The General Department of Taxation has requested tax departments in provinces and centrally-run cities to continue to review all businesses, households, individuals engaged in gold and gemstone processing within their management areas. The tax agency emphasizes the business activities of buying and selling gold materials and gold pieces.

Accordingly, the tax department proactively develops plans, reports to provincial People’s Committees, proposes measures, and coordinates with departments and agencies to strengthen the management of businesses, households, and individuals engaged in gold, silver, and gemstone trading.

The tax agency closely coordinates with relevant functional agencies such as the police, market management, banks, customs… to strictly manage the types of gold, silver, and gemstone businesses, minimizing risks in tax management.

The General Department of Taxation requests to review businesses, households engaged in gold trading, and prevent incomplete tax declaration. (Illustrative image).

“Through inspection and examination, if violations of tax laws and signs of criminal offenses by organizations and individuals engaged in gold, silver, and gemstone trading are detected, the cases will be transferred to the police. From there, functional agencies will investigate and handle in accordance with the provisions of the law,” the General Department of Taxation requests.

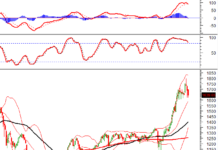

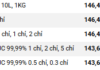

The gold market has been continuously fluctuating recently. On March 7, the domestic gold price reached its highest level in history, with SJC gold at 81.8 million VND/tael, plain round rings at nearly 69 million VND/tael. The price of SJC gold pieces is 17 million VND/tael higher than the world gold price, and gold rings are 4 million VND/tael higher.