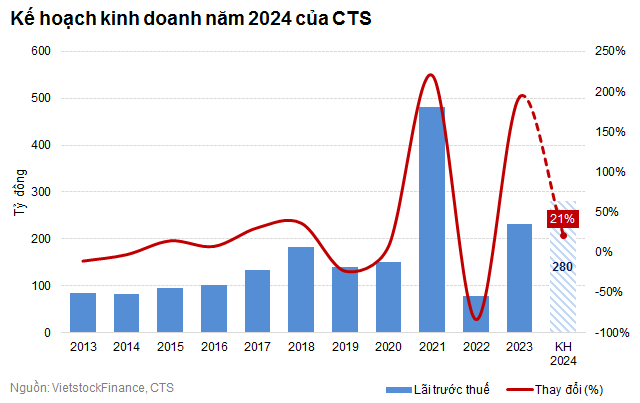

Accordingly, CTS aims to achieve a pre-tax profit of over 280 billion VND in 2024, a 21% increase compared to the previous year; and a dividend ratio of 10%.

The Board of Directors also proposed the election of 5 members for the Board of Directors, including at least 1 independent member; and 3 Auditors for the new term from April 10, 2024, to April 9, 2029.

Looking back at the financial results of 2023, CTS recorded operating revenue of 1,145 billion VND, a 31% increase compared to the previous year. The pre-tax profit reached 231 billion VND, nearly tripled; and the after-tax profit was close to 188 billion VND, more than 2.5 times higher than the previous year.

In the fourth quarter of 2023, the company’s after-tax profit was close to 33 billion VND, compared to a loss of over 3 billion VND in the same period.

Profit after tax per quarter of CTS during the 2022-2023 period:

According to the explanation, the recovery of the VN-Index in the fourth quarter had a positive impact on the company’s business results. CTS has also actively developed its margin lending and source trading activities. As a result, the revenue from these activities increased significantly. In addition, the company has restructured its securities portfolio and realized investment profits, leading to a strong increase in revenue from securities investment.

Kha Nguyễn