According to data from the General Statistics Office, in 2023, the total import-export turnover is estimated to reach $683 billion, a decrease of 6.6% compared to the previous year.

|

Vietnam’s Import-Export in 2023

Source: General Statistics Office

|

The overall picture is still gray due to weaker external demand, with most of it coming from Vietnam’s key export markets such as the US and Europe, which decreased by 11.6% and 5.9% respectively compared to the previous year. In addition, the impact also came from the decrease in import value from China by 5.9%, South Korea by 15.5%, and ASEAN by 13.3%.

At the Conference on the Summary of 2023 and the Implementation Plan for 2024 of the Maritime Administration, Hoang Hong Giang, the Deputy Director of the Maritime Administration, said that in 2023, the total volume of goods through seaports is estimated to be 756.8 million tons, an increase of 5% compared to 2022. Container volume is expected to reach 24.7 million TEUs, the same as the previous year.

Looking back at the container throughput of Vietnam’s main ports, the volume in the first quarter decreased significantly, especially in January, which decreased by 25% compared to the same period. The situation improved in the second quarter with a decrease of 8-11% and started to show positive growth since August, although the growth rate was still slow, around 3-7%.

According to statistics from VietstockFinance, the total revenue of 25 port and logistics enterprises listed on the stock exchanges (HOSE, HNX, and UPCoM) in 2023 reached over VND 48 trillion, a decrease of 6% compared to the previous year. The net profit was over VND 6 trillion, an increase of 2%. Compared to the same period, 12 companies saw an increase in profits, 10 companies saw a decrease in profits, and 3 companies continued to incur losses.

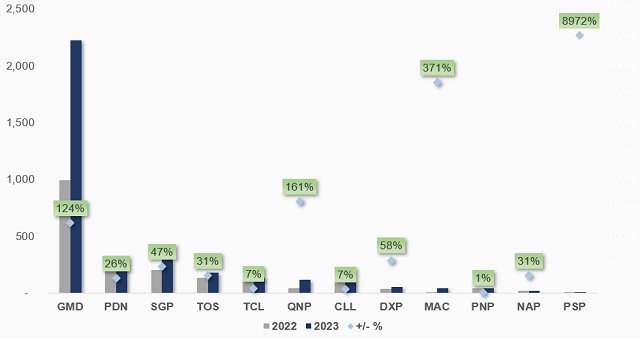

The most profitable growth company:

With a nearly 9,000% increase compared to the previous year, reaching VND 8.7 billion, PSP Port Service became the company with the highest profit growth in 2023. In the fourth quarter of 2023, PSP made a profit of VND 4.5 billion, accounting for more than half of the annual profit, while it incurred a loss of VND 0.5 billion in the same period last year. The revenue from container handling activities and the improved gross profit margin were the key factors for this positive outcome.

In addition to PSP, there were 3 companies that saw an increase in net profit of over 100%: MAC, QNP, and GMD. Among them, Quy Nhon Port (HOSE: QNP) reported growth results in 2023 and became listed on HOSE on January 18, 2024.

Despite a 12% decrease in revenue to nearly VND 939 billion, QNP achieved a profit of over VND 112 billion, an increase of 154%, thanks to the improved gross profit margin and the decrease in SG&A expenses as a result of no short-term provision expenses like in 2022.

Gemadept (HOSE: GMD) ended the year with a profit of nearly VND 2.222 trillion, the highest in its history since going public, thanks to the complete transfer of its 84.66% stake in Nam Hai Dinh Vu Port, which recognized a long-term financial investment transfer profit of over VND 1.84 trillion.

A similar scenario was used by GMD to bring in exceptional profits in 2018, by selling a 51% stake in CJ Gemadept Logistics Holdings Limited Liability Company, selling a 49% stake in CJ Gemadept Shipping Holdings Limited Liability Company, and divesting from Hoa Sen Gemadept International Port Joint Stock Company.

Other companies such as DXP, SGP, NAP, TOS, and PDN also saw double-digit profit growth rates of 58%, 47%, 31%, 31%, and 26% respectively.

|

Companies with Profit Growth in 2023

Unit: billion VND

Source: VietstockFinance

|

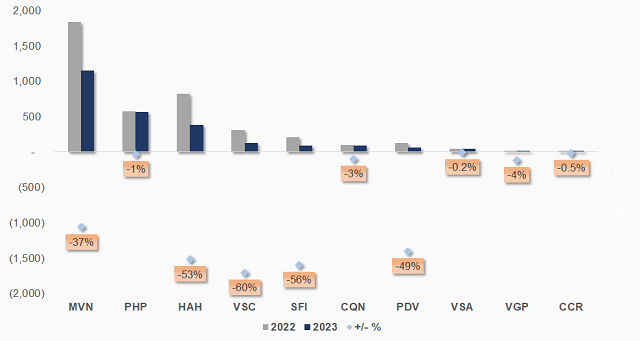

Major companies with decreased profits:

Many companies experienced a decrease in profits in 2023, including major players such as VSC, HAH, and MVN.

Topping the list of profit declines is Container Vietnam (Viconship, HOSE: VSC), with a 60% decrease, reaching VND 126 billion, despite a 9% increase in revenue to VND 2,181 billion, mainly due to a significant increase in interest expenses from VND 1 billion to VND 170 billion. This is also the lowest profit in 15 years for VSC since 2009.

Starting from the fourth quarter of 2022, VSC began to significantly increase its borrowings to fund investment activities. By the end of 2023, VSC’s short-term debt was VND 119 billion and long-term debt was VND 1,446 billion. These funds were used to acquire Nam Hai Dinh Vu Port from Gemadept and invest in the Hyatt Place Hai Phong hotel project.

For Hai An Transport and Stevedoring Corporation (HOSE: HAH), both revenue and profit decreased by 18% and 53% respectively, to nearly VND 2,613 billion and VND 385 billion. In the fourth quarter, the profit decreased by 63% to VND 63 billion, the lowest in 12 quarters and marked the 5th consecutive quarter of negative growth. HAH explained that the results were due to decreased ocean freight rates and charter rates, especially for bulk cargo. Additionally, HAH incurred losses from its newly-established joint venture company Zim Hai An, which only started operations in March 2023.

As for Vietnam National Shipping Lines (Vinalines, UPCoM: MVN), it achieved revenue of VND 12,814 billion, a decrease of 11%, and profit of VND 1,152 billion, a decrease of 37%. The fourth quarter of MVN recorded a high net profit of 12 times the same period (due to reduced financial expenses, increased other income, and restructuring of bank debts), but it did not contribute to the overall growth for the year.

In the previous period, MVN had 4 consecutive quarters of profit decline due to difficulties in its shipping, port operation, and maritime services.

One member of PV Trans, namely Vinalines Eastern Shipping Lines (PVT Logistics, UPCoM: PDV), saw its profit decrease by nearly half to nearly VND 64 billion, due to a decrease in vessel freight rates, especially for breakbulk cargo. In addition, many vessels had to suspend operations for 25-30 days for routine repairs, resulting in no revenue but still incurring costs.

|

Companies with Profit Decline in 2023

(Unit: billion VND)

Source: VietstockFinance

|

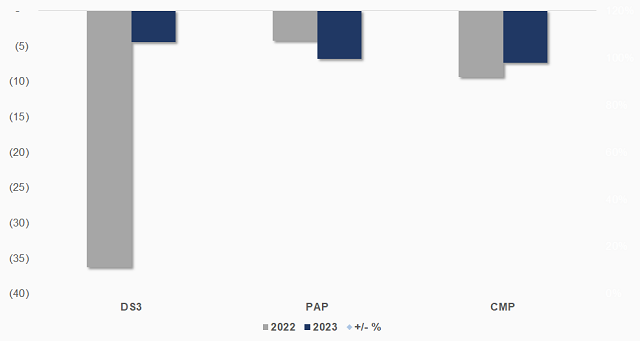

3 companies still incurring losses:

In the year 2023, 3 companies continued to incur losses, namely DS3, PAP, and CMP, with PAP even having a higher loss than the previous year.

Dau Khi Dau Tu Khai Thac Cang Phuoc An (UPCoM: PAP) continued to report a loss of nearly VND 7 billion, heavier than the VND 6 billion loss in the previous year. PAP stated that it is still in the investment phase and has not yet started operations, therefore, there is no revenue from business activities. On the other hand, the company still has to bear business management expenses, consulting and project management costs, leading to the aforementioned loss. By the end of 2023, PAP’s accumulated loss was nearly VND 14 billion.

Chân May Port (UPCoM: CMP) continued to incur a loss of over VND 7 billion due to higher financial and business management expenses.

DS3 River and Harbor Management (HNX: DS3) saw the largest decrease in losses, thanks to a profit of over VND 14 billion in the fourth quarter, after implementing human resource restructuring, expanding new business areas, restructuring investments, and long-term business cooperation.

In December 2023, DS3 changed its model to not have subsidiaries after transferring 90% of the shares of An Phu Road Joint Venture Company and divesting all capital in Ha Long Riverway Joint Stock Company. Despite a net loss of VND 4 billion in 2023 due to the heavy impact of the first three quarters, it was still better than the VND 36 billion loss in the previous year.

|

Companies Still Incurring Losses in 2023

Unit: billion VND

Source: VietstockFinance

|

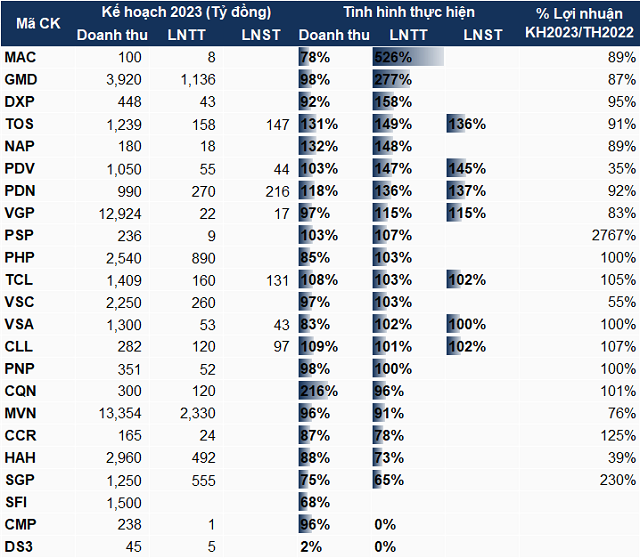

Most companies exceed the annual plan:

According to statistics, 15 companies achieved or exceeded their profit targets in 2023. MAC was at the top with 526% of the plan, thanks to a 371% profit growth. GMD, DXP, TOS, NAP, PDV, and others followed.

Out of the 15 companies that achieved their targets, 9 companies surpassed their modest targets but were still lower than the previous year’s results.

On the contrary, CQN, MVN, CCR, HAH, SGP, CMP, DS3, and SFI were the companies that could not reach their targets.

|

Performance in Meeting the 2023 Plan

Source: VietstockFinance

|

Prospects for 2024:

In the Prospect Report for the Seaport and Logistics Industry in 2024, SSI Research predicts that the seaport industry will recover its throughput due to improved import-export demand (especially from inventory replenishment in the US/Europe), while supply remains stable until 2025.

SSI forecasts that the seaport industry’s profit will increase by 15-20% compared to the same period, thanks to improved throughput and average freight rates at some ports. Deep-water port areas (such as Lach Huyen and Cai Mep) may experience higher growth than the low base in the first half of 2023, and transshipment ports may also increase their volume.

The container transport sector may face less pressure on profits (with a decrease of about 10-15%), as geopolitical tensions reduce pressure on freight rate reductions in 2024. The expected new vessel supply will account for 10.4% of the total vessel supply in 2024, the highest since 2010.

Oil tanker shipping companies will continue to benefit from high freight rates, but the profit growth rate will decrease to around 10-15%. Escalation or prolongation of the Red Sea tension is considered a supportive factor for cargo transportation in a situation where capital supply has tightened for oil tankers due to the Russia-Ukraine conflict.

The logistics industry may recover its throughput due to increased production activities, which will reduce pressure on average freight rates. The decrease in fuel costs is also a positive factor, according to SSI Research.