The “Shop Like a Billionaire” advertising campaign by e-commerce company Temu is taking place everywhere. All products are shipped from China under the guise of the parent company PDD Holdings – the ambitious conglomerate that is expanding its retail operations at the fastest pace in history.

With Temu, PDD wants to change the way people shop worldwide: a faster, sleeker, cheaper “Amazon 2.0” version spreading from China to 49 countries in less than 2 years of operation. The driving force largely comes from the advertising policy, where algorithms and AI predict the ideas and desires of shoppers. Products are shipped for free directly from the factory gates in China, eliminating intermediaries and ensuring highly competitive prices.

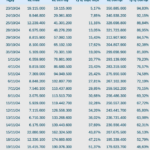

PDD has recorded over 870 million active users domestic market. Over 13 million merchants generate 1/3 of the total parcel volume in the whole country. Billions of packages are sent each year.

Just 9 years into operation, PDD is now competing with the world’s largest e-commerce company Alibaba in terms of retail scale and market capitalization. This position has raised questions rather than answers.

For instance, why does PDD look like small companies in the same industry when it comes to the level of employees and research expenditure? Why haven’t competitors described the impact of PDD’s rise? How can a $200 billion company own assets valued below $150 million? Why do American investors trust PDD so much?

In response, PDD spokesperson encouraged Financial Times to “look into financial reports and earnings calls to get a comprehensive view”.

Few companies promise as much to investors as PDD does. The conglomerate operates like the third-party marketplaces of eBay and Amazon, connecting buyers with sellers to profit from every transaction and advertising fees on the platform.

In the latest quarter, revenue nearly doubled compared to the previous year, reaching $9.4 billion. A cash flow of $2.5 billion was recorded, even after PDD poured a large sum into expanding Temu.

It is known that PDD’s logistics, servers, and customer service call centers are mostly outsourced, transient and not counted. Murkiness persists inside the business. Employees use aliases and know very little about other teams. This is characteristic of Colin Huang, a former Google engineer who founded Pinduoduo in 2015 and hid his ownership rights for a long period of time.

Initially, PDD attracted users with commercial games, mimicking addictive titles like Farmville and Candy Crush. Combined with rewards, discounts, this approach was expected to lure consumers back to the app and shop.

By 2018, the app had attracted 300 million customers and, within just 3 years of operation, successfully listed on the Nasdaq stock exchange, raising $1.7 billion.

In 2020 and 2021, PDD sold goods worth $2 billion, but revealed little information. Founder Huang, one of China’s richest people, unexpectedly resigned in 2021 with a statement of wanting to pursue food science and life sciences research. The vacant position was quickly filled by co-CEOs Chen and Jiazhen Zhao.

Perhaps the biggest mystery about PDD is just how big the conglomerate actually is. Analysts estimate last year’s total GMV to be between $500 billion to $700 billion. In a 2022 earnings call, Chen revealed that user interaction contributed to revenue growth.

Temu currently tops the chart of the most downloaded free apps in the US and several European countries, including the UK. It is also the most downloaded free shopping app in Japan and South Korea within a few months since its launch in July.

“We have reinvented the online shopping experience. The approach has been embraced by global consumers, while cementing our position and reputation,” said a PDD representative.

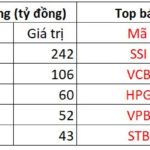

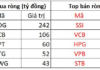

PDD’s rise in a densely competitive e-commerce market has sounded the alarm for many investors as well as long-standing domestic rivals, including Alibaba and JD.com. Jack Ma admitted the conglomerate needed to transform, while JD founder Richard Liu stressed, “If JD doesn’t advance, we’ll have no way forward.”

With Pinduoduo, customers come above all else. Buyers can instantly get refunds without returning the products if they are unsatisfied with the quality – a strategy that has helped the company attract a large number of loyal fans. It also differentiates PDD’s model from Alibaba – a conglomerate that has put a lot of burdens on buyers in disputes with sellers.

However, according to Jacob Cooke, co-founder and CEO of WPIC Marketing and Technologies, some consumers are still reluctant to buy expensive products on Pinduoduo because “counterfeit goods are still rampant on the platform”.

“Some brands have used Pinduoduo as a means to reach new customers and clear inventory, like a digital shopping center. However, the numbers remain low,” Cooke said.

In response, PDD affirmed that the company has invested heavily in technology and anti-counterfeit processes to protect consumers. “We quickly remove and investigate any infringing item upon receiving information,” said a Pinduoduo representative.

Source: FT, Bloomberg