In the latest announcement, Vietnam Rubber Industry Group – Joint Stock Company (code GVR) stated that it will hold its extraordinary shareholders’ meeting for 2024 on March 29. The company has also released the meeting documents.

Specifically, GVR will present to the shareholders various topics such as production and business development plan, profit distribution plan for 2024, restructuring plan for the Group until the end of 2025, production and business development plan until the end of 2025, development strategy until 2030 and vision until 2035…

“Flat” plan for 2024, spending VND 1,200 billion on dividends

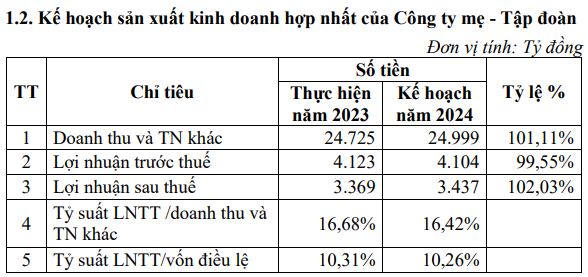

In 2024, GVR plans to achieve a consolidated revenue of around VND 25,000 billion, a slight increase of 1% compared to 2023. The target pre-tax profit is VND 4,101 billion, equivalent to the previous year. The after-tax profit is expected to increase by 2% to VND 3,437 billion.

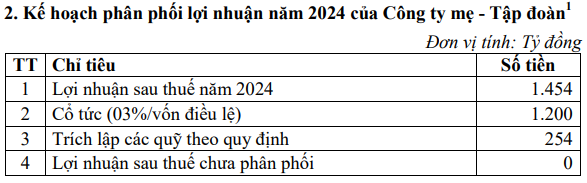

For the parent company’s plan, the target for revenue and other income is VND 3,988 billion, and after-tax profit is VND 1,454 billion, an increase of about 1% compared to the previous year.

Notably, GVR plans to allocate over VND 1,100 billion for basic construction investment in 2024, 77 times higher than the figure in 2023 (VND 13 billion), and also set aside an additional VND 145 billion for long-term financial investment.

Regarding the distribution of profits for the parent company, GVR plans to pay a 3% dividend, equivalent to about VND 1,200 billion, and use the remaining VND 254 billion for reserves as regulated.

GVR plans for a “flat” performance in the context of the company experiencing difficulties in 2023 due to a decrease in rubber exports. The company even had to adjust down its consolidated business plan for 2023 with only over 1 week left until the end of the financial year with the reason “implementing based on the principle of completing the business plan of the parent company”.

During the whole year of 2023, GVR’s total revenue reached VND 22,080 billion, and after-tax profit was VND 3,370 billion, a decrease of 13% and 30%, respectively, compared to 2022. The after-tax profit for shareholders of the parent company was VND 2,585 billion, a decrease of 33%.

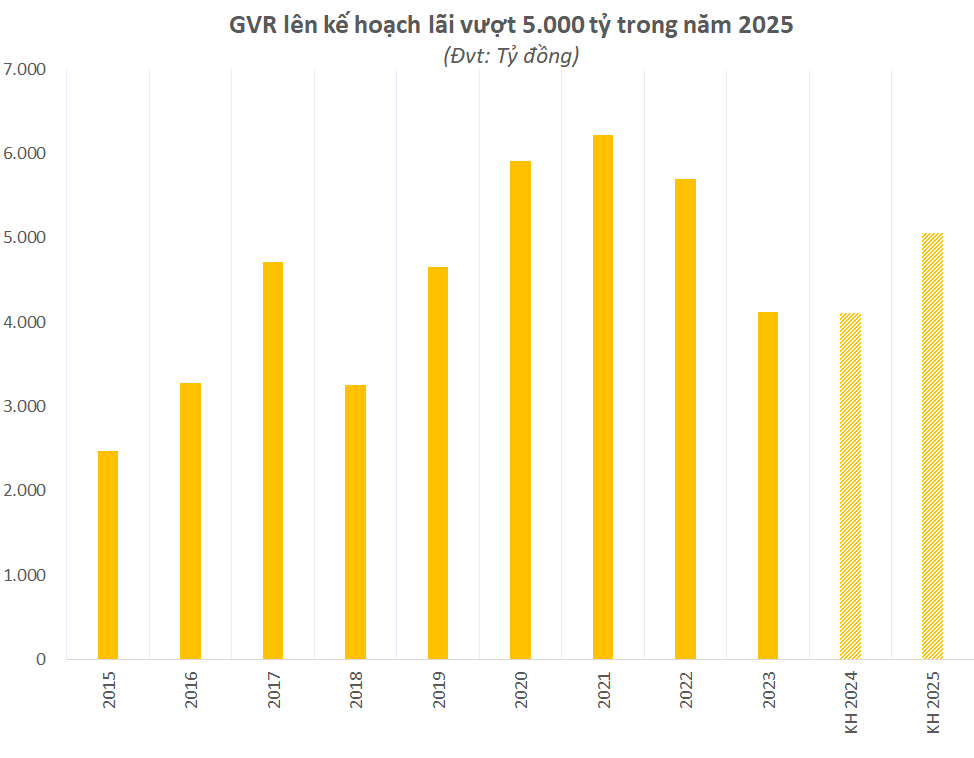

Target profit exceeds VND 5,000 billion in 2025

Vietnam Rubber Industry Group was established in 2006 and operates in 4 main sectors: (1) Production and business of rubber latex, (2) Production and business of rubber products such as tires, (3) Wood processing activities, (4) Industrial park development. GVR is managing nearly 400 thousand hectares of rubber plantations both domestically and internationally. Recently, GVR has been in the process of restructuring and focusing on developing the industrial park business thanks to the abundant land resources held by the Group.

According to the restructuring plan until 2025, GVR aims to achieve a total consolidated revenue of VND 28,575 billion for the entire group in 2025, with an average annual growth of about 5%. The target consolidated pre-tax profit is VND 5,051 billion.

During the period from 2021 to 2025, the accumulated total consolidated revenue is estimated to reach VND 135,000 billion, and the cumulative consolidated pre-tax profit is estimated to reach VND 25,075 billion.

GVR plans to cultivate, care, exploit, and trade products from rubber trees with an area of 360-370 thousand hectares (245-255 thousand hectares in Vietnam and 115 thousand hectares abroad), exploit about 400 thousand tons of rubber latex, consume about 500 thousand tons (including processed rubber and purchased rubber), and exploit about 1.5 million m3 of rubber wood.

GVR will also invest in, expand and upgrade the capacity of wood processing factories with a production capacity of about 1.5 million m3 of various types. Continuously develop the tire brand; effectively exploit industrial parks, converted rubber land; actively invest in expanding and establishing new industrial parks and clusters. Aim to develop about 10 thousand hectares of various crops with sufficient conditions to apply high-tech solutions and be efficient.

In the period from 2026 to 2030, GVR is expected to increase the proportion of revenue from its core operations to 95% by 2030; the proportion of profit structure from core operations accounts for about 70-80%. The average annual growth rate is about 5% to 6%.

In the vision towards 2035, GVR will maintain its leading position in Vietnam in the rubber planting, processing, and trading industry; artificial wood processing; high-tech industrial products; investment and business in industrial parks; high-tech agriculture; owning large forest planting areas; partly converting areas to other economically valuable crops. Actively and comprehensively participate in carbon credit trading as an investor. Build a rubber industry ecosystem. Develop VRG-branded products in a synchronized and internationally recognized manner.

Transfer 8 member companies including 4 listed companies on the stock exchange

In terms of the restructuring plan, GVR plans to transfer capital in a subsidiary where it holds a controlling stake, which is Vietnam Rubber Trading Services and Tourism Joint Stock Company; together with 7 non-controlling stake companies, including 4 listed companies on the stock exchange: Vietnam Urban Development and Industrial Zones Investment Joint Stock Company (code VRG), Vung Tau International Travel Joint Stock Company (code VIR), EVN International Joint Stock Company (code EIC), and Sai Gon VRG Investment Corporation (code SIP); alongside 3 other companies named: Dien Viet Lao Joint Stock Company, Vietnam Construction and Irrigation Joint Stock Company 4, and An Loc – Hoa Lu National Highway BOT Joint Stock Company.

On the other hand, GVR will consider investing additional capital to hold a controlling stake in Ben Thanh Rubber Joint Stock Company (code BRC).

In addition, GVR will also arrange 5 hydroelectric companies in accordance with the directives, decisions, and rulings of the competent authorities and dissolve the Visorutex Joint Venture Production Unit when the conditions prescribed by law are met. Member companies in Laos are also part of the plan, with the merger of VRG Oudomxay Co., Ltd. into Quasa Geruco Joint Stock Company and Quavan Rubber Co., Ltd. into Vietnam Laos Rubber Joint Stock Company.

In the stock market, at the end of the session on March 11, GVR’s stock price reached VND 29,550 per share. This is also the 2-year peak price for this stock. GVR’s market capitalization currently stands at around VND 118,000 billion.