reported losses. In particular, HND reported a “deep” loss of 115 billion VND (compared to a loss of 8 billion VND in the same period last year). The main reasons for the losses were the increase in production costs and the completion of the major overhaul of Unit 1, which was completed and put into operation in December 2023, resulting in the recognition of completion costs in Q4/2023.

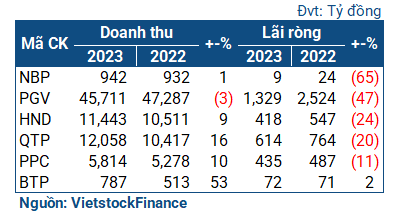

The unfavorable results in Q4 also darkened the overall picture for the cumulative performance of the thermal power group. With the exception of BTP which saw a slight increase, other companies recorded a decrease in profit. The biggest decrease was seen in NBP (65%), reaching 9 billion VND. PGV fell nearly half of its profit, reaching over 1.3 billion VND.

|

Cumulative results for the whole year 2023 of the thermal power group

|

Hydropower Sector: Strong differentiation

While the colors of the thermal power group are quite clear, the Q4 picture of the hydropower group shows differentiation. Some names have seen strong profit growth, while others have experienced significant declines.

|

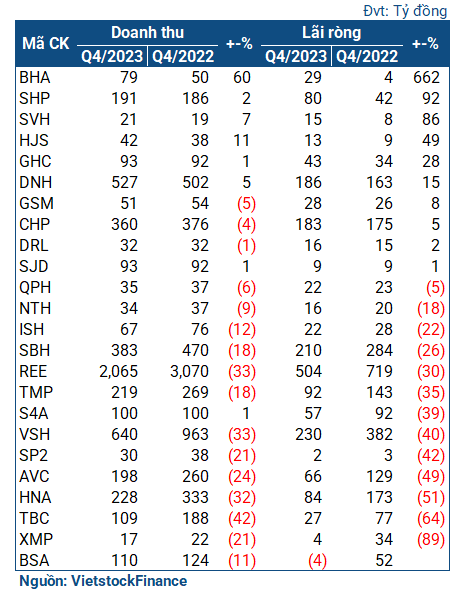

Q4/2023 results of the hydropower group

|

Bac Ha Hydropower (BHA) is the name with the strongest growth in this group, reaching a net profit of 29 billion VND, nearly 8 times higher than the same period last year. The company benefited from increased water levels in the reservoir, resulting in increased electricity production and a significant increase in revenue compared to the same period last year.

Similarly, thanks to favorable water inflows to the reservoir, Southern Hydropower (SHP) saw a more than 90% increase in profit in Q4, reaching 80 billion VND. Song Vang Hydropower (SVH) and Da Nhim Hydropower (DNH) also had similar results, with an 86% and 15% increase in net profit compared to the same period last year, respectively.

However, not all companies have favorable hydrological conditions. Decreased water levels caused Xuan Minh Hydropower (XMP) to experience an 89% decline in profit in Q4, reaching only about 3.7 billion VND. Similarly, Thac Ba Hydropower (TBC) reported a 64% decrease in profit, reaching about 27 billion VND. Vinh Son – Song Hinh (VSH) also fell by 40%, reaching a net profit of 230 billion VND in Q4. Thac Mo Hydropower (TMP) decreased by 35%, reaching 92 billion VND.

| VSH is among the companies that fell in Q4 |

With REE (Refrigeration Electrical Engineering Corporation), the downturn of its subsidiaries (VHS, TBC, TMP, etc.) also contributed to the decline in the company’s profit. REE ended Q4 with a net profit of only 504 billion VND, 30% lower than the same period last year.

Unlike the differentiation in Q4, the business picture for the whole year of the hydropower group is gloomy. All companies in the group recorded a decrease in profit. The biggest decrease was seen in XMP, reaching only 5 billion VND, a decrease of 76% compared to the previous year. Other notable names include TBC (a 61% decrease), HNA (Hua Na Hydropower – a 59% decrease), and VSH (a 21% decrease).

|

Cumulative results for the whole year 2023 of the hydropower group

|

Renewable Energy: Recovery?

The Q4 picture of the renewable energy group also showed differentiation. Some names shone, while others experienced significant declines.

GEG (Gia Lai Electricity) had a brighter Q4 compared to the gloomy outlook for the whole year as it recorded a net profit of 51 billion VND, 2.7 times higher than the same period last year. The operation of the Tan Phu Dong 1 Wind Power Plant contributed to the significant increase in GEG‘s revenue. However, the main reason for the increase in profit was due to a significant increase in financial revenue of 63 billion VND, 2.6 times higher than the same period last year, thanks to income from share transfer.

| GEG had a brighter Q4 compared to the gloomy outlook for the whole year |

The two consulting companies for electricity construction, TV3 and TV4, also reported growth in profit, reaching 28 billion VND and 15 billion VND in net profit in Q4, respectively, corresponding to an increase of 89% and 47% compared to the same period last year.

However, the remaining names are still going through a tough period. Haduco Group (HDG) reported a 16% increase in profit, reaching 289 billion VND, but the energy sector – which has the majority of the company’s revenue – decreased. In Q4, the gross profit of this segment reached 486 billion VND, 8% lower than the same period last year.

TV2 and TV1 even experienced significant declines, reaching 62% and 82% decreases in net profit, respectively, with net profits of 13 billion and 21 billion VND.

Looking at the cumulative results for the whole year, most of the group saw a decrease in profit, except for TV2 which remained stable. The biggest decrease was seen in GEG, losing more than half of its profit compared to the previous year, reaching just over 137 billion VND.

Expectations for 2024: Positive outlook for thermal power, challenging start for hydropower

MBS forecasts that in 2024, hydropower and gas-fired electricity production will recover by 8% and 11%, respectively, compared to the low base of the previous year. Renewable energy production will see a slight increase of 6%, supported by additional capacity from transitional projects, while coal-fired electricity production will continue to grow by 9% due to high demand in the northern region.

MBS believes that construction activities for transmission projects are necessary, given the current situation where the power system has not been able to meet the high proportion of renewable energy capacity, along with the urgent need to enhance power supply to the northern region. On the other hand, the construction of power sources will be a driving force for economic growth, especially with the government’s focus on developing renewable energy to move towards Net Zero by 2050.

For hydropower, the International Research Institute for Climate and Society (IRI) forecasts that the El Nino phase will peak in December 2023 and January 2024, and then continue until at least Q2/2024, bringing extreme weather conditions, heatwaves, and droughts. In this context, hydropower production is expected to remain low, providing room for mobilizing other power sources. However, improvement is expected in the second half of 2024, when the weather transitions to neutral, supporting a recovery in hydropower production by 8% from the low base in 2023.

With the El Nino phase extending to Q2, there are positive prospects for mobilizing thermal power production, which is expected to grow by 9% compared to the same period, especially in the northern region in the first six months of the year. The gas-fired segment is also forecasted to have a positive outlook, but there is a risk of gas shortage during peak periods, which may impact the effectiveness of mobilization and result in high gas prices, reducing the competitiveness of gas-fired electricity during surplus supply periods.