Recently, the Office of the Government announced that Prime Minister Pham Minh Chinh will hold a Conference on the Implementation of Monetary Policy Tasks 2024, resolving difficulties for production and business, promoting macroeconomic growth and stability. The conference will be attended by the Prime Minister, as well as the leaders of major corporations, including Deputy Prime Minister Le Minh Khai. The meeting will take place at 8am on March 14, 2024 at the Government Headquarters.

The invited companies include Vingroup, Sungroup, Geleximco, FPT, Masan Group, TH, Deo Ca, Novaland, Hung Thinh, Savico, Taseco, Becamex IDC, Phat Dat, Hoang Quan, Vinaconex.

It is important to note that these are all well-known conglomerates in the field in which I operate. To get a better understanding of the “magnitude” of these companies in the economy, we need to know about their financial indicators.

Among them, only Sungroup, Geleximco, Deo Ca, TH, and Hung Thinh are unlisted companies, but they also have some member companies represented on the stock market. However, these companies all have huge ecosystems, spanning multiple industries, and especially have valuable real estate projects.

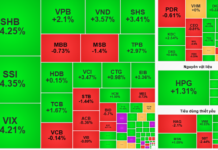

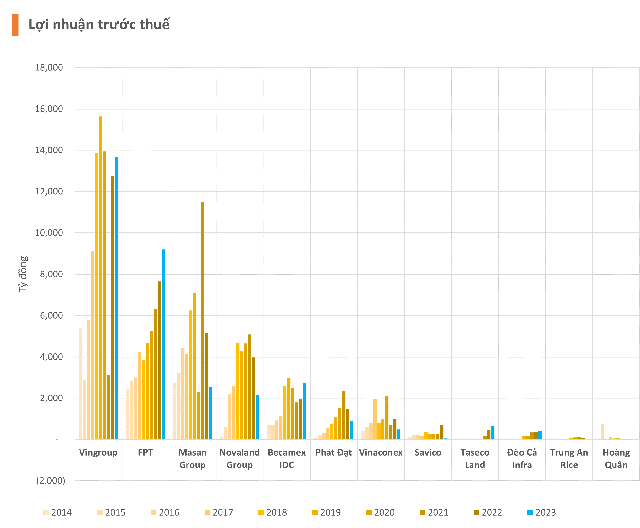

As for the remaining companies, these are all well-established names on the Vietnamese stock market. In the past year of 2023, these companies generated a total profit before tax of nearly 33,000 billion VND.

Vingroup (VIC) is the most profitable company in this group, earning 13,681 billion VND. This business is owned by the richest man in Vietnam, Mr. Pham Nhat Vuong, who owns famous brands like Vinhomes, VinFast, and Vincom. The business operations of this conglomerate extend from the north to the south.

In addition to Vingroup, FPT, Masan Group, and Novaland also reported billions of VND in pre-tax profits in the past year. The only loss-making company among the above-mentioned companies is Gao Trung An (TAR) with a loss of 10 billion VND. However, this company is also one of the giants in the rice industry.

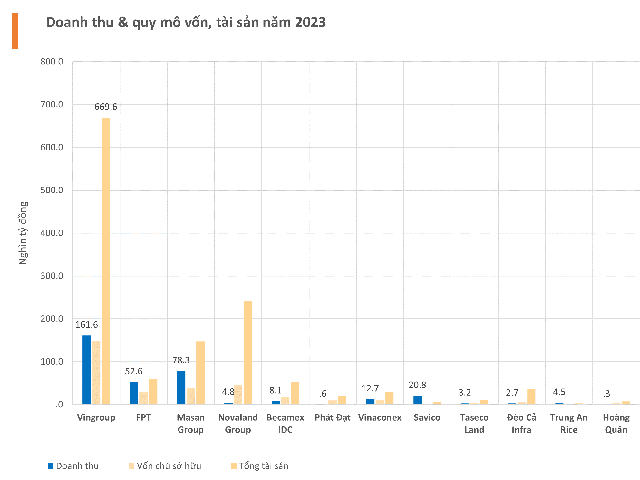

Turning to the amount of assets held, the listed companies summoned in this meeting have a total assets of 1.29 million billion VND, with owner’s equity at 318,000 billion VND. These assets include land, fixed assets, cash… as well as debt.

Among them, Vingroup, Novaland, and Masan Group are the non-financial companies with the largest assets on the stock market. Along with a large amount of assets, these companies also have a huge amount of “debt”, so any monetary policies or exchange rate issues will have a significant impact.

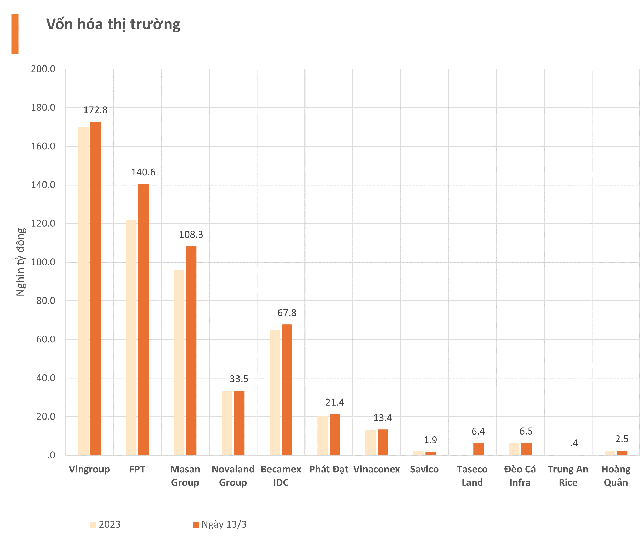

In terms of market capitalization, these companies have a total value of 575,000 billion VND, an increase of 8% compared to the beginning of the year. Most companies recorded an increase in market capitalization. Among them, Vingroup, FPT, and Masan Group are frequently on the list of companies with a market capitalization of over 100,000 billion VND.

In recent times, with the sluggishness of the domestic and global economy, the fact that the Government and the Prime Minister have summoned such an urgent meeting can partly alleviate the difficulties for businesses. Especially, in the context of continuously rising exchange rates, a stagnant real estate market, reduced export orders, and tightened spending by the general public… all have a significant impact on these companies. Therefore, major conglomerates and corporations also hope to receive some support from the Government to overcome this period.