According to the investigation conclusion, Ms. Truong My Lan is accused of embezzling more than 304.096 trillion dong. In which, Ms. Truong My Lan has gradually taken over, leading to holding a stake of over 91.54% of SCB’s charter capital. To withdraw money, Ms. Lan used the Van Thinh Phat ecosystem with thousands of satellite companies and legal entities “borrowing the name” to create fake profiles for loans, withdrawing over 1.06 trillion dong from SCB.

The “phantom companies” were divided into groups, including (i) the financial group including SCB, Tan Viet Securities (TVSI), Viet Vinh Phu Company; (ii) the group of companies with business activities and large charter capital, holding controlling stakes in member companies; (iii) the group of foreign companies as fronts and the rest are companies used to create loan profiles.

SCB plays a particularly important role as a capital provider for the Van Thinh Phat ecosystem. According to the investigation conclusion, SCB has escaped from several inspections and has not been subject to special control, when the bad debts of SCB were “kept off the books”, or sought to shorten the inspection time, specifically handling debt to prevent loans from being classified as bad debts.

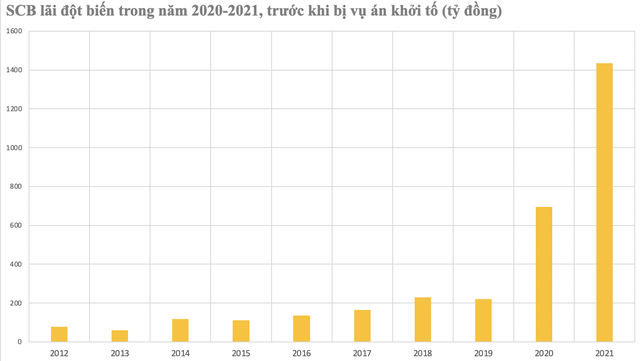

The financial report of SCB shows regular profits of hundreds of billion dong each year. By 2020, SCB’s profit unexpectedly tripled to 696 billion dong, then reached its peak in 2021 with over 1,400 billion dong. In the first half of 2022, before the case was prosecuted, SCB still made a profit of 718 billion dong.

As of June 30, 2022, SCB’s total assets reached 761,178 billion dong, and debts to be paid amounted to 738,054 billion dong. Within the total debts to be paid, customer deposits reached 594,630 billion dong (mostly individual customer deposits), an increase of 16% compared to the beginning of the year.

It is worth noting that SCB’s financial reports over the past decade have been audited by major audit companies such as KPMG, Ernst & Young Vietnam (EY), and Deloitte.

The fiscal year 2012 audit report and the half-yearly review report of 2013 (the first accounting period in which the bank made a review report according to regulations) was audited by Ernst & Young Vietnam and raised some issues, including mentioning the bank’s liquidity.

In particular, the audit raised concerns about overdue receivables but were assessed by the bank as capable of recovery, so no provision was set aside. In addition, there were also provisions for interest on loans to customers with a one-year term that had reached the end of the contract, yet the bank assessed the recovery capacity and trusted that the interest would be fully paid.

The 2021 financial report (the year SCB recorded unexpected profits) highlighted issues, emphasizing that readers should pay attention to the supplementary notes regarding the classification of debts, provisions, and interest on pre-collected income related to the bank restructuring project associated with the handling of bad debts during the 2019-2020 period.

However, overall most of the quarterly reports are “no problems found”, “honest reflection”, and in line with accounting standards….

Up to now, after the Ministry of Public Security’s Investigative Agency prosecuted the case of fraud and misappropriation of assets at the Van Thinh Phat Group, the investigative agency has verified and assessed SCB’s financial situation.

According to the investigation report, the financial situation of SCB as of June 30, 2017, had a bad debt ratio of up to 20.92% compared to SCB’s reported figure of only 0.61%; CAR – capital adequacy ratio of 6.5% compared to SCB’s reported figure of 10.06%; the proportion of real estate loans/total loans was 62.95% compared to SCB’s reported figure of 55% (the State Bank of Vietnam allows no more than 55%)…

The review report and evaluation for SCB’s results showed negative owners’ equity of 443,769 billion dong, accumulated losses of 464,547 billion dong. For the Truong My Lan group, the investigation results showed that throughout the process, more than 1.06 trillion dong was disbursed.

As of the time of the prosecution, the outstanding debt of the Truong My Lan group is still 677,286 billion dong. Meanwhile, the total customer deposits at SCB are more than 511,262 billion dong. The appraisal value of SCB’s remaining assets by Hoang Quan Appraisal Company shows a value of 295,940 billion dong.